Auction.com has released its Auction Market Dispatch for the first quarter of 2025, which found completed foreclosure auctions jumped 20% from the prior quarter, and 4% year-over-year to reach a six-quarter high, led by a January 2025 spike to a 21-month high. While volume may have dipped in February, the month of March closed strong with a 5% annual gain.

The Auction Market Dispatch is a quarterly report based on proprietary inventory, bidding, pricing, and survey data from Auction.com. The report found that foreclosure auction volume was up across all loan types except for loans insured by the U.S. Department of Agriculture (USDA). Loans insured by the U.S. Department of Veterans Affairs (VA) led the way with a 104% annual increase. The VA foreclosure auction spike came after a nationwide foreclosure moratorium on VA loans expired at the end of 2024.

The report found that scheduled foreclosure auctions rose 14% from the previous quarter to a five-quarter high. Despite the gains, total completed auction volume remains at just 49% of its pre-pandemic level. Although foreclosure activity started strong in January, it softened in February and March, keeping the overall Q1 sales rate essentially flat quarter-over-quarter and down from a year earlier.

Scheduled foreclosure auctions, often an indicator of future volume, climbed 14% quarterly to 60% of pre-pandemic levels, the highest levels reported since Q4 2023.

REO supply also rose, up 2% quarterly, and 3% annually—reaching a six-quarter high, though still just 39% of pre-pandemic levels.

Auction Demand Mixed

The foreclosure auction sales rates began Q1 on an upswing, reaching an eight-month high in January 2025, up a slight 1% year-over-year. However, February saw demand drop to a 26-month low, with rates falling 7% annually. March 2025 showed a partial recovery, but remained 7% below prior-year levels.

REO (real estate-owned) auction activity was up modestly from the previous quarter, with bidders per asset increasing 2%. But year-over-year comparisons remained negative across all three months, resulting in a 16% annual decline.

Half of the 76 major metro areas analyzed posted year-over-year declines in foreclosure auction demand (sales rate), led by:

- Chicago, Illinois (down 16%)

- Houston, Texas (down 42%)

- Dallas-Fort Worth, Texas (down 19%)

- Louis, Missouri (down 17%)

- Atlanta (down 14%)

On the other end of the spectrum, 37 metro markets posted annual gains, with notable increases reported in:

- New York, New York (up 19%)

- Philadelphia, Pennsylvania (up 10%)

- Detroit, Michigan (up 3%)

- Washington, D.C. (up 8%)

- Minneapolis-St. Paul, Minnesota (up 4%)

Among the top-performing metros in Q1 2025 in terms of foreclosure auction sales rate were found in:

- Richmond, Virginia

- Milwaukee, Wisconsin

- Hartford, Connecticut

- Rockford, Illinois

- Providence, Rhode Island

The weakest performing metro markets in Q1 2025 included:

