Becoming a homeowner is a wonderful thing, but there is a piper to pay: property taxes. Median property taxes in the U.S. rose by an average of 10.4% between 2021 and 2023, the latest year of available data, according to a new analysis by LendingTree. Property taxes vary widely across the 50 largest metros, from a low of $1,091 to almost ten times that ($9,937).

Lending Tree’s analysis revealed these key findings:

- Homeowners pay a median property tax of $2,969 annually, or about $247 a month. Homeowners without a mortgage paid a median of $2,474 in property taxes, while those with a mortgage paid a higher median of $3,343—$869 more.

- Property taxes increased in each of the 50 largest metros between 2021 and 2023. In 11 metros, the increase was lower than the national average of 10.4%. The three metros with the lowest increases are Pittsburgh (4.4%), Philadelphia (8.2%), and Milwaukee (8.3%). In contrast, Tampa (23.3%), Indianapolis (19.8%), and Dallas (19.0%) saw the highest property tax increases.

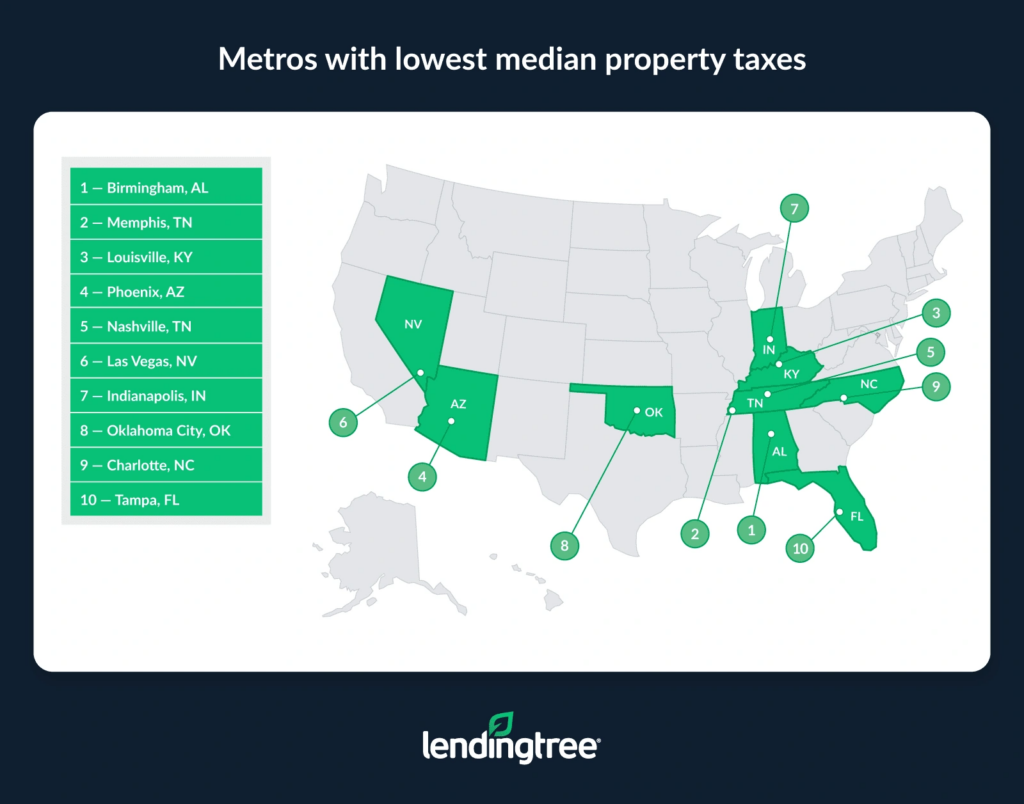

- At $1,091, Birmingham, AL has the lowest median property taxes of the 50 largest metros. Memphis and Louisville followed at $1,856 and $1,912, respectively. Despite both being among the lowest, Birmingham’s property taxes are 41.2% lower than Memphis’.

