In Q2 2025, the price premium above existing homes fell to a historic low of 7.8%, making new building a more appealing and affordable option for today’s consumers. In addition to being more common than in previous years, newly constructed homes are also more affordable per square foot than existing homes, particularly in the South where supply is recovering the quickest, according to the most recent Realtor.com New Construction Quarterly Report.

“In a market still grappling with a shortage of nearly 4 million homes, affordable new construction plays a critical role in restoring balance. Even with recent slowdowns in starts and permits, builders continue to deliver new homes to the market at a healthy pace,” said Realtor.com Chief Economist Danielle Hale. “In many areas, these homes are not only available, they also offer better value compared to existing home inventories. We’re even seeing new home price declines in some of the most active pandemic-era hot spots, signaling a shift toward greater affordability in markets that were previously out of reach for many.”

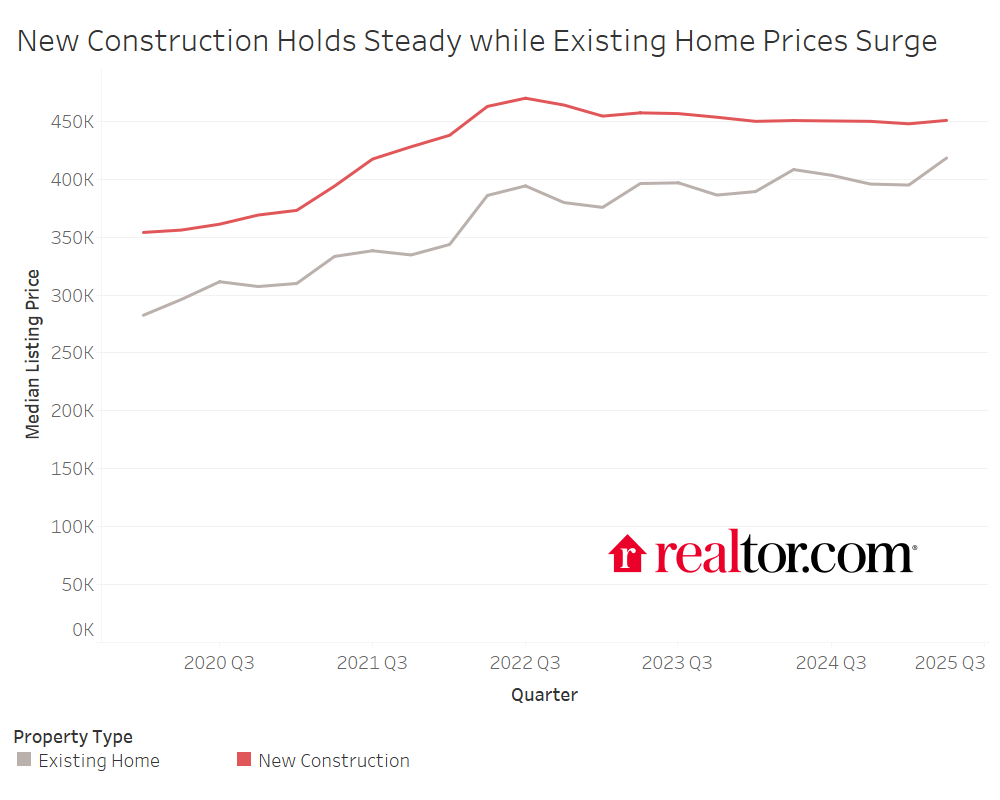

As builders maintained pricing stability and existing home prices continued to grow, the price premium for new construction compared to existing homes fell to a historic low of 7.8% in Q2 2025. In Q2, the typical list price of a newly constructed home was $450,797, which was virtually unchanged from the same period last year. Meanwhile, the median price of an existing home increased 2.4% to $418,300. Additionally, new homes are typically larger and provide better value per square foot. On average, new construction cost $218.66 per square foot nationwide, while existing residences cost $226.56.

New Builds Offer More Affordability

In the South and West, where new homes account for a larger percentage of for-sale listings, the affordability advantage is greatest. The West, which offers comparatively lower new construction prices than the other regions, was the only region in the United States where the new-home premium increased year over year. This was due to a combination of rising new home prices and an influx of lower-priced existing homes, while the price premium in three other regions decreased.

Thirty of the 100 largest metro areas saw a local reduction in new construction list prices, with the South experiencing the sharpest drops due to heavy inventory and cooling demand. Austin, Texas (-8.5%), Wichita, KS (-7.9%), Jacksonville, FL (-7.8%), Cape Coral, FL (-7.4%), and Little Rock, AR (-15.6%) are the top five markets experiencing the largest declines in new building list prices. A number of factors have contributed to these price reductions, including builder attempts to provide more reasonably priced options, more competition from pre-existing homes, and decreased buyer demand as a result of high mortgage rates and low buyer confidence.

With over 50% of both new and existing home listings, the South continues to dominate the country’s housing supply, surpassing its 39.4% share of American households. Because of the high levels of builder activity, it is also the only location where the proportion of new construction surpasses that of existing homes for sale. The Northeast, on the other hand, continues to have the most limited inventory, with a severe lack of both new and existing homes for its 17.1% of American households.

New construction is primarily a premium product in the Midwest and Northeast due to limited inventories and high demand, which has driven new build costs considerably above existing homes—in many cases, more than 50% more.

Completions have been hitting the market steadily since the epidemic, as builders stepped in to meet increased housing demand, even as builder activity has slowed amid tariff fears and the threats of decreased demand and higher material costs. New construction listings have increased 37.3% since Q1 2020, while existing home listings have increased 15.4%, with the majority of the rise occurring in the most recent quarter. The overall percentage of new homes for sale on the market has decreased due to the flood of existing home listings; it was 17.9% a year ago and is currently down to 16.4% in Q2, down from a quarterly high of 20.2% in 2023 Q2.

Cross-market demand data from Realtor.com demonstrates how buyer behavior varies by market for new construction. Demand is mostly driven by out-of-town buyers in major metropolises like Miami, New York, and Los Angeles. In contrast, local consumers are the main source of new development interest in middle-tier towns like Bakersfield, CA; Toledo, Ohio; and Tucson, AZ.

Even when looking outside of their own metro region, new homebuyers in construction-heavy cities like Durham, North Carolina; Atlanta; and Salt Lake City are more inclined to look for new development. This implies that consumers actively search for comparable options elsewhere after witnessing or experiencing the advantages of new construction in their local market.

To read more, click here.