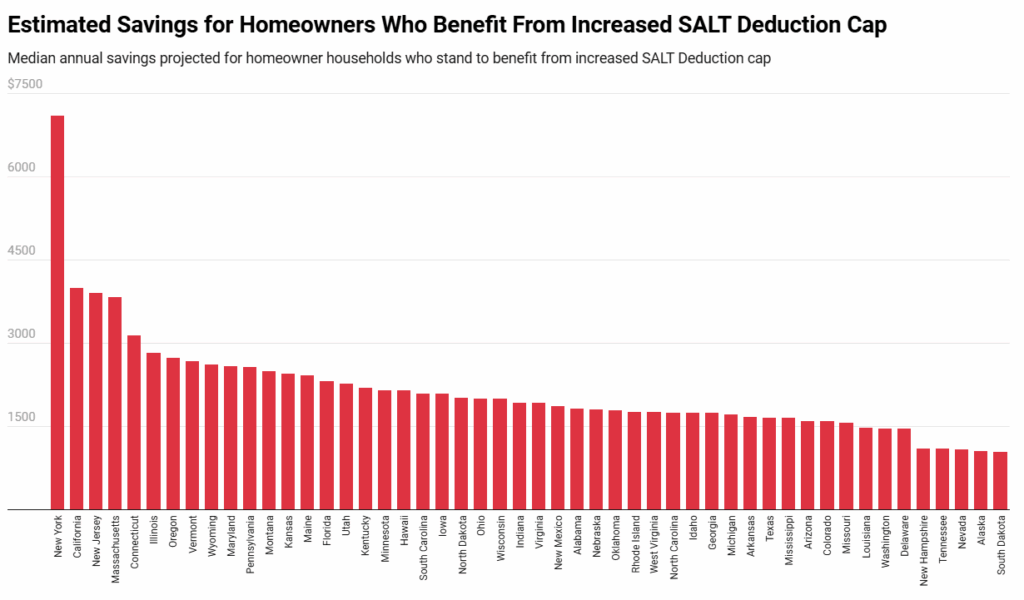

A new report by Redfin has found that the typical New York homeowner impacted by the raised state and local tax (SALT) deduction cap could save more than $7,000 a year—the highest of any state. But the share of homeowners who benefit from the SALT cap increasing from $10,000 to $40,000—and how much they save—varies widely across the country. In some states, like Massachusetts, almost every homeowner could benefit, while in others, like Tennessee, only a small fraction are likely to be impacted.

The raised SALT deduction cap was introduced as part of President Trump’s “One Big Beautiful Bill Act.” The SALT deduction is for taxpayers who itemize their deductions to reduce their federally taxable income. Those taxpayers can deduct up to $10,000 for 2024 or $40,000 for 2025—of property, sales, or income taxes already paid to state and local governments. This limit, known as the SALT cap, was originally set at $10,000 by the Tax Cuts and Jobs Act (TCJA). However, the One Big Beautiful Bill Act increased the cap to $40,000 for 2025, subject to a phasedown. The SALT deduction can be especially attractive for taxpayers in high-tax states and high-income filers as it avoids double taxation.

Using local tax revenue, home value and income data, Redfin’s analysis projects how much typical homeowners could expect to deduct if they itemize their deductions. In the report, Redfin projects the share of homeowners who could benefit from the SALT cap increase. It’s important to note that the share of households who are likely to itemize their taxes will be smaller, as many homeowners will continue to take the standard deduction.

