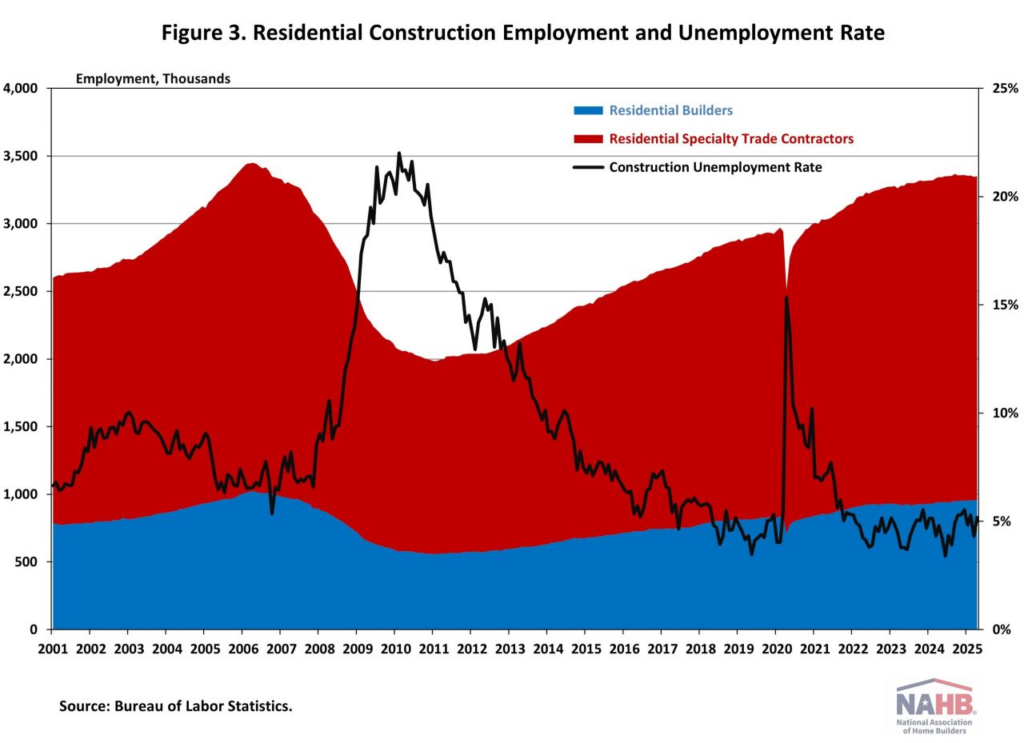

According to a recent Labor Department report, residential construction companies added 3,400 jobs in April, contributing to an overall 11,000 job growth in construction employment. But since homebuyer demand has been impacted by inflation in housing prices, high mortgage rates, and material pricing worries, home builder hiring has remained almost stagnant for a year. This is according to a new report from the National Association of Home Builders (NAHB).

Some 956,000 home builders and 2.4 million residential specialty trade contractors made up the 3.3 million Americans working in the residential construction industry in April. Only 5,000 net new jobs have been created by home builders and remodelers in the past 12 months. The average monthly change in home building employment over the past six months has been -1,583.

Seasonally adjusted, the construction worker unemployment rate increased to 5.2% in April. The number of jobs in residential construction has increased by over 1.4 million since the Great Recession‘s aftermath in 2010. The improvements, however, fell short of bringing home building employment back to its 2006 peak during the housing bubble.

