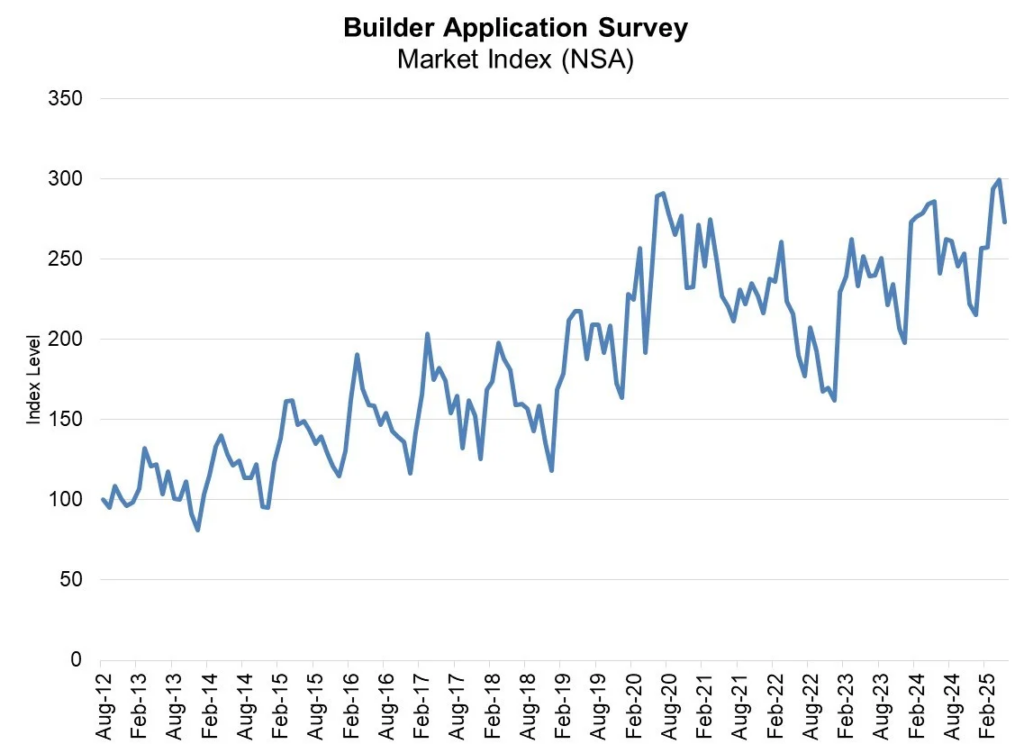

According to May 2025 data from the Mortgage Bankers Association’s (MBA) Builder Application Survey (BAS), mortgage applications for new home purchases fell an estimated 4.5% from the previous year. The share of applications dropped by 9% from April 2025; however, typical seasonal patterns have not been adjusted for in this update.

“Economic uncertainty, rising mortgage rates, and increasing competition from growing existing-home sales inventory likely dampened overall demand for new home purchases in May,” said Joel Kan, MBA’s VP and Deputy Chief Economist.

Key Findings from the BAS — National (by product type)

- Conventional loans composed 47.3% of loan applications;

- FHA loans composed 37.8%;

- RHS/USDA loans composed 1.0%;

- and VA loans composed 13.8%.

Overall, the average loan size for new homes increased from $376,992 in April to $379,209 in May.

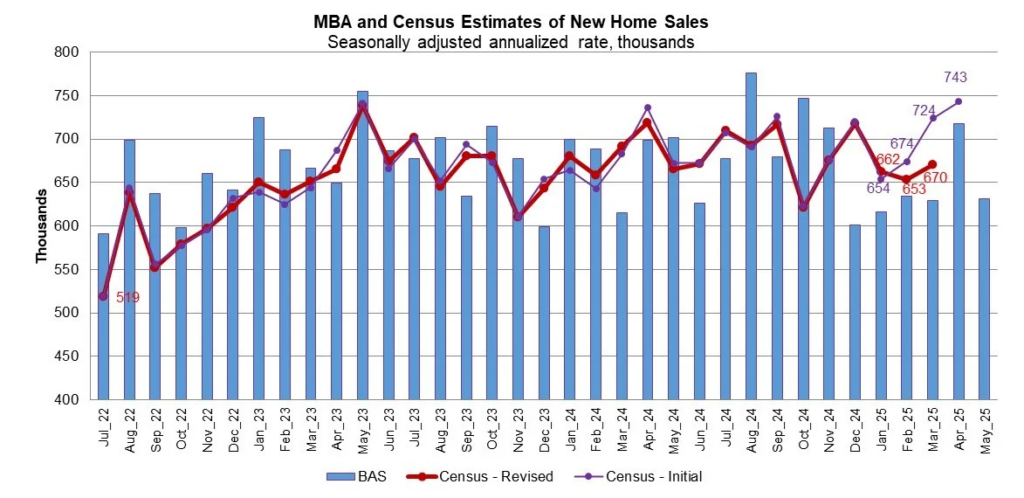

According to MBA, the number of new single-family home sales in May 2025 was 631,000 units, a seasonally adjusted annual rate that has been a leading indication of the U.S. Census Bureau’s New Residential Sales report for years. The BAS’s mortgage application data, along with assumptions about market coverage and other variables, are used to calculate the new home sales estimate.

The pace of 718,000 units in April is 12.1% higher than the seasonally adjusted projection for May. According to MBA, the number of new home sales in May 2025 was 58,000, down 10.8% from 65,000 in April on an unadjusted basis.

“Applications to purchase newly built homes fell to their slowest pace in three months as buyers held off on their purchase decisions,” Kan said. “Estimated new home sales posted a 12% drop, reversing April’s large gain and closer to levels seen earlier in the year.”

Note: MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level. This data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.