- Minneapolis-St. Paul, Minnesota

- Little Rock, Arkansas

- Beaumont, Texas

- Corpus Christi, Texas

- Mobile, Alabama

Buyers Remains Cautious

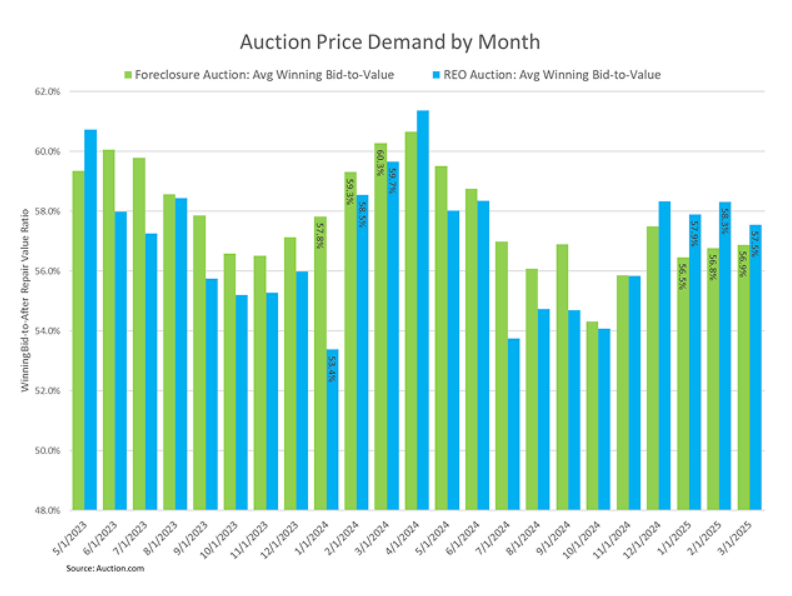

Price demand—the amount buyers at auction are willing to pay relative to estimated after-repair value—flattened in Q1 2025. Foreclosure auction price demand held steady sequentially at 56.7%, up slightly from 55.9% in Q4 2024, but down from 59% year-over-year.

Monthly performance painted a more precise story of declines in foreclosure auction price demand, as the metric fell 2% year-over-year in January, 4% in February, and 6% in March.

REO price demand followed a similar pattern, having risen 3% quarterly, and 1% annually to 57.9%—but with monthly softening. After starting strong with an 8% year-over-year rise in January, gains flattened in February, and turned to a 4% decline in March.

Of the 76 markets analyzed, 59% saw annual declines in foreclosure auction price demand in Q1 2025, including:

- Chicago, Illinois (down 4%)

- New York, New York (down 1%)

- Houston, Texas (down 14%)

- Philadelphia, Pennsylvania (down 7%)

- Dallas, Texas (down 8%)

Auction.com found that some bright spots emerged with 41% of markets posting year-over-year increases in foreclosure auction price demand, led by:

- Minneapolis-St. Paul, Minnesota (up 57%)

- New Orleans, Louisiana (up 7%)

- Baton Rouge, Louisiana (up 5%)

- Baltimore, Maryland (up 2%)

- Pittsburgh, Pennsylvania (up 2%)

Foreclosure Volume Shows Signs of Recovery

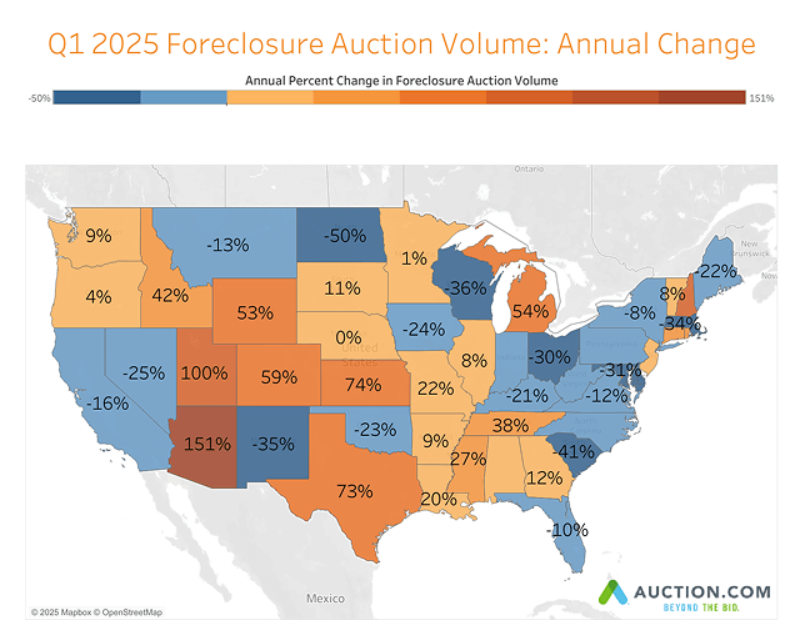

Foreclosure auction completions surged 20% quarter-over-quarter to their highest level since Q3 in Q4 2024. States reporting the largest annual increases were found in:

- Arizona (up 151%)

- Utah (up 100%)

- New Hampshire (up 80%)

- Kansas (up 74%)

- Texas (up 73%)

Trends among top-volume states were uneven, with Texas, Illinois and Michigan posting an annual increase, and New York and Ohio posting an annual decrease.

Among states with above-100 percent foreclosure auction volume recovery relative to pre-pandemic norms were Connecticut, Colorado, Wyoming, Alaska, Louisiana, South Dakota, Minnesota, Kentucky, and Utah.

Click here for more on the Auction Market Dispatch for Q1 of 2025.