Many young Hispanic families in the United States face significant obstacles on the path to homeownership, according to a new analysis from the Joint Center for Housing Studies of Harvard University. These early-stage barriers—shaped by income, wealth, credit access, and geography—contribute to persistent racial and ethnic disparities in housing equity.

The study, Cumulative Disadvantage in Hispanic Homeownership: Barriers to Passing Housing Equity to the Next Generation, identifies four stages in the homeownership lifecycle:

- Becoming a homeowner

- Maintaining homeownership

- Late-life homeownership

- Passing housing wealth to future generations.

The first stage, becoming a homeowner, reveals the steepest challenges for younger Hispanic households.

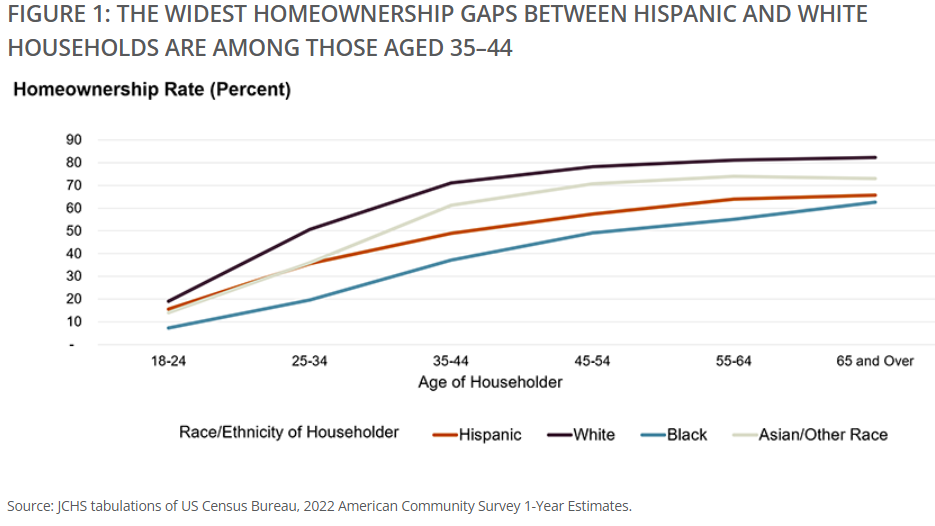

Homeownership typically begins between ages 35 and 44, but Hispanic households tend to enter later. In 2022, the homeownership rate for Hispanic households in this age range was 22 percentage points lower than for white households. The median first-time buyer age was 34 for Hispanics, compared to 31 for white households.

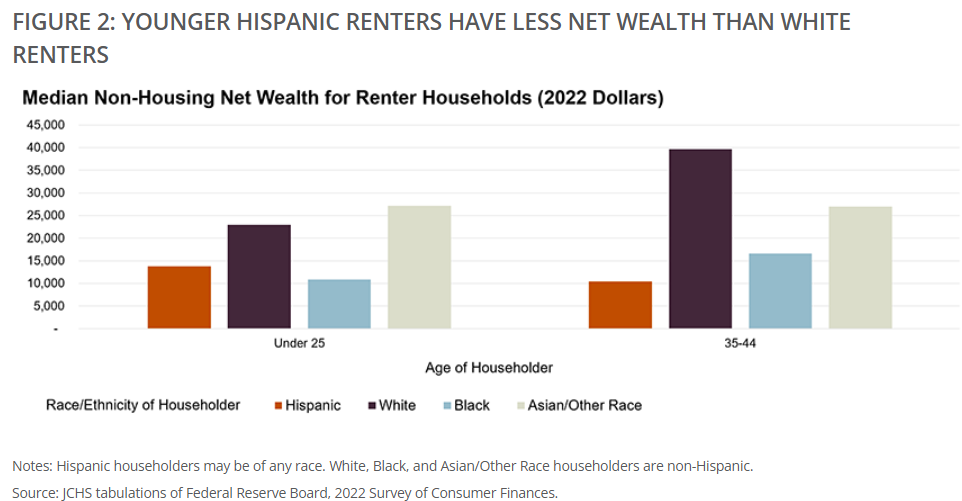

Income differences partly explain the delay. Hispanic renters aged 35 to 44 had a median income of $53,020, while white renters in the same age group earned $63,900. Wealth gaps are even more stark. Hispanic renters had a median net wealth of $10,400, compared to $39,670 for white renters, making it harder to cover downpayments, closing costs, and other upfront expenses.

Only 7.2% of Hispanic households reported receiving a financial gift or inheritance, compared to 29.9% of white households. And when financial transfers do occur, Hispanic families receive significantly less ($52,200) versus $88,500 for white households.

Credit access is another hurdle. In 2022, Hispanic households were 1.5 times more likely than white households to be denied credit and 17% avoided applying due to fear of rejection, compared to just 4% of white households. Among renters aged 35 to 44, the median debt-to-income ratio for Hispanic households was 0.29, nearly twice the 0.15 for white renters.

Geography adds another layer, where 61% of Hispanic homeowners live in the nation’s most expensive housing markets, versus 39% of white homeowners, compounding affordability challenges.

The report concludes that “lower incomes and wealth, limited credit access, and residence in high-cost markets delay homeownership for many Hispanic families, undermining their ability to build and transfer housing wealth across generations.” To address these gaps, it calls for expanding access to credit, launching affordable homeownership initiatives, and increasing support for first-time buyers.

Click here for more on the Joint Center for Housing Studies of Harvard University’s report “Cumulative Disadvantage in Hispanic Homeownership: Barriers to Passing Housing Equity to the Next Generation.”