A new analysis from Redfin shows that in 44.4% of U.S. home sale transactions in Q1, home sellers made concessions to purchasers. That is only behind the 45.1% record high set at the beginning of 2023, and it is up from 39.3% a year ago.

Data given by Redfin buyers’ agents nationwide, spanning rolling three-month periods from 2019 to the present, served as the basis for this analysis. When an agent notes that a seller offered something that helped lower the buyer’s overall cost of buying the house, that is considered a concession. This could include funds for mortgage-rate buydowns, closing costs, and/or repairs. Situations when the seller reduced the advertised price of their house or did so as a result of a negotiation with a buyer are not included.

According to Portland, Oregon-based Redfin Premier real estate agent Chaley McVay, most of the offers she writes for buyers ask the seller to make concessions, particularly if it’s the buyer’s first time buying a house.

“Buyers used to ask for concessions to cover little things like repairs. Now they’re negotiating concessions so they can afford to buy a home,” McVay said. “A lot of sellers are offering money for mortgage-rate buydowns, and I recently had one seller cover seven months of HOA fees for the buyer.”

Due to a shift in the property market in favor of buyers, sellers are making more and more compromises. Due to high housing prices, high mortgage rates, and economic uncertainty, demand from homebuyers is slow. At the same time, with listings at a five-year high, sellers are up against increasing competition from one another. Generally speaking, purchasers have more negotiating power when they have more selections. Additionally, a lot of homes are overpriced, which means they stay on the market longer and force sellers to make compromises in order to find a buyer, according to Redfin brokers.

“Sellers are feeling nervous because a lot of them bought at the top of the market in 2021 and 2022, and will now be re-buying at a higher mortgage rate,” said McVay. “They’re worried about net proceeds. That’s why I recommend my buyers ask for concessions instead of a lower sale price—it can be a win-win because then the buyer is catching a break and the seller doesn’t have to go below the price they had in their head.”

Western Regions See Highest Level of Rising Concessions

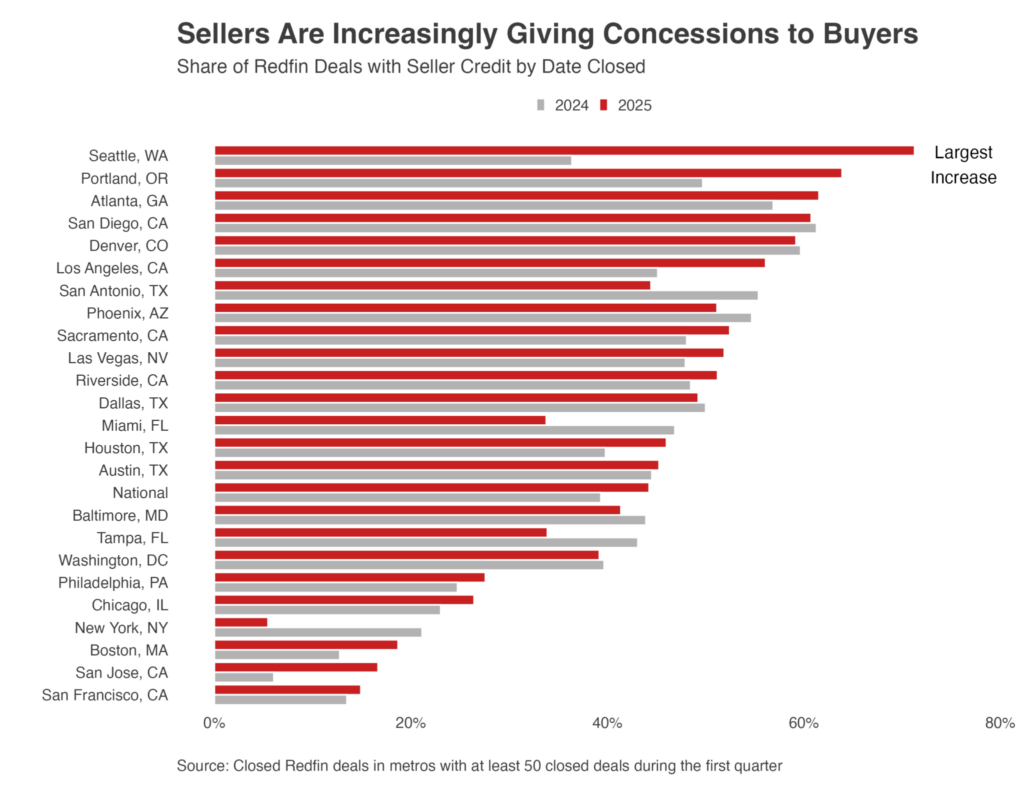

In Q1, 71.3% of home-sale deals in Seattle involved concessions from sellers to buyers, the greatest percentage of any of the 24 major U.S. metropolitan regions Redfin examined. That is the biggest rise among the metros Redfin examined, nearly doubling the 36.4% share from a year ago.

“It’s super common to see seller concessions for condos and new-construction townhomes, but less so for single-family homes—unless the single-family home has been sitting on the market for a while,” said Stephanie Kastner, a Redfin Premier real estate agent in Seattle. “Condos have become a tougher sell because of skyrocketing HOA fees and insurance. And builders are offering concessions because it’s in their best interest to keep sale prices high; they’re willing to pay buyers’ closing costs and maybe provide a free washer-dryer if it means they don’t have to drop the listing price.”

Portland, OR saw the next biggest increase, up 14.2 percentage points to 63.9%, which was the second highest rate. Next came Los Angeles (+11 ppts to 56.1%), San Jose, CA (+10.6 ppts to 16.7%) and Houston (+6.2 ppts to 46%). After Seattle and Portland, the highest concession rates are in Atlanta, San Diego and Denver.

New York saw the biggest drop in concessions. Home sellers there gave concessions to buyers in just 5.5% of home-sale transactions, down 15.7 percentage points from a year earlier and the lowest share among the metros Redfin analyzed. The next biggest declines were in Miami (-13.1 ppts to 33.8%), San Antonio (-10.9 ppts to 44.4%), Tampa, FL (-9.2 ppts to 33.9%), and Phoenix (-3.5 ppts to 51.2%).

Prices are currently declining in several areas of Florida and Texas, where housing markets have been cooling for some time. Because they have had more time to adjust to a slow market, sellers in Florida and Texas have begun pricing their properties lower from the outset, which means they frequently don’t need to make compromises. Boston, Chicago, San Francisco, and San Jose have the lowest concession rates after New York.

When a seller lowers their asking price after putting their house on the market, accepts an offer below their asking price, or both, they may be making concessions and receiving less money than they had intended for their properties.

In addition to a concession, about one in five homes (21.5%) that sold in Q1 had a final sale price that was lower than the asking price, up from 18.5% in the same period last year. About one in six (16.2%) obtained a concession and a price reduction, compared to 13% the previous year. Additionally, around one out of ten (9.9%) had all three: a price reduction, a concession, and a final sale price that was lower than the initial list price. Compared to 8% a year ago, there is an increase.

Overall, a lot of last-minute home purchases are also happening as a result of growing economic anxiety. A little more than a year ago, over 52,000 home-purchase agreements in the U.S. were canceled in March, or 13.4% of all homes that went under contract that month. That is the third-highest March figure since 2017, with the biggest being in 2020, when the pandemic stopped the home market.

To read more, click here.