Beginning a life together is not the only goal of marriage. Finding a location to call home is another important concern for many couples. However, juggling your aspirations for a wedding and homeownership is no simple feat. Due to the high cost of weddings—as a new LendingTree study shows that many couples put off plans to buy a home due to financial woes.

Newlyweds don’t hesitate to seek assistance with homebuying. In lieu of wedding presents, 48% of homeowners who were married within the last two years and made a down payment asked for assistance. 71% of newlywed homeowners reported that their parents assisted them with the down payment and/or wedding expenses.

Many people’s plans to buy a property are impacted by weddings. 36% of newlywed homeowners say their wedding reduced their down payment, and 35% say their wedding postponed their plans to buy a property. Just 16% of newlywed homeowners who made a down payment wish they had made a smaller one, compared to 41% who wish they had made a larger one.

A lot of people would rather spend their wedding money on their house. 59% of newlywed homeowners who made a down payment say they spent more money on that than their wedding, and more than half (52%) say they had a smaller wedding to afford a larger home. In total, newlywed homeowners make an average down payment of $46,741.

Both life events are undoubtedly stressful. While 33% of married homeowners say wedding planning was more stressful, 36% say purchasing a home was more difficult. Thirty-one percent more report feeling similarly stressed. Wedding planning was cited by most respondents (36%) as the process that led to the most disagreements.

For many engaged couples, “something borrowed” might be a home loan, and guests could significantly lower the amount they must withdraw.

Some 48% of homeowners who were married within the last two years and made a down payment asked for financial assistance instead of wedding presents. This percentage is particularly high for men (57%), people with children under the age of 18, and people who have recently been married (53%).

That’s generally a good thing, according to Matt Schulz, chief consumer finance analyst at LendingTree and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“Wedding gifts used to be dinnerware, silverware, candlesticks and other things that would sit in a box or cabinet and maybe get used once a year,” he said. “Now, there’s less stigma in asking for money toward a down payment or a honeymoon. That’s good for the newlyweds, and it’s good for those giving the gift because they know their gifts won’t be stashed and collect dust.”

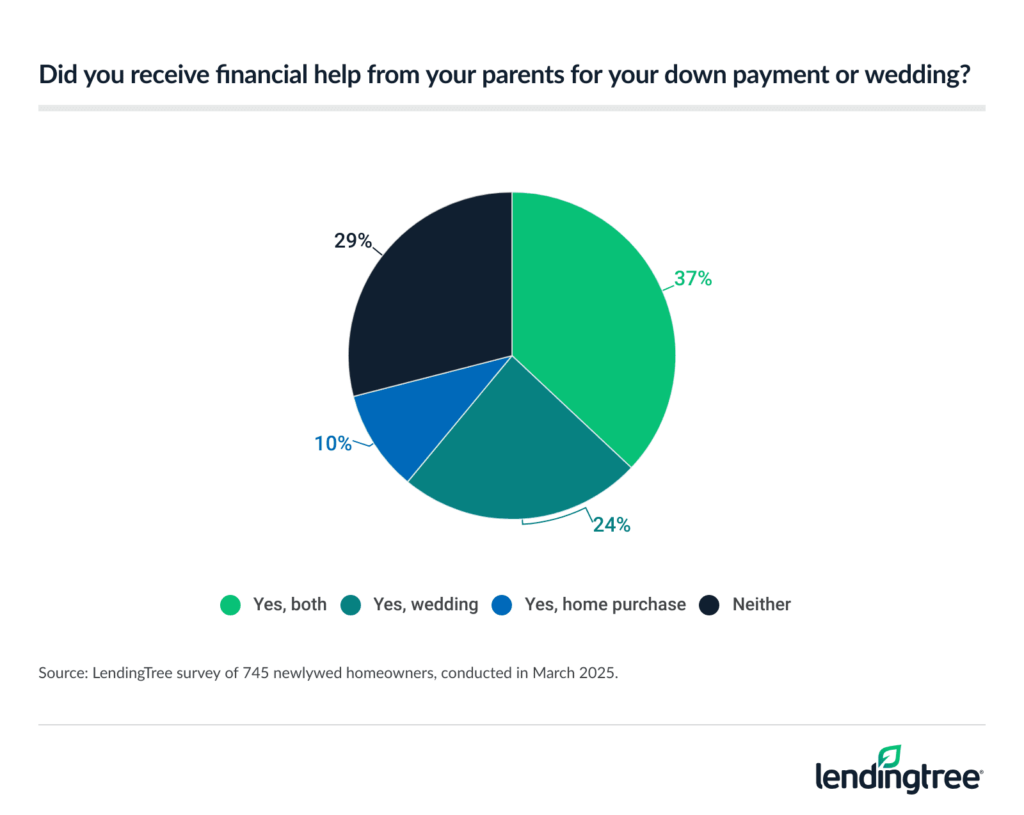

The guests aren’t the only ones contributing. Of all newlywed homeowners, 71% reported that their parents assisted them with either their wedding expenses or their down payment, and many (37%) reported that their parents assisted with both.

To read more, click here.