A new paper from the Joint Center for Housing Studies (JCHS) at Harvard University projects a decade of slower growth for both homeowner and renter households. Between 2025-2035, annual growth in homeowner households is expected to range from 337,000 to 685,000, while renter households are projected to add between 174,000 and 523,000 per year. These figures reflect a general cooling in household formation, with overall household growth averaging well below historic levels at just 859,000 annually.

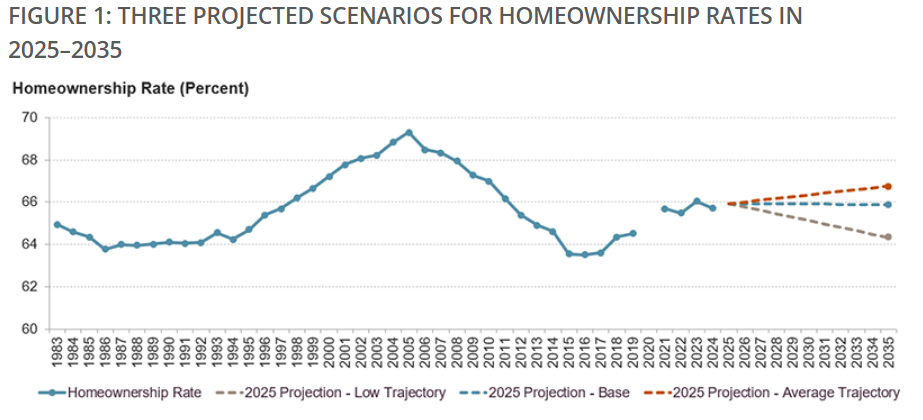

The projections also consider potential shifts in homeownership rates under three different scenarios. The results range from a 0.8 percentage point increase, reaching 66.8%, to a 1.6 percentage point decline, dropping to 64.3%. The base scenario holds rates steady at 65.9%. These modest swings reflect the demographic drivers behind the model, which do not account for sudden changes in financial conditions like mortgage rate fluctuations.

In the base scenario, average annual homeowner growth reaches 560,000 per year from 2025 to 2035—about 18% below the historical average of 685,000 since 2000. Renter growth is projected at 299,000 per year, nearly 50% below the historical average of 524,000.

The average-trajectory scenario, which assumes younger cohorts will become homeowners at historically average rates, produces the highest growth in homeowner households: 685,000 annually, matching historic norms. However, renter growth drops sharply to 174,000 per year, 67% below the long-term average.

By contrast, the low-trajectory scenario assumes persistent affordability barriers for younger buyers. In this case, the overall homeownership rate falls by 1.6 percentage points, and homeowner growth slows to just 337,000 per year, which is 51% below the long-term average. At the same time, renter growth rises to 523,000 per year, nearly equal to historical renter trends.

Taken together, the three scenarios paint a picture of slowing growth across the board.

“In the context of slowing household growth overall, the three projection scenarios produce increases in both homeowner and renter households that are historically average at best and well below average in others,” writes Daniel McCue, Senior Research Associate at JCHS.

While the low-trajectory scenario may be the most realistic given high home prices and interest rates, JCHS notes that sudden shifts, such as a drop in mortgage rates, could quickly alter these outcomes. For now, the projections suggest a future in which renter demand remains resilient, but homeowner household growth falls well short of past decades.

Click here for more on the report, “Projections of Homeownership Rates and Household Growth by Tenure for 2025-2035.”