- New York, San Jose, and San Francisco have the highest median property taxes. The median amounts: New York ($9,937), San Jose ($9,554), and San Francisco ($8,156). Among the 10 metros with the highest property taxes, four are in California and two are in Texas.

- Among the large metros, Birmingham and Phoenix pay the smallest percentage of their home value in property taxes. Homeowners in these metros each have an effective tax rate of 0.48%, ahead of Las Vegas and Denver at 0.50%. Conversely, the highest rates are in Buffalo (2.11%), Chicago (2.08%), and Cleveland (1.74%).

Median Property Taxes in U.S. are $2,969 Annually

Across the U.S., homeowners pay a median property tax of $2,969 annually—about $247 a month. Those with a mortgage pay significantly more than those without a mortgage: a median of $3,343 for the former, and $2,474 for the latter ($869 less).

“It may not seem like an earth-shattering amount of money, but that equates to about $70 to $75 a month that can’t go toward paying bills or reaching other financial goals,” said Matt Schulz, LendingTree chief consumer finance analyst and author of Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life. “It’s an even bigger deal when you also have a mortgage.”

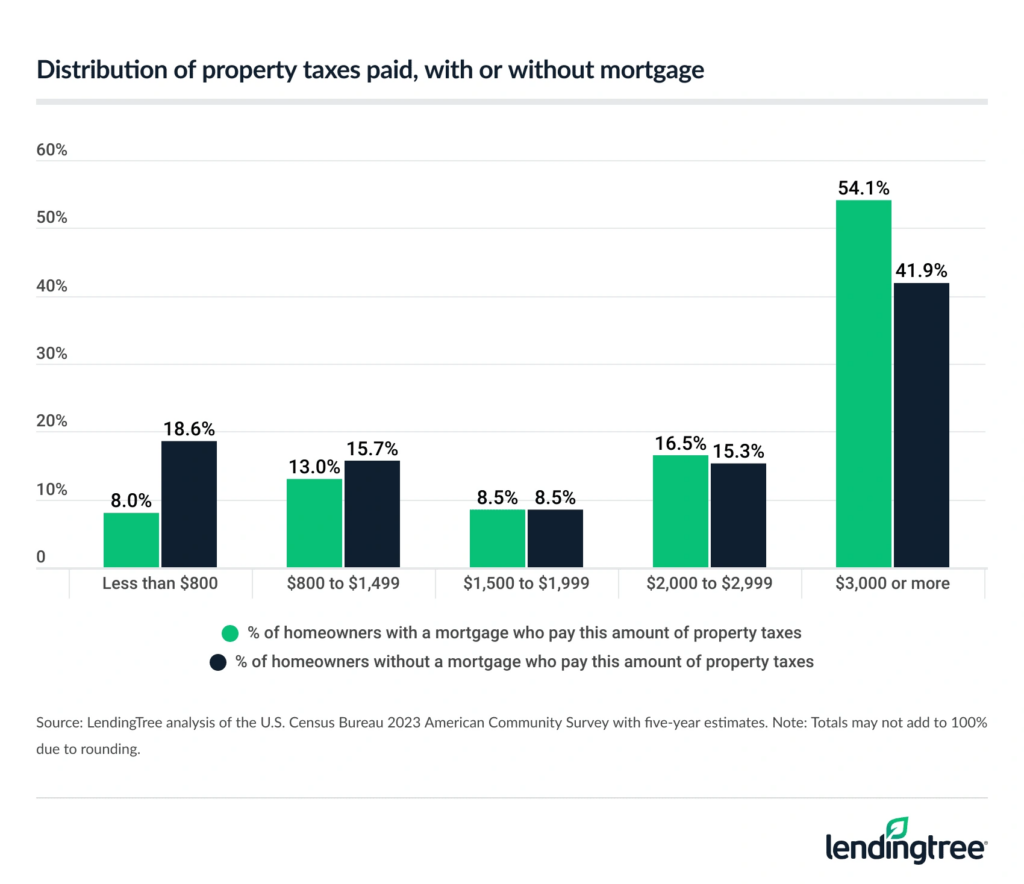

Households without a mortgage are 2.3 times more likely to pay less than $800 in property taxes than households with a mortgage. While 18.6% of mortgage-free households pay less than $800, just 8.0% of mortgage holders do.