Empire State Leads the Way

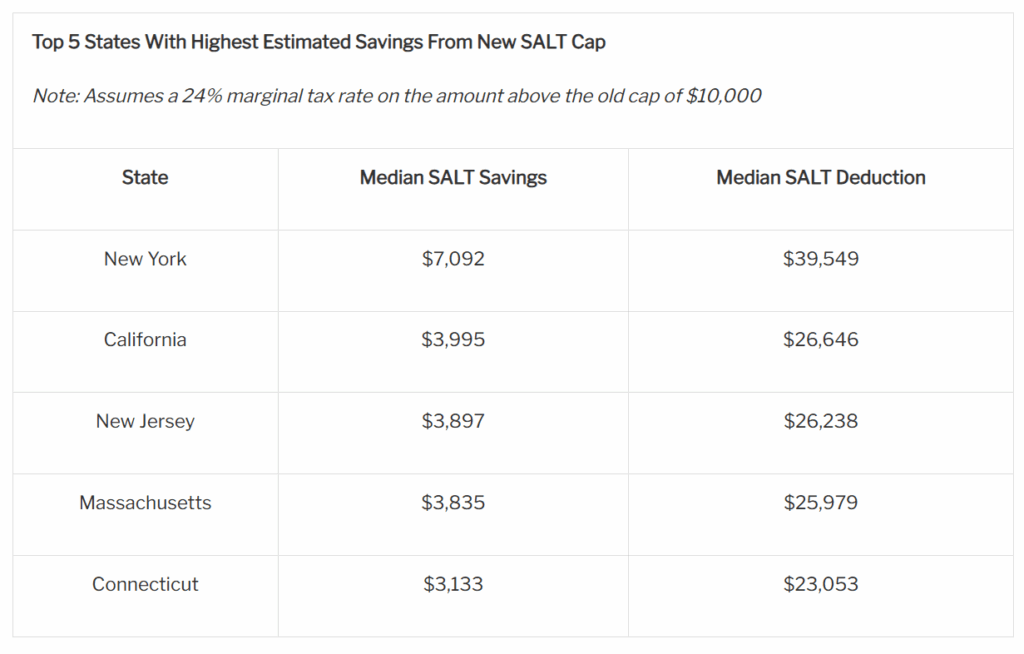

The typical New York homeowner impacted by the increased SALT cap will save $7,092 annually. Redfin estimates savings by first calculating how much the typical impacted homeowner could deduct under the new SALT rules, then applying a 24% marginal tax rate to the portion that exceeds the previous $10,000 cap.

California homeowner households impacted by the new cap will save the second-highest amount each year ($3,995), followed by New Jersey ($3,897), Massachusetts ($3,835) and Connecticut ($3,133).

“Homebuyers in states like Illinois, where the potential tax savings are high relative to home prices, may look at the new SALT cap as an opportunity to increase their homebuying budget,” said Redfin Senior Economist Asad Khan. “Theoretically, that could lead to an increase in demand, and higher prices.”

Where Are the Lowest SALT Savings Found?

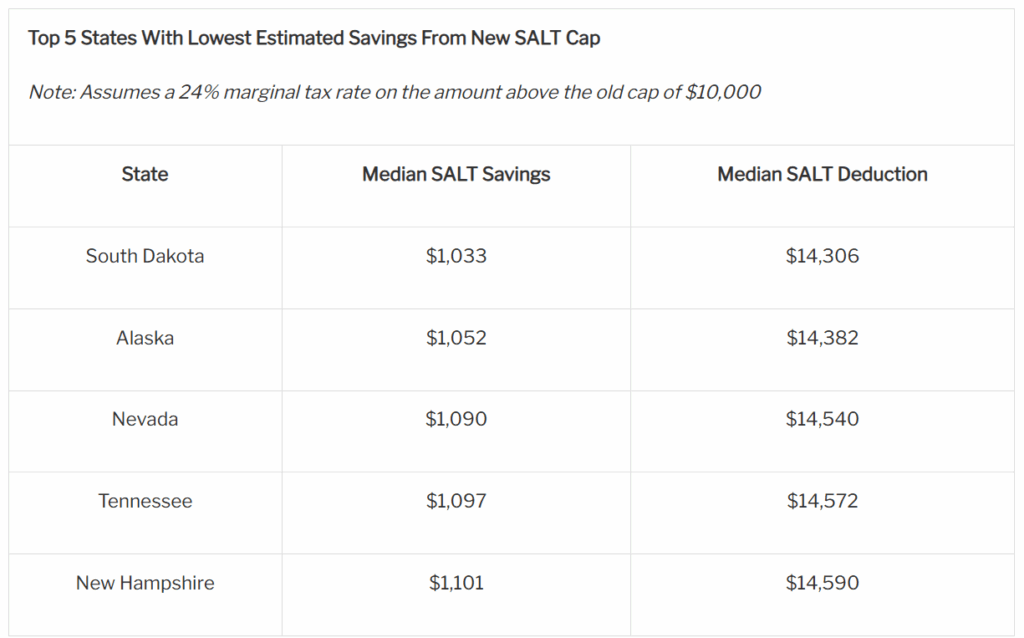

The typical homeowner household impacted by the new cap in South Dakota will save $1,033 per year—the lowest of any state. Alaska homeowner households impacted by the new cap will save the second-lowest amount each year ($1,052), followed by Nevada ($1,090), Tennessee ($1,097) and New Hampshire ($1,101). Khan said the five lowest states do not have a state income tax, meaning homeowner households are less likely to cross the old $10,000 SALT deduction cap.

“For households in these states, the only real way to benefit is if their home is valuable enough for property taxes to exceed $10,000,” Khan said. “Even then, the savings are relatively small, since many of these owners are just barely over the old limit.”

Who Benefits From the Raised SALT Cap?

