The National Association of REALTORS’ Metropolitan Median Area Prices and Affordability and Housing Affordability Index shows that in Q2 of 2025, home prices increased in 75% of metro markets (170 out of 228). Compared to 83% in Q1, this is significantly lower. Compared to 11% in Q1 of 2025, only 5% of metro regions saw double-digit price increases in Q2.

The median single-family existing-home price in the country reached a record high of $429,400, up 1.7% from the previous year. The national median price rose 3.4% year-over-year (YoY) in Q1.

Key Findings — National Housing Affordability

- Some 24% of markets experienced declining home prices (up from 17% last quarter)

- Monthly mortgage payment on a typical existing single-family home with a 20% down payment (an estimated $2,256)

- A 6.5% increase quarter-over-quarter (QoQ)

- Roughly 0.3% decrease YoY

- Average share of income typical families spent on mortgage payments (25.7% up from 24.4% last quarter)

- Overall affordability remains down from 26.9% last year

U.S. Market Prices, Home Sales Fluctuate Nationwide

For first-time buyers, attaining a home may be becoming more difficult. With a 10% down payment, the average starter home with a $365,000 valuation had a $2,212 monthly mortgage payment. This is only a $134 rise from Q1 and a $6 decrease YoY. First-time buyers’ monthly mortgage payments accounted for an anticipated 38.7% of their income, up from 36.8% in Q1 and down from 40.6% YoY.

“Home prices have been rising faster in the Midwest, due to affordability, and the Northeast, due to limited inventory,” said Lawrence Yun, NAR Chief Economist. “The South region—especially Florida and Texas—is experiencing a price correction due to the increase in new home construction in recent years.”

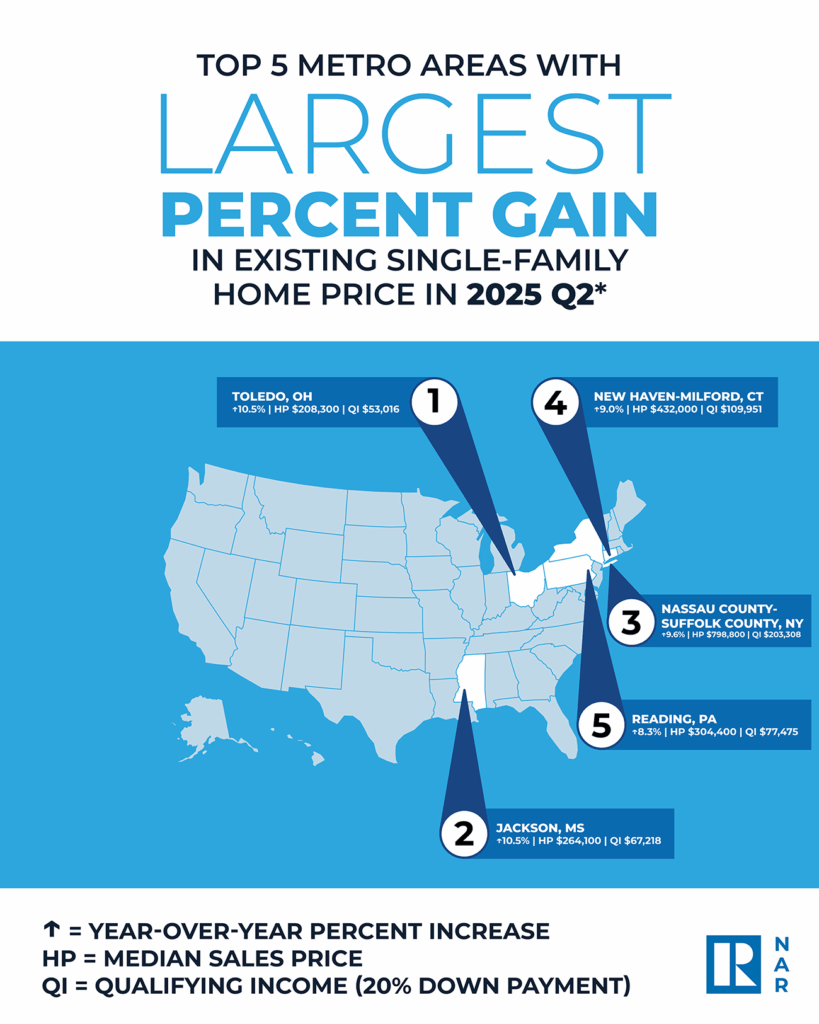

Top 10 large markets with biggest YoY median price increases:

- Toledo, Ohio (10.5%)

- Jackson, MS (10.5%)

- Nassau County-Suffolk County, NY (9.6%)

- New Haven-Milford, CT (9.0%)

- Reading, PA (8.3%)

- Springfield, MO (8.2%)

- Akron, Ohio (8.1%)

- Montgomery, AL (7.9%)

- Cleveland-Elyria, Ohio (7.8%)

- Rochester, N.Y. (7.8%)

Median existing single-family home price by region (YoY change):

- Northeast: $527,200 (+6.1%)

- Midwest: $328,800 (+3.5%)

- West: $646,100 (+0.6%)

- South: $376,300 (No change)

“Home sales and the homeownership rate are underperforming relative to job growth,” Yun said. “There have been over 7 million net job additions compared to the pre-COVID peak. However, elevated mortgage rates have kept home sales below pre-COVID levels. The homeownership rate has fallen by a full percentage point since early 2023.”

Top 10 most expensive U.S. markets:

- San Jose-Sunnyvale-Santa Clara, CA ($2,138,000; 6.5%)

- Anaheim-Santa Ana-Irvine, CA ($1,431,500; -0.4%)

- San Francisco-Oakland-Hayward, CA ($1,426,000; -1.6%)

- Urban Honolulu, Hawaii ($1,148,600; 4.3%)

- San Diego-Carlsbad, CA ($1,025,000; -2.4%)

- Salinas-Monterey, CA ($978,400; -5.5%)

- Oxnard-Thousand Oaks-Ventura, CA ($958,100; 3.3%)

- San Luis Obispo-Paso Robles, CA ($928,000; 3.7%)

- Los Angeles-Long Beach-Glendale, CA ($879,900; 2.9%)

- Boulder, CO ($859,500; -3.2%)

“If interest rates decline, the strongest release of pent-up housing demand is likely to occur in states with significant job growth in recent years, such as Idaho, Utah, the Carolinas, Florida, and Texas,” Yun concluded.