According to the Mortgage Bankers Association‘s (MBA) National Delinquency Survey, at the end of Q1 of 2025, the delinquency rate for mortgage loans on residential properties with one to four units rose to a seasonally adjusted rate of 4.04% of all outstanding loans.

The delinquency rate increased by 10 basis points from a year ago and by six basis points from Q4 of 2024. In Q1, the percentage of loans on which foreclosure actions were initiated increased by 5 basis points to 0.20%.

“There were mixed results for mortgage performance in Q1 of 2025 compared to the end of 2024. Delinquencies on conventional loans increased slightly, while mortgage delinquencies on FHA and VA loans declined,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Foreclosure inventories increased across all three loan types, and particularly for VA loans.”

MBA’s Q1 of 2025 National Delinquency Survey — U.S. Highlights

- For all outstanding loans, the seasonally adjusted mortgage delinquency rate rose in comparison to the previous quarter. The 30-day delinquency rate rose 11 basis points to 2.14%, the 60-day delinquency rate dropped 3 basis points to 0.73%, and the 90-day delinquent bucket dropped 2 basis points to 1.17%, according to stage.

- Compared to the previous quarter, the overall seasonally adjusted delinquency rate for conventional loans rose by 8 basis points to 2.70%. Seasonally adjusted delinquency rates fell 41 basis points to 10.62% for the FHA and 7 basis points to 4.63% for the VA.

- Overall mortgage delinquencies for all outstanding loans rose year-over-year (YoY). Compared to the prior year, the delinquency rate rose 8 basis points for conventional loans, jumped 23 basis points for FHA loans, and fell 3 basis points for VA loans.

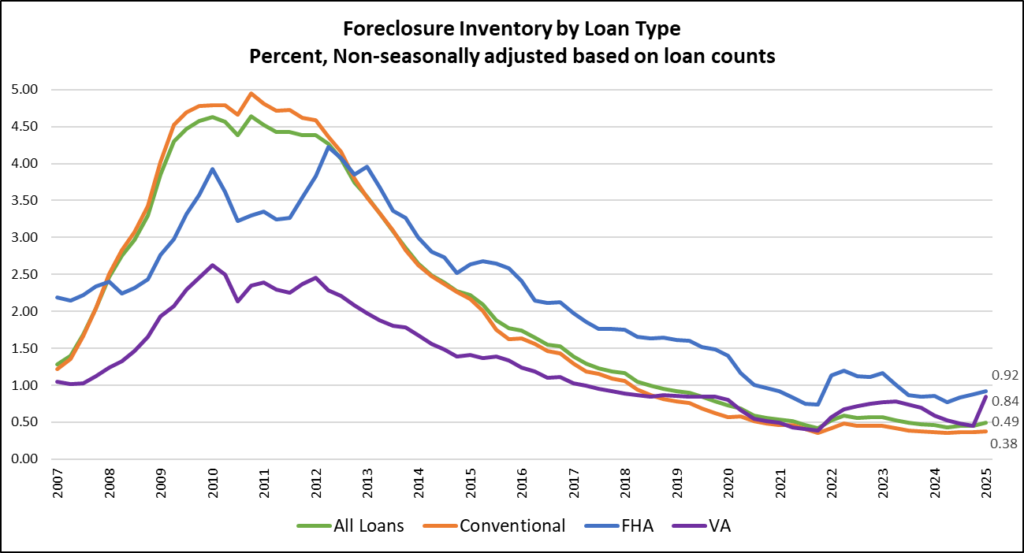

- Loans that are at least one payment past late are included in the delinquency rate; however, loans that are in the foreclosure process are not. At the conclusion of Q1, the percentage of loans in the foreclosure process was 0.49%, which was 3 basis points higher than a year ago and 4 basis points higher than Q4 of 2024.

- The percentage of loans that are 90 days or more past due or in the foreclosure process, known as the non-seasonally adjusted seriously delinquent rate, was 1.63%. It rose 19 basis points from the previous year and dropped 5 basis points from the previous quarter.

- Compared to the prior quarter, the seriously delinquent rate dropped 3 basis points for conventional loans, 14 basis points for FHA loans, and 7 basis points for VA loans. The seriously delinquent rate went up 5 basis points for conventional loans, 80 basis points for FHA loans, and 50 basis points for VA loans over the previous year.

Walsh pointed out that in order to give the Veterans Affairs Servicing Purchase (VASP) Program time to be implemented, a voluntary VA foreclosure moratorium was in place through the end of 2024. Since then, that program has ceased without a congressionally approved successor loss mitigation option. If the economy deteriorates and there are no choices for debt workouts, the foreclosure rate may rise much more.

“The percentage of VA loans in the foreclosure process rose to 0.84%, the highest level since the fourth quarter of 2019,” Walsh said. “The increase from the previous quarter marks the largest quarterly change recorded for the VA foreclosure inventory rate since the inception of MBA’s survey in 1979.”

The top five states with the largest YoY year increases in their overall delinquency rate were:

- Florida (46 basis points)

- South Carolina (26 basis points)

- Georgia (25 basis points)

- Delaware (25 basis points)

- Wyoming (24 basis points)

“Despite certain segments of borrowers having difficulty making their mortgage payments, the overall national delinquency and foreclosure rates remain below historical averages for now,” Walsh said.

Note: According to the original terms of the mortgage, MBA requests that servicers identify loans in forbearance as late for survey purposes if the payment was not paid. April 2025 results will be released on Monday, May 19, 2025.

To read more, click here.