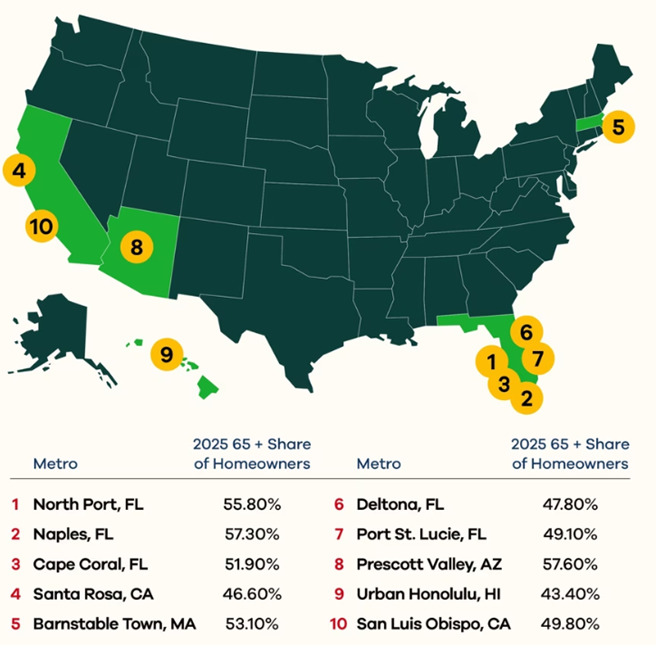

A new analysis from Realtor.com highlights the U.S. metro areas where baby boomers, defined as those born between 1946 and 1964, hold the greatest amount of housing wealth. Florida dominates the list, with five of the top 10 metros, but other areas, from coastal California to New England, also rank high.

The rankings reflect a mix of factors: the number of homeowners aged 65 and older, the overall value of homes in each metro, and the share of that value held by retirees. The result is a snapshot of where older Americans have built up the most home equity.

North Port-Bradenton, Florida, tops the list with boomers owning $97 billion of the metro’s $174 billion total real estate value. More than half of homeowners there are 65 or older, and the median home price is $495,000.

Naples-Marco Island, Florida, comes in next, with retirees owning $70 billion in property. The area’s high-end appeal, white-sand beaches, luxury resorts, and more than 90 golf courses pushes the median home price up to $749,000.

In Santa Rosa-Petaluma, California, homeowners aged 65 and up hold $54 billion in real estate wealth. The median home price is $995,000, making it one of the priciest areas on the list.

Barnstable Town, Massachusetts, which includes Cape Cod, shows a median home price of $899,250. Older residents own $34 billion of the $64 billion total home value in the area.

Prescott-Prescott Valley, Arizona, rounds out the top group with retirees owning $27 billion in real estate. The region’s dry climate and lower insurance costs make it an appealing alternative to Florida, though the median price is still $669,000.

One standout is The Villages, a sprawling retirement community in Florida. Nearly 80% of homeowners are 65 and older, and the median home price is just $369,900, far lower than other top retiree markets. The area was also the nation’s fastest-growing metro in 2023, according to U.S. Census data.

As of early 2025, owner-occupied home values totaled $47.9 trillion, with $34.5 trillion in home equity. Realtor.com estimates that boomers hold up to $19 trillion of that equity, more than any other generation.

According to the U.S. Census Bureau, nearly 12,000 people a day will turn 65 through 2027. But despite the aging trend, many boomers say they are in no rush to transfer their wealth. A Charles Schwab survey found that nearly half want to “enjoy my money for myself while I’m still alive.”

Click here for more on Realtor.com’s analysis of U.S. housing wealth.