In March 2024, the National Association of Realtors (NAR) agreed to a $418 million settlement to resolve multiple suits with sellers who claimed NAR was driving up the price of commissions.

NAR’s settlement accomplished two goals: it released most NAR members and many industry stakeholders from liability in these instances, and it ensured that cooperative compensation remains an option for customers when purchasing or selling a house.

In the settlement, NAR also obtained a mechanism enabling practically all brokerage organizations with a residential transaction volume of more than $2 billion in 2022, as well as MLSs that are not completely controlled by Realtor’s associations, to acquire releases efficiently if they so desire.

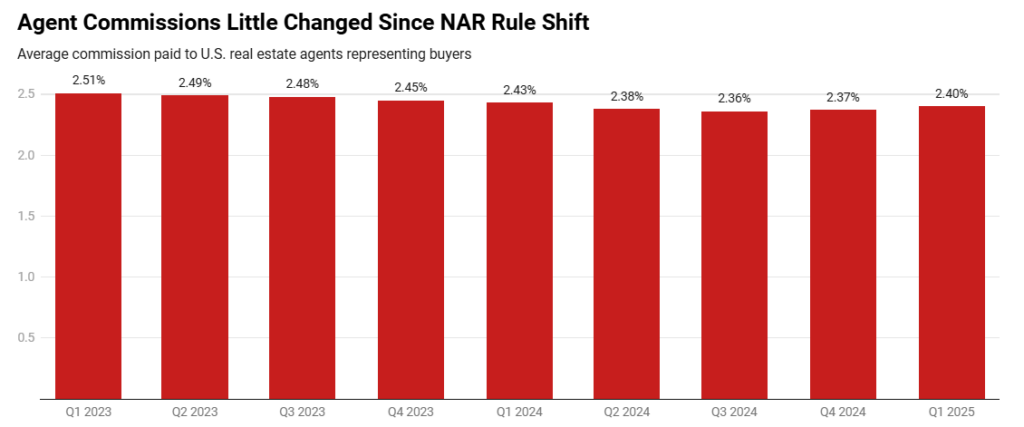

A new report from Redfin finds that the average buyer’s agent commission was 2.4% for homes sold in Q1 of 2025, up slightly from 2.37% reported in Q4 of 2024, and 2.36% in Q3 of 2024—when the new NAR commissions rules went into effect—but down slightly from 2.43% in Q1 of 2024, when the new rules were announced.

Bottom line … buyer’s agent commissions haven’t changed much since new real estate commission rules went into effect in the U.S. on August 17.

What a Difference a Year Makes?

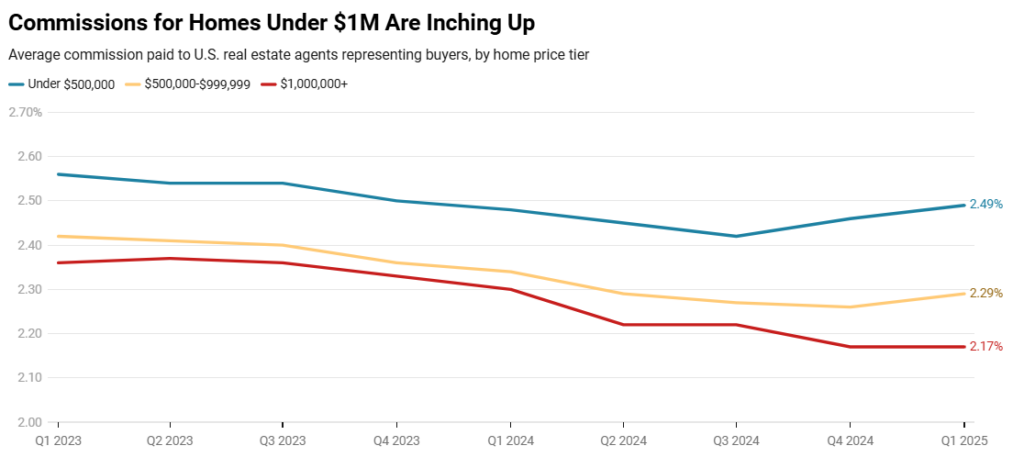

For the report, Redfin analyzed data on buyer’s agent commissions for closed home sales. The analysis uses national, aggregated sales data from Redfin agents’ listings, deals referred by Redfin.com to partner agents, and deals where buyers used Redfin-owned Bay Equity Home Loans. When the commissions data are broken down by price tier, a different trend emerges. Buyer’s agents were reportedly earning a slightly smaller commission percentage for luxury homes than before the NAR settlement, and a slightly bigger percentage for more affordable homes.

For homes that sold for $1 million or more in Q1, the average buyer’s agent commission was 2.17%. That’s unchanged from the prior quarter, but down from 2.22% in Q3 of 2024 when the new rules took effect, and down from 2.30% a year earlier.

For homes that sold in the $500,000-$999,999 range, the average buyer’s agent commission was 2.29%—up from 2.26% in the prior quarter and 2.27% in Q3 of 2024, but down from 2.34% a year earlier.

For homes that sold for less than $500,000, the average buyer’s agent commission was 2.49%—up from 2.46% in the prior quarter, 2.42% in Q3 of 2024, and 2.48% a year earlier.

Commissions were lower for high-priced homes because agents have more room to reduce their fees, yet still earn a healthy paycheck.

Most Sellers Are Still Paying Buyer’s Agent Commissions

Redfin agents report that most sellers are still choosing to pay the buyer’s agent commission, though there are some exceptions. Commission rates had started to fall gradually in the decade prior to the NAR settlement. But in dollar terms, buyer’s agents earn more money because home prices have risen significantly. Agents in some markets are reporting a shift in commissions, while agents in others are reporting that it’s business as usual.

“Most sellers are choosing to pay a 2.5% or 3% commission to the buyer’s agent, but I am seeing an increase in the number of sellers offering 2%,” said Stephanie Kastner, a Redfin Premier Agent in Seattle.

Chaley McVay, a Redfin Premier Agent in Portland, Oregon, said she has not seen much of a change since the new rules went into effect.

“Sellers don’t seem to have any issue paying a buyer’s agent commission,” McVay said. “But if we enter a seller’s market similar to that of 2021 and 2022—with rampant bidding wars—sellers may be inclined to offer low or no commission to the buyer’s agent, forcing buyers to bridge the gap. And if that happens, first-time buyers will be hit hardest because many of them can already barely afford to buy a home.”

Recent Buyers Not Negotiating Agent Commissions

Nearly two in five (37.4%) people who sold a home in the last year negotiated or tried to negotiate the commission paid to their agent, according to a Redfin-commissioned survey conducted by Ipsos in March-April 2025.

Most recent sellers (45.9%) did not try to negotiate. Buyers were less likely to negotiate, probably because they often are not the ones paying their agent. Nearly one-quarter (27.2%) of those who bought a home in the last year negotiated or tried to negotiate the commission paid to their agent, the survey found, while 47.8% did not try to negotiate.

Click here for more on Redfin’s analysis of real estate commission trends.