More than half (54.1%) of American households with a mortgage pay $3,000 or more in property taxes, versus a smaller 41.9% of households without a mortgage.

Property Taxes Rose in All Large Metros

Property taxes rose by an average of 10.4% nationally between 2021 and 2023, largely driven by rising home prices in the same time frame.

In 11 of the 50 largest U.S. metros, the increase was lower than the national average of 10.4%. Pittsburgh saw the smallest increase, rising 4.4%. Philadelphia (8.2%), and Milwaukee (8.3%) followed.

Conversely, property taxes in Tampa jumped significantly— by 23.3%, the largest by metro. Since Florida does not charge income tax, the state relies on property and sales taxes to fund projects, and those taxes will continue to rise. In 2024, voters in Hillsborough County, which includes Tampa, approved a property tax increase of $1 per every $1,000 in assessed value to improve teacher pay and school programs.

Indianapolis (19.8%) and Dallas (19.0%) saw the next biggest property tax jumps between 2021 and 2023.

Such increases put a strain on homeowners, Schulz said.

“Most people’s financial margin for error is so small right now, thanks to inflation and the general cost of life, that any increase may become even more difficult to manage,” he said. “And these types of increases aren’t things you can cancel like a Netflix subscription, so it’ll likely require some sacrifice to handle it.”

Metros with largest/smallest % increase in median property taxes paid (2021 to 2023):

| Rank | Metro | Property taxes, 2023 | Property taxes, 2022 | Property taxes, 2021 | % change, 2021 to 2023 |

|---|---|---|---|---|---|

| 1 | Tampa, FL | $2,385 | $2,185 | $1,935 | 23.3% |

| 2 | Indianapolis | $2,029 | $1,867 | $1,694 | 19.8% |

| 3 | Dallas | $5,589 | $5,266 | $4,695 | 19.0% |

| 4 | Jacksonville, FL | $2,401 | $2,256 | $2,022 | 18.7% |

| 5 | Miami | $3,570 | $3,315 | $3,011 | 18.6% |

| 5 | Atlanta | $2,738 | $2,560 | $2,308 | 18.6% |

| 7 | Seattle, WA | $5,832 | $5,543 | $4,927 | 18.4% |

| 8 | San Antonio | $4,331 | $4,086 | $3,664 | 18.2% |

| 9 | San Diego | $5,542 | $5,214 | $4,697 | 18.0% |

| 10 | Charlotte, NC | $2,205 | $2,047 | $1,875 | 17.6% |

Median Property Taxes Range from $1,091 to $9,937

Looking at the metros with the lowest median property taxes, Birmingham, AL comes in first at just $1,091. Memphis is at a distant second, at $1,856. Even as the two lowest, homeowners in Birmingham pay 41.2% less than those in Memphis. Louisville, KY rounds out the top three at $1,912.

All three metros are among those with the lowest median home values, according to a 2024 LendingTree analysis. Although Memphis has lower median home values than Birmingham, Alabama significantly limits the property tax hikes homeowners can face.

Conversely, New York homeowners pay the most in property taxes, at a whopping median of $9,937. San Jose ($9,554) and San Francisco ($8,156) follow. Among the 10 metros with the highest property taxes, four are in California (San Jose, San Francisco, Los Angeles, San Diego) and two are in Texas (Austin, Dallas). That’s understandable, given that median home values in these areas are among the highest in the nation.

Homeowners with mortgages typically pay higher property taxes in nearly all metros, except for Seattle, Salt Lake City, and Boston.

