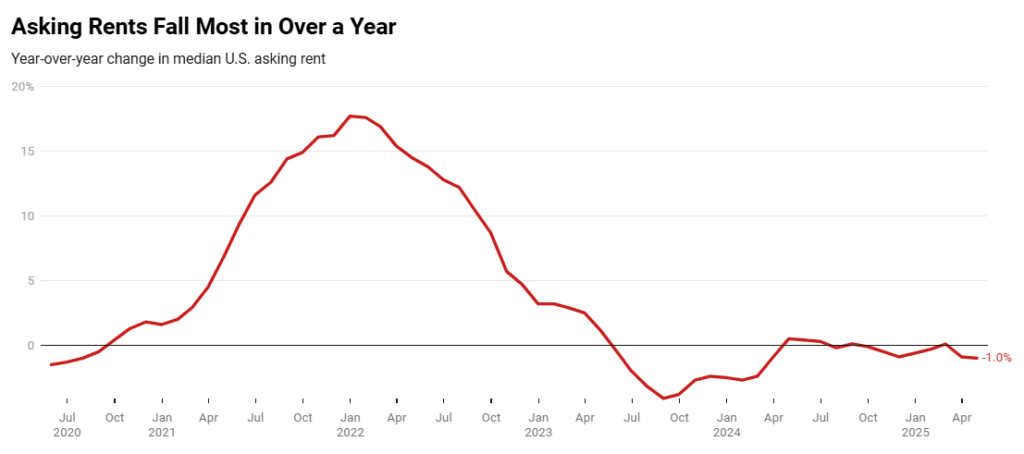

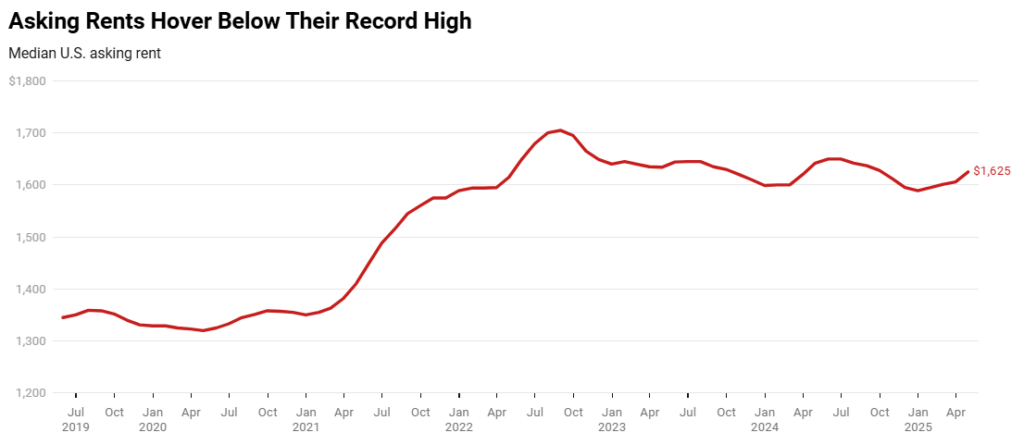

According to a new report from Redfin, the median asking rent nationwide fell 1% year-over-year to $1,625 in April, marking the biggest decline since February 2024—$80 below the August 2022 record high of $1,705. On a month-over-month basis, the median U.S. asking rent rose 1.2% in April—typical for this time of year.

“Asking rents are sluggish because there are more apartments for rent than people who want to rent them,” said Redfin Senior Economist Sheharyar Bokhari. “Renter demand is strong, but growth in apartment supply is even stronger because multifamily construction surged in the wake of the pandemic moving frenzy. Permits to build apartments have started to taper off, though, so asking rents could rebound in the coming months.”

The rental vacancy rate for buildings with five or more units was 8.2% in Q1—the most recent period for which data is available—tied with the prior quarter for the highest level since early 2021. Less than half of newly built apartments were being rented out within three months—one of the lowest shares on record.

