A new White Paper from Restb.ai has revealed a significant blind spot in the real estate and mortgage ecosystem by analyzing over 1,200 real estate appraisals and revealing, for the first time, over $27 billion in potential hidden financial risk linked to poor property condition and quality adjustments.

A recent Restb.ai study reveals pervasive irregularities and problems with transparency in the way appraisers evaluate and account for the physical state and quality of a property, two elements that have a direct bearing on lender risk, borrower equity, and property valuation. Importantly, the White Paper offers in-depth information on how appraisers can utilize computer vision to reduce risks by detecting and more precisely justifying condition and quality improvements using objective image-based assessments.

“The scale of flawed condition and quality adjustments in appraisals is bigger than most people realize,” said Nathan Brannen, Chief Product Officer at Restb.ai. “Most AMCs and lenders simply don’t have a quick and easy way to check for these issues, so they ignore the problem and hope for the best. AI finally offers a solution to efficiently manage this risk.”

The results of this research are consistent with previous advisories from Fannie Mae, which listed condition and quality misreporting as one of its top three concerns regarding assessment quality.

According to the study, these trends may result in systematic overvaluations or undervaluations, which might put lenders and appraisal management firms at risk financially, legally, and in terms of their reputation.

Survey Overview:

Restb.ai examined approximately 6,495 comparable homes and 1,271 appraisals using its in-house computer vision technology and discovered the following:

- A significant risk associated with condition or quality modifications that don’t match the actual property is present in one out of every three appraisals.

- Warning indications of irregularities that could result in erroneous assessments are present in almost three out of four appraisals.

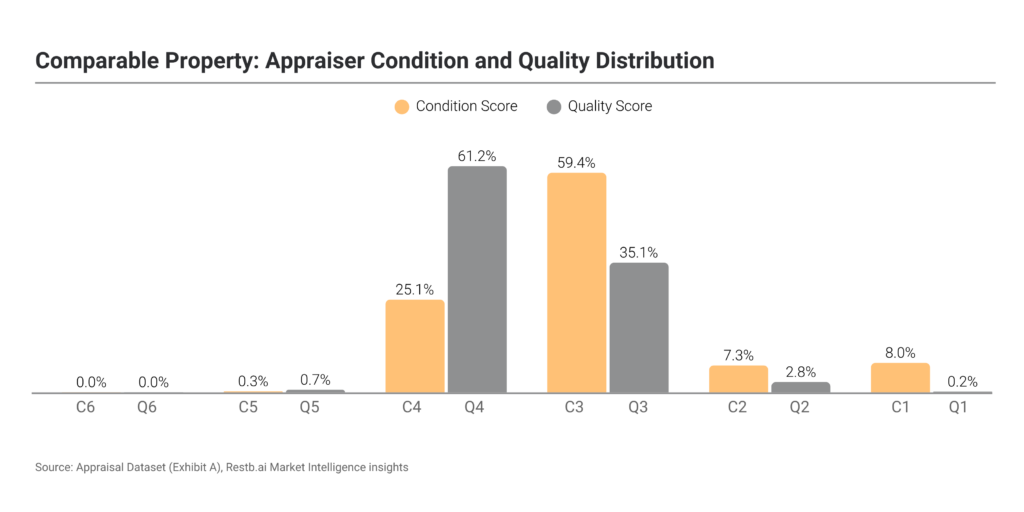

- It was challenging to determine the true variations that can impact property value because the majority of homes were grouped into only two groups based on condition (86%) and quality (97%).

- There are concerns regarding consistency and transparency as adjustments were made even when homes had the same condition or quality scores (11.8% for condition and 5.3% for quality).

- The repurchase risk ranged from $27.1 billion to $59.7 billion, with 33.6% of evaluations having a high risk and 73.9% having a medium risk of insufficient or missing modifications.

- Inaccurate condition and quality adjustments can cause properties to be overvalued or undervalued, which can impact market stability, financing costs, and repurchase risk.

- Quality control procedures can be made more effective while lowering risk by implementing automated AI analysis to quickly identify potential conditions and quality concerns.

Acknowledging U.S. Appraiser Power to Lower Risk

The GSEs’ push for component-based scoring and appraisal modernization coincide with the release of the Restb.ai White Paper on quality and condition findings. The study offers unquestionable statistical proof that AI-powered computer vision is an essential tool for appraisers, enabling them to more consistently, precisely, and confidently address one of the most enduring and historically expensive problems facing the sector.

In order to create a more stable and equitable housing finance system, the White Paper demonstrates how the use of AI technologies can improve assessment quality, increase compliance, and comply with changing GSE criteria.

Interestingly, more equivalent properties are used without the appropriate condition changes than quality adjustments. Further, condition variations are still not appropriately accounted for in more cases than quality difficulties, even though appraisers are currently making condition changes at a rate three times faster than quality adjustments.

As this study indicates, price adjustments and condition and quality evaluations are often erroneous, which invariably results in imprecise valuations and elevated risk. Given the challenge of manually distilling intricate property data into two high-level scores, these inaccuracies make sense.

Even though there are several quality assessments conducted during an appraisal’s lifetime, it has proven difficult to consistently find and fix these problems. It is simply too time-consuming to search up images of comparable houses to make sure all properties have been appraised consistently, and it is too difficult to tell when a significant condition or quality adjustment—or lack thereof—may exist.

Legal cases have demonstrated how these errors can result in inaccurate appraisals, and Fannie Mae has flagged them as common concerns.

For lenders, these risks result in high financial expenses. A recent analysis by Reggora found that the average home loan repurchase rate is 0.49%, which means the lender will typically have to pay $32,288. The 33.6% of high risk evaluations, assuming a modest estimate of 2.5 million appraisals annually, would translate into a total lender risk of almost $27 billion in repurchase expenses.

The good news is that this study shows how computer vision may be used to automatically detect these problems. Even if some appraisers are still dubious about AI, its value lies in its capacity to identify possible problems early on and request a closer examination rather than waiting for inconsistencies to be discovered later in the evaluation process.

To read the full White Paper, click here.