Metros with smallest/largest median property taxes:

| Rank | Metro | Median paid on all homes | Median paid on homes with mortgages | Median paid on homes without mortgages |

|---|---|---|---|---|

| 1 | Birmingham, AL | $1,091 | $1,216 | $838 |

| 2 | Memphis, TN | $1,856 | $2,007 | $1,516 |

| 3 | Louisville, KY | $1,912 | $1,999 | $1,730 |

| 4 | Phoenix | $1,927 | $1,974 | $1,808 |

| 5 | Nashville, TN | $1,976 | $2,014 | $1,904 |

| 6 | Las Vegas | $1,990 | $2,040 | $1,888 |

| 7 | Indianapolis | $2,029 | $2,112 | $1,857 |

| 8 | Oklahoma City | $2,053 | $2,287 | $1,667 |

| 9 | Charlotte, NC | $2,205 | $2,381 | $1,756 |

| 10 | Tampa, FL | $2,385 | $2,751 | $1,767 |

Two metros have an effective tax rate of just 0.48%

Looking at property taxes as a percentage of home values, Birmingham and Phoenix tie for the lowest effective tax rate, at 0.48% for both. However, the median home value in Phoenix is significantly higher than that in Birmingham, at $401,400 and $226,200, respectively.

Las Vegas and Denver follow at 0.50%. While Las Vegas has a median home value of $400,800, Denver has a significantly higher median home value of $570,300.

Metros where homeowners pay smallest percentage of home value in property taxes:

| Rank | Metro | Median home value, 2023 | Property taxes, 2023 | Effective tax rate |

|---|---|---|---|---|

| 1 | Birmingham, AL | $226,200 | $1,091 | 0.48% |

| 1 | Phoenix | $401,400 | $1,927 | 0.48% |

| 3 | Las Vegas | $400,800 | $1,990 | 0.50% |

| 3 | Denver | $570,300 | $2,873 | 0.50% |

Meanwhile, Buffalo has the highest effective tax rate at 2.11%, with a median home value of $209,600. Chicago (2.08%, $301,900) and Cleveland (1.74%, $201,000) follow.

Metros where homeowners pay smallest/highest percentage of home value in property taxes:

| Rank | Metro | Median home value, 2023 | Property taxes, 2023 | Effective tax rate |

|---|---|---|---|---|

| 1 | Birmingham, AL | $226,200 | $1,091 | 0.48% |

| 1 | Phoenix | $401,400 | $1,927 | 0.48% |

| 3 | Las Vegas | $400,800 | $1,990 | 0.50% |

| 3 | Denver | $570,300 | $2,873 | 0.50% |

| 5 | Nashville, TN | $376,800 | $1,976 | 0.52% |

| 6 | Salt Lake City | $478,200 | $2,701 | 0.56% |

| 7 | Los Angeles | $825,300 | $5,621 | 0.68% |

| 8 | Charlotte, NC | $319,400 | $2,205 | 0.69% |

| 9 | San Diego | $791,600 | $5,542 | 0.70% |

| 10 | Raleigh, NC | $381,000 | $2,712 | 0.71% |

Tips for Dealing with Higher Property Tax Rates

With life and property taxes getting more expensive every year, Schulz has some tips for homeowners feeling the financial pinch:

How much interest are you earning on your property tax money? “This won’t work if your property tax payments are part of your mortgage payments, but for others, setting aside your estimated property tax amount in a high-yield savings account can be a great idea,” Schulz said. “Returns are no longer at record highs, but they’re still often over 4%. That means that if you leave $3,000 in one of those accounts for a year, you’ll earn about $120 in interest for having done nothing more than being planful with that money and leaving it alone.”

Are you getting all the exemptions you’re qualified for? “Not everyone pays the same property taxes,” he said. “For example, those 65 and older may be partially exempt from property taxes in many areas. Some home improvements and homesteads qualify for tax exemptions as well. Do some Googling and see what you might qualify for.”

Have you considered appealing your property tax assessment? If you believe your property taxes are higher than they should be, you can challenge the assessment with your local tax assessor” (a shockingly low number of home owners do. “Look at comparable homes in your area to see if your home is assessed higher than others with similar features.

Note: The Census Bureau uses the term “real estate tax” to define a tax charged on an “entire property (land and buildings) payable to all taxing jurisdictions, including special assessments, school taxes, county taxes and so forth.” Real estate taxes are often referred to as property taxes. The terms are used interchangeably in this study.

To read more, click here.