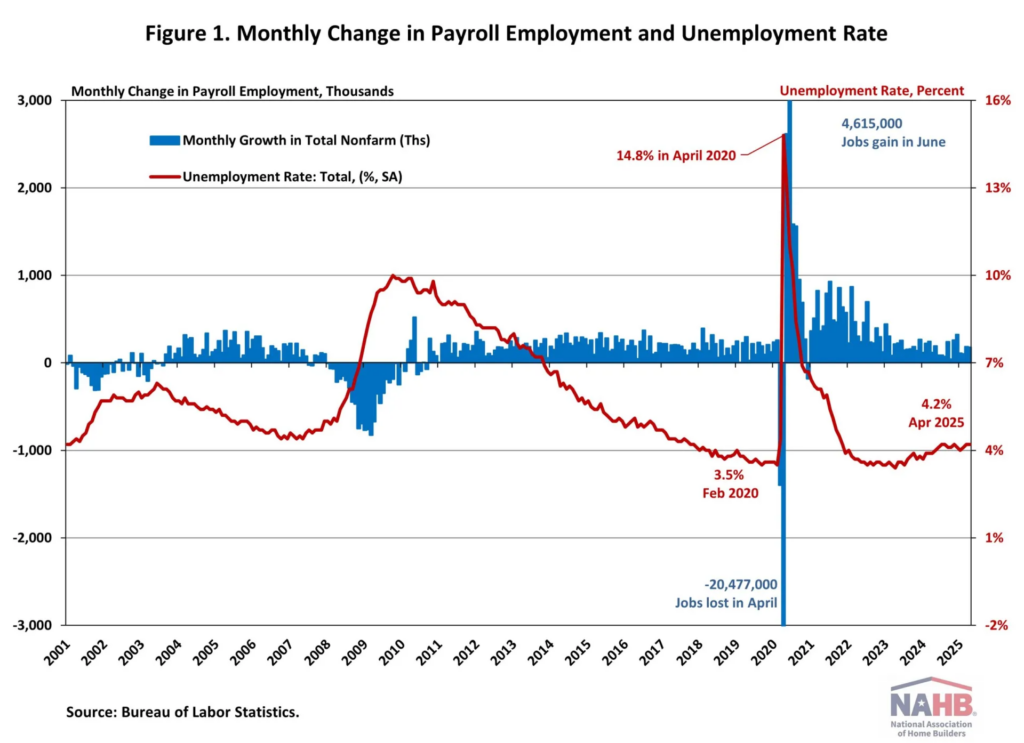

In February and March, the monthly change in total nonfarm payroll employment was revised down by 15,000 to 102,000 and 43,000 to 185,000, respectively. The total number of adjustments was 58,000 less than what had been originally published. In April, the 4.2% national unemployment rate did not change. The number of unemployed people rose by 82,000, despite a 436,000 increase in the number of employed people.

National Employment: Job Markets & Wage Growth

Jing Fu, Senior Director of Forecasting and Analysis for the NAHB mentioned that April saw a small slowdown in the U.S. labor market, with significant downward adjustments to February and March data. At 4.2%, the unemployment rate remained stable. Despite rising economic uncertainty, the labor market is still strong, though there are some early indications that it may be slowing. Wages increased just 3.8% year-over-year. For almost two years, wage growth has exceeded inflation, which usually happens when productivity rises.

Following a downwardly revised rise of 185,000 jobs in March, total nonfarm payroll employment increased by 177,000 in April, according to the Bureau of Labor Statistics’ (BLS) Employment Situation Summary. The U.S. job market has seen the third-longest employment boom period on record, with 52 straight months of job growth since January 2021. In 2025, the average monthly increase in employment was 144,000, while in 2024, the average monthly gain was 168,000.

The estimates for the two months prior were lowered. In February and March, the monthly change in total non-farm payroll employment was revised down by 15,000, from +117,000 to +102,000, and 43,000, from +228,000 to +185,000, respectively. This exceeds analysts’ projections in the labor market. However, the estimates for the preceding two months were lowered.

The percentage of the population that is either employed or seeking for work, known as the labor force participation rate, increased by one percentage point to 62.6%. The participation rate increased three percentage points to 83.6% among those aged 25 to 54, the greatest level since September 2024. Even with these improvements, the overall labor force participation rate at the start of 2020 is still lower than its pre-pandemic level of 63.3%. Further, after reaching a high of 83.9% last summer, the rate for the prime working-age group (25 to 54) has been declining.

Financial activities (+14,000), transportation and warehousing (+29,000), and health care (+51,000) all had increases in April. As a result of government cuts, employment in the federal government has decreased by 26,000 since January 2025, including 9,000 in April. “Workers on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey,” according to the BLS.

To read more, click here.