The month of June had the third-largest increase on record since 2012, with the overall number of properties for sale in the Washington, D.C. metro area increasing 22.7% year-over-year (YoY). This is according to a recent report from Redfin, which revealed the only two months with greater growth were the previous two: Listings increased by 23.9% in April and 25.5% in May.

In contrast, pending home sales in Washington, D.C., decreased slightly (-0.3%) from the previous year. The average D.C. property that went under contract in June took 36 days to sell, compared to 26 days a year earlier. This indicates that properties in the nation’s capital are selling more slowly than they used to. The accumulation of stale listings is one factor contributing to the increase in overall inventory. Furthermore, fewer houses are selling for more than their asking price: Compared to almost half (47.8%) a year ago, around one-third (35.7%) of properties sold for more than their asking price.

The housing market in Washington, D.C., has changed as a result of widespread layoffs of federal employees and budget cuts for services that depend on government financing. Some former federal employees have taken early retirements or buyouts in addition to layoffs. Some people have advertised their houses because they are relocating or because they are no longer employed and cannot afford their payments. The employment losses and economic uncertainties in Washington, D.C., are not only increasing the supply of homes but also reducing demand for homebuying.

Measuring the D.C. Market Supply

“The local market is recalibrating and the pace of sales is slowing, partly due to federal job cuts,” said Marshall Park, Redfin’s Senior Market Manager in Washington, D.C. “For sellers, that means they have to be strategic about pricing, staging, and marketing—and they need to be realistic about what they’re going to get for their home. But buyers have a window of opportunity: More inventory means they’re able to be patient and picky, and they’re sometimes able to negotiate prices down and get concessions from sellers.”

According to Park, reasonably priced, move-in ready single-family houses in prime areas continue to sell fast and receive several offers. It’s also important to remember that most people in D.C. are not federal employees, and the current administration has no direct influence on their financial situation.

| June 2025 Housing Market Highlights: Washington, D.C. Metro Area | ||

| June 2025 | YoY change | |

| Median sale price | $608,000 | 2.1% |

| Pending home sales | 5,818 | -0.3% |

| Homes sold | 5,553 | 4.4% |

| New listings | 6,328 | 0.3% |

| Total homes for sale (active listings) | 20,016 | 23% |

| Months of supply | 2.4 | 0.5 |

| Median days on market | 36 | 10 |

| Share of homes that sold above final list price | 35.7% | -12.1 pts. |

| Average sale-to-final-list-price ratio | 99.9% | -1.1 pts. |

| Pending sales that fell out of contract, as % of overall pending sales | 12% | 2.1 pts. |

D.C Supply Jumps with Help from Local Markets

Although the number of properties for sale is increasing more quickly in D.C. than the rest of the country, rising inventory and flat sales are indicative of a broader national trend. June saw a 13.3% year-over-year increase in total supply and a 0.8% decline in pending sales nationwide (compared to +23% and -0.3%, respectively, in Washington, D.C.).

For a number of reasons, demand is weak and inventory is rising across the country. First, record-high prices are discouraging homebuyers and encouraging homeowners to sell. Second, prospective purchasers are being deterred from making a significant purchase by economic uncertainty surrounding issues like tariffs and a possible recession. Third, the lock-in effect of mortgage rates has begun to lessen as homeowners who purchased at ultra-low rates begin to sell.

Because Washington, D.C.’s economy is so dependent on the federal government, where job security is unpredictable, inventory is probably increasing more quickly there than it is nationwide—according to the Redfin report.

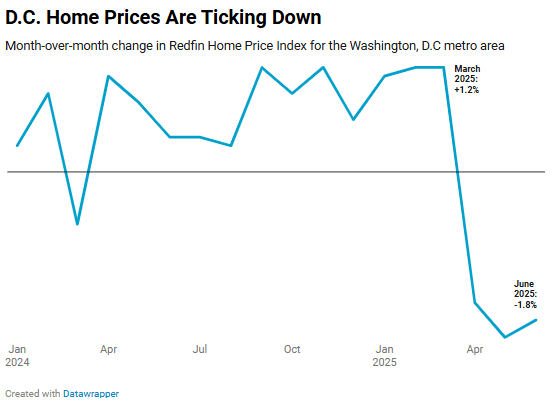

As supply exceeds demand, home values in Washington, D.C., are beginning to decline. According to Redfin’s Home Price Index, single-family home prices in the nation’s capital experienced the second-largest loss on record in June, falling 1.8% seasonally from a month earlier. The largest decline was 1.9% in May. Additionally, D.C. prices have decreased by at least 1.5% month-over-month for the third consecutive month.

On an annual basis, prices continue to rise. In June, the median price of a property in D.C. increased by more than 2% year-over-year. Washington, D.C.’s housing supply is expanding overall, but the number of new listings is staying the same. For the second time in 15 months, new listings did not show a significant growth, with June’s new listings being almost unchanged (0.3%) year-over-year.

Should the number of new listings in Washington, D.C. begin to decline more quickly, the excess supply will begin to diminish and buyers will become less competitive.

To read the full report, click here.