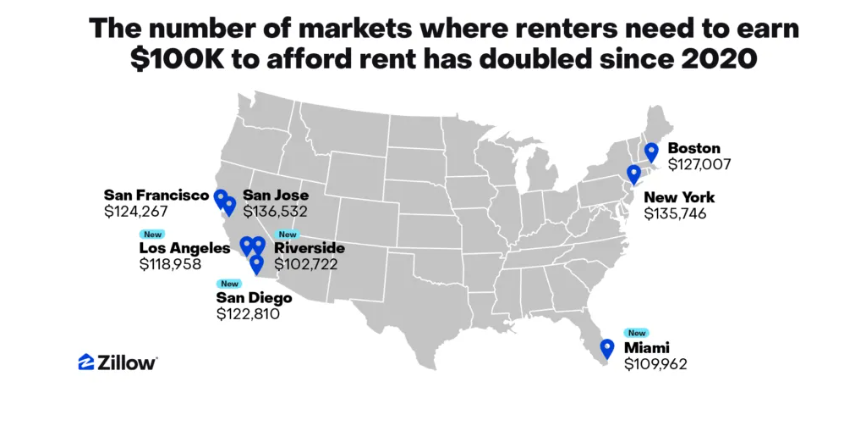

The rising costs of living have impacted affordability for renters across the U.S., with renters today needing to earn more than $80,000 to comfortably afford the typical rental—a 33% increase from just five years ago, when it was $60,000, according to a new Zillow report. And in eight major metro areas, renters now must make six figures to comfortably afford rent, up from just four metros five years ago.

The most expensive rental markets. those with the highest required income include:

- San Jose, California ($137,000 income required)

- New York, New York ($145,000)

- Boston, Massachusetts ($127,000)

The most affordable rental markets, with the lowest required income, include:

- Buffalo, New York ($55,000)

- Oklahoma City, Oklahoma ($56,000)

- Louisville, Kentucky ($57,000)

Since April 2020, rent for a typical U.S. apartment has increased to $1,858, a 28.7% jump, while rent for a single-family home increased a whopping 42.9% to $2,256. Yet the median U.S. household income has only risen 22.5%, to about $82,000—driving home the point that wages have not kept up with rents.

Since April 2020, rent for a typical U.S. apartment has increased to $1,858, a 28.7% jump, while rent for a single-family home increased a whopping 42.9% to $2,256. Yet the median U.S. household income has only risen 22.5%, to about $82,000—driving home the point that wages have not kept up with rents.

“Housing costs have surged since pre-pandemic, with rents growing quite a bit faster than wages,” said Orphe Divounguy, Senior Economist at Zillow. “This often leaves little room for other expenses, making it particularly difficult for those hoping to save for a down payment on a future home. High upfront costs are often overlooked, which can keep renters in their current homes.”

A renter making the median income and leasing a typical U.S. rental spends 29.6% of their income on rent, barely under the rent burden threshold of 30%. If they rent in one of eight metros (San Jose, New York, Boston, San Diego, San Francisco, Los Angeles, Miami, and Riverside, California), they’re most likely going to need a six-figure income: the typical rent in these markets is many hundreds of dollars above the national asking rent of $2,024.

In six of those eight markets, the median household would spend over 30% of its income on a typical rental. However, in San Jose and San Francisco, wages have been better at keeping pace with rent. A median San Jose household would spend 25% of its income on a typical rental, while one in San Francisco would spend 28%.

Thankfully, there are still plenty of markets affordable for median earners. The top three are Buffalo ($55,000 income required), Oklahoma City ($56,000), and Louisville ($57,000). In each of these, the median renter would spend 23% or less of their income on rent.

One of the difficulties is that high monthly rent prices come with other potential barriers, such as large upfront costs. In New York and Boston, for instance, broker fees add to the new renter’s costs—and that’s on top of the security deposit and advance rent payments of one to two months. Some relief may be in sight, however, with the recent passage of the FARE Act by the New York City Council and ongoing legislative conversations around broker fees in the Massachusetts and New York state legislatures.

Click here for more on Zillow’s rental affordability report.