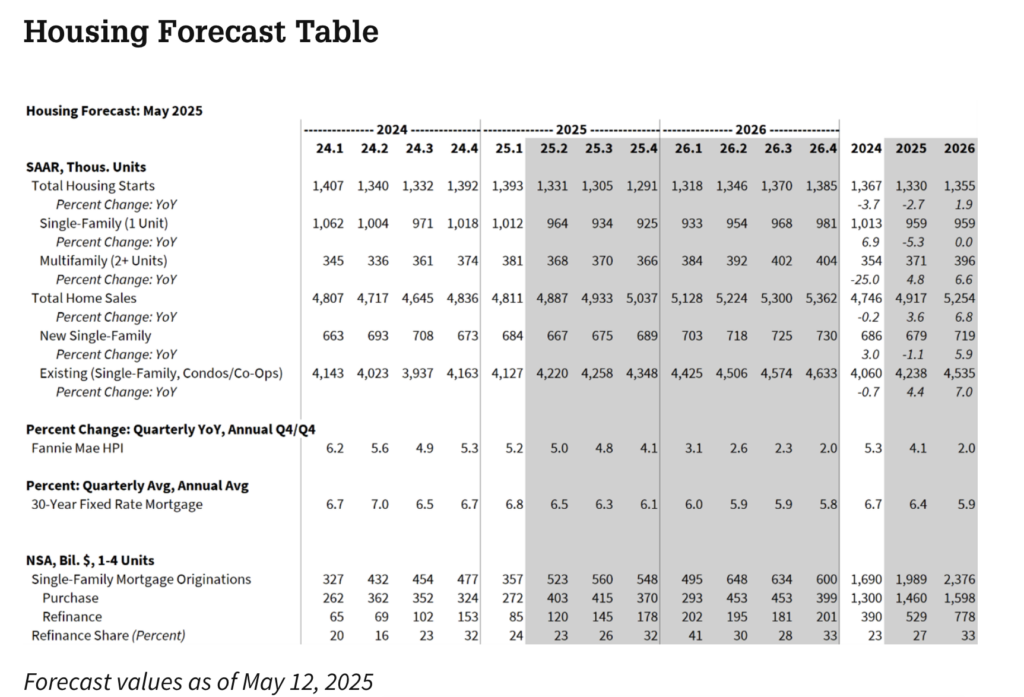

The Fannie Mae Economic and Strategic Research (ESR) Group’s May 2025 Economic and Housing Outlook projects that total single-family home sales will reach 4.92 million units by the end of 2025, with existing house sales making up 4.24 million of those units. A reduction in the ESR Group’s projections for mortgage rates, which it now projects to conclude 2025 and 2026 at 6.1% and 5.8%, respectively, contributed to the revisions to the home sales prediction.

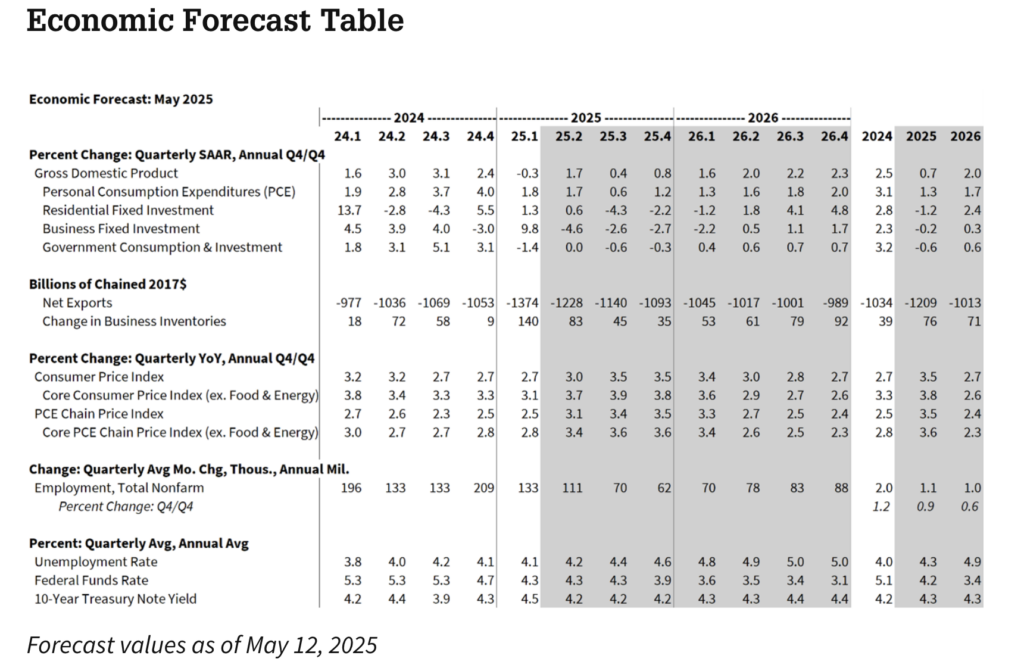

According to the most recent forecast, the real gross domestic product is expected to expand by 0.7% in 2025 and 2.0% in 2026 on a Q4/Q4 basis.

Note: The Fannie Mae HPI forecast is updated on the first month of every quarter. Interest rate forecasts are based on rates from April 30, 2025; all other forecasts are based on the date above. All mortgage originations data are Fannie Mae estimates as there is no universal source for market-wide originations data. Unshaded areas denote actuals, while shaded areas denote forecasts.

U.S. Economic & Housing Highlights — May 2025

The Fannie Mae 2025 Economic and Housing Outlook report identified numerous new trends as well as some recurring ones. While the U.S. market remains volatile, 2025 may bring homebuyers more opportunity as housing development continues. Or will it? Let’s take a look:

The real gross domestic product (GDP) growth outlook for 2025 and 2026 has been updated by Fannie Mae from 0.5% and 1.9% in our previous forecast to 0.7% and 2.0% on a Q4/Q4 basis, respectively.

As predicted in April, experts now anticipate that the Consumer Price Index (CPI) would increase by 3.5% in Q4 of 2025. The core CPI is predicted to increase by 2.8% in 2026 (unchanged) and 3.8% in 2025 Q4/Q4 (down from 3.9% earlier).

According to Fannie Mae experts, mortgage rates are expected to drop from 6.2% and 6.0% from their previous projection to 6.1% and 5.8% at the end of 2025 and 2026, respectively. The forecast for total home sales in 2025 was changed from 4.86 million to 4.92 million.

Additionally, Fannie Mae forecasts that mortgage originations would increase from the previous estimate of $1.98 trillion and $2.33 trillion to $1.99 trillion and $2.38 trillion, respectively, for 2025 and 2026.

Note: Interest rate forecasts are based on rates from April 30, 2025; all other forecasts are based on the date above. Unshaded areas denote actuals.

To read more, click here.