According to a recent follow-up study by MetroSight economists supported by the National Multifamily Housing Council (NMHC) and the National Apartment Association (NAA), certain housing regulations raise rent, especially for renters with lower incomes and those residing in small multifamily buildings. Significantly, this paper expands on research published earlier this year that showed that excessive regulation can raise operating expenses.

This study is conducted at a time when the country is experiencing an affordability problem brought on by a lack of new housing supply and made worse by stringent zoning and permitting regulations.

“As housing affordability continues to be a nationwide concern requiring action from state, local and federal lawmakers, this study importantly shows how misguided regulations have the ability to increase monthly costs for renters,” said NAA President and CEO Bob Pinnegar. “Now more than ever, our nation needs responsible, sustainable policy solutions that, instead of raising costs, work to boost the supply of housing and improve affordability long-term.”

Have regulations that govern multifamily housing operations contributed to higher costs for renters?

This finding comes at a critical moment. Housing affordability challenges have become a nationwide concern, driven by several converging forces:

- Years of exceptionally low interest rates have fueled sustained growth in home prices. These rising prices likely contributed to higher rents by locking people out of homeownership and boosting rental demand.

- New housing supply, even of the traditional exurban greenfield variety, continues to fall short. The construction industry never fully recovered from the downturn of the 2000s. For almost two decades, single-family residential building permits per capita have been far below the historical average, creating a shortage that persists even as the U.S. population continues to grow.

- Despite recent efforts by some communities to boost supply, state and local regulations continue to have an outsized and enduring negative impact on multifamily housing development. Zoning restrictions, permitting delays, and other procedural hurdles continue to raise barriers to development and discourage multifamily housing.

Factors Affecting Housing Affordability Concerns & Renters

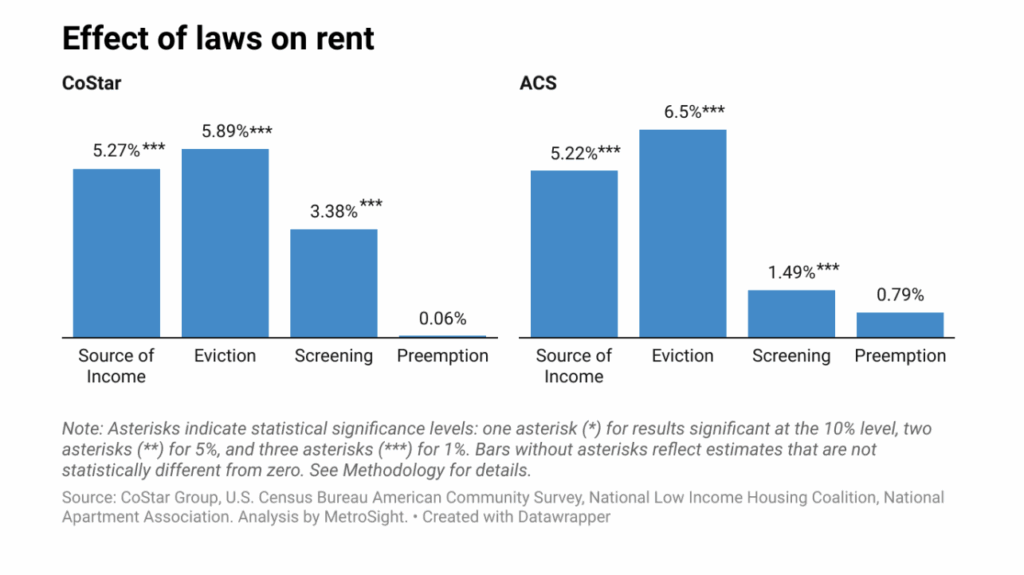

In particular, the study examined how state preemption laws, resident screening, evictions, and source of income affected rent prices. Two different and independent datasets were employed in the study: one from the U.S. Census Bureau’s American Community Survey (ACS), which included 307 metros between 2005 and 2023, and another from CoStar Group, which included market-level data from 391 metros between 2000 and 2024.

Among the report’s main findings are:

- Source-of-income regulations increase rents between 5.2% and 5.3%, or about $876 to $1,104 per unit annually.

- Eviction laws increase rents between 5.9% and 6.3%, or about $1,092 to $1,224 per unit annually.

- Resident screening laws increase rents between 1.5% and 3.4%, or about $252 to $708 per unit annually.

“As the nation continues to confront a housing affordability crisis, it’s critical that we understand how sometimes well-intentioned regulations may impact rent levels—particularly for those who can least afford increases,” said NMHC President Sharon Wilson Géno. “This new research finds that certain policies, while at times designed to protect renters, are associated with higher rents, especially for lower-income households. By bringing these data to light, we and our partners at NAA hope to support a more balanced policy conversation—one that supports renters while improving affordability and expanding the supply of rental housing.”

Lower-income families experienced greater rent increases than higher-income ones as a result of the source-of-income constraints, resident screening limitations, and eviction-related regulations linked to rental housing that we examined.

This trend aligns with the idea that these protections are more likely to be applied to market segments that serve inhabitants with lower incomes, which means they are more likely to increase operating expenses and rents in these segments.

The causal interpretation of the report’s findings is further supported by this pattern. We would anticipate more consistent rent rises across income levels if growing rents were being driven by unrelated market forces.

Rather, a coincidental explanation is less likely given the concentration of rent increases among lower-income tenants, who are the group most impacted by these laws.

To put it briefly, these policies may unintentionally burden those very households with increased rents, even while their goal is to assist vulnerable households.

“If we want rent regulations to align with affordability, we need to plainly recognize the tensions between them,” said Issi Romem, Ph.D, Founder and Economist for Metrosight. “It is striking that we found their cost has fallen hardest on lower-income renters and residents of small apartment buildings—the very people they’re meant to support.”

To read the full report, click here.