With today’s home buying marketplace defined by interest rates still over the 6.5% mark, and persistent affordability challenges, new data from Realtor.com reveals just how far buyers’ budgets are being stretched.

Realtor.com’s August 2025 Buying Power Report found that only 28% of homes on the market were priced within reach of the typical household as the maximum affordable home price for a median-income household in the U.S. has fallen to $298,000. The figure is down nearly $30,000 from $325,000, which is where it sat in 2019.

“Even as incomes grow, higher interest rates have eroded the real-world purchasing power of the typical American household,” said Danielle Hale, Chief Economist, Realtor.com. “This dynamic is forcing many buyers to adjust their expectations, whether that means looking for smaller homes, moving farther out, or delaying the dream of homeownership altogether.”

Nationwide, the average wage has risen 15.7% in the same time frame, however wages have not kept pace with mounting borrowing costs. With mortgage rates hovering averaging 6.75% through July, the monthly mortgage payment on a $320,000 fixed-rate loan was reportedly $600 higher than it would have been at 2019’s average rate. That’s an additional $7,200 a year out of the average buyer’s pocket, and that payment won’t buy what it used to. In 2019, a $320,000 loan would have covered the entire median home price while today it would need to be accompanied by a nearly 28% down payment to buy the typical-listing (priced at $439,450).

States Being Hit the Hardest

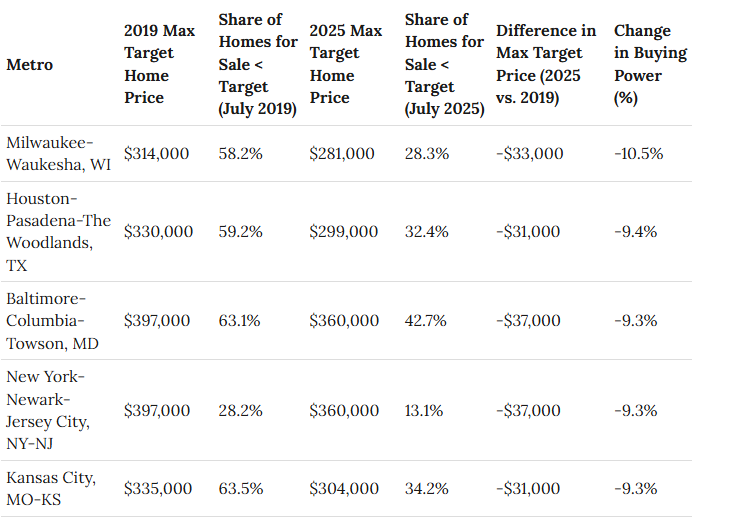

Buying power has dropped most dramatically in metros like Milwaukee, Wisconsin; Houston, Texas; Baltimore, Maryland; New York City; and Kansas City, Missouri—all of which have seen declines of 9%-10.5% in what the median earner can afford.

For example, the Milwaukee area experienced the highest buying power percentage decrease at 10.5%, while the maximum affordable home price fell from $314,000 to $281,000, a $33,000 drop.

While affordability declined, these metros still had a relatively high share of affordable homes—except for New York, where just 13.1% of listings in July were within reach of a median-income household.

Where Has Buying Power Gained?

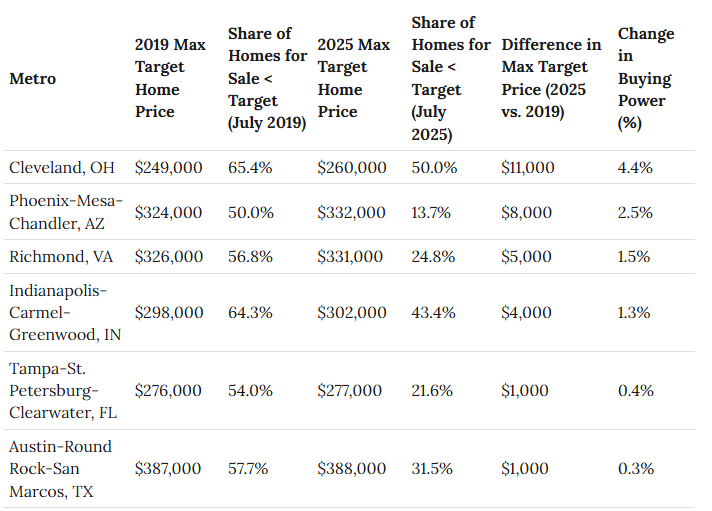

Only six of the 50 largest U.S. metros saw buying power increase since 2019. Leading the way was Cleveland, Ohio, where strong wage gains helped boost the affordable home price from $249,000 to $260,000 (+4.4%). Also, 50% of the housing inventory on the market in Cleveland in July was affordable to median-earning households.

Former pandemic boomtowns such as Phoenix, Arizona; Tampa, Florida; and Austin, Texas have seen a slight boost in buying power due to a rise in wages, but even with gains in earnings, rapid home price growth has outpaced income gains, leaving few truly affordable options.

The Impact of a Loss in Buying Power

As buying power dwindles, it is not just a matter of dollars and cents anymore, but a reshaping buyer behavior. As affordability declines, many buyers are competing more aggressively for lower-priced homes, turning to rentals when homeownership feels out of reach, or delaying their plans altogether—especially younger households without existing equity.

The market’s shift in demand also impacts sellers, who may need to adjust pricing expectations or prepare for a longer period of time on the market. Restoring lost buying power may depend on a combination of modestly lower mortgage rates, stronger wage growth, and most critically, a boost in housing supply, particularly in the affordable segment. Until those conditions improve, today’s buyers will need to remain both strategic and flexible in navigating the market.

Click here for more on Realtor.com’s August 2025 Buying Power Report.