As asking rents fell last month, zooming out to a longer timeline paints a picture of stability. April marked the 14th consecutive month in which asking rents barely decreased or increased, with a year-over-year change of 1% or less during each of those months. Those fluctuations were a drastic shift from the pandemic era, when asking rents jumped as much as 17.7%, and fell as much as 4.1%.

Asking Rents Down in Austin

In Austin, Texas, the median asking rent dropped 9.6% year-over-year to $1,399 in April—$400 below the record high—marking the largest decline in percentage terms among the 44 major core-based statistical areas (CBSAs) analyzed by Redfin. Austin was followed by:

- Minneapolis, Minnesota (-7.3%)

- Portland, Oregon (-5.3%)

- San Diego, California (-5.2%)

- Raleigh, North Carolina (-5.2%)

Texas was one of the top homebuilders during the pandemic building boom, which is one reason Austin is seeing such a large decline in rents, offering renters some relief.

“Many people in Austin are finding that it’s a lot cheaper to rent than buy,” said local Redfin Premier Real Estate Agent Andrew Vallejo. “You could buy a home and have a monthly mortgage payment of $3,200, but the same home will rent for $1,900. Unless the buyer has a good amount of money for a down payment, renting is way less expensive.”

Rent vs. Wages

The typical U.S. homebuyer needs to earn in excess of $50,000 more than the typical renter to afford monthly housing payments, and the gap has been widening—partly because mortgage payments are at a record high due to elevated mortgage rates. Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) averaged 6.76% as of May 8, 2025, unchanged from the previous week. A year ago at this time, the 30-year FRM averaged 7.09%. This affordability gap is boosting demand for rentals, as inflation and high rates as well as high home prices have kept many prospective homebuyers on the sidelines. Zillow reports the average U.S. home value currently at $367,711, up 1.4% over the past year.

Asking rents rose the most in:

- Cincinnati, Ohio (8.7%)

- Pittsburgh, Pennsylvania (7.5%)

- Baltimore, Maryland (5.9%)

- Birmingham, Alabama (5.8%)

- Washington, D.C. (5.2%)

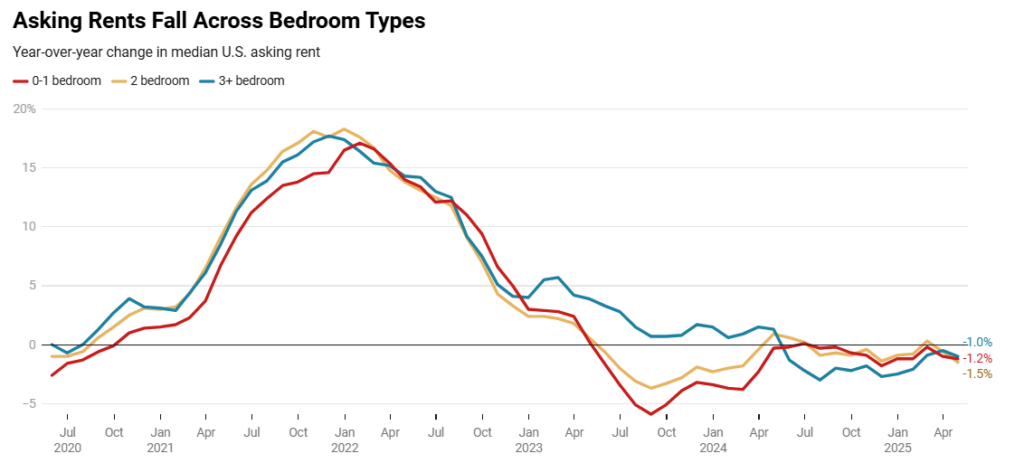

Asking Rents Falling the Quickest for Two-Bedroom Units

The median asking rent for zero to one bedroom apartments fell 1.2% year-over-year to $1,481. For two bedroom apartments, it decreased 1.5% to $1,699—the largest decline since February 2024. And for 3-plus bedroom apartments, it fell 1% to $1,999.

Click here for more on Redfin’s analysis of U.S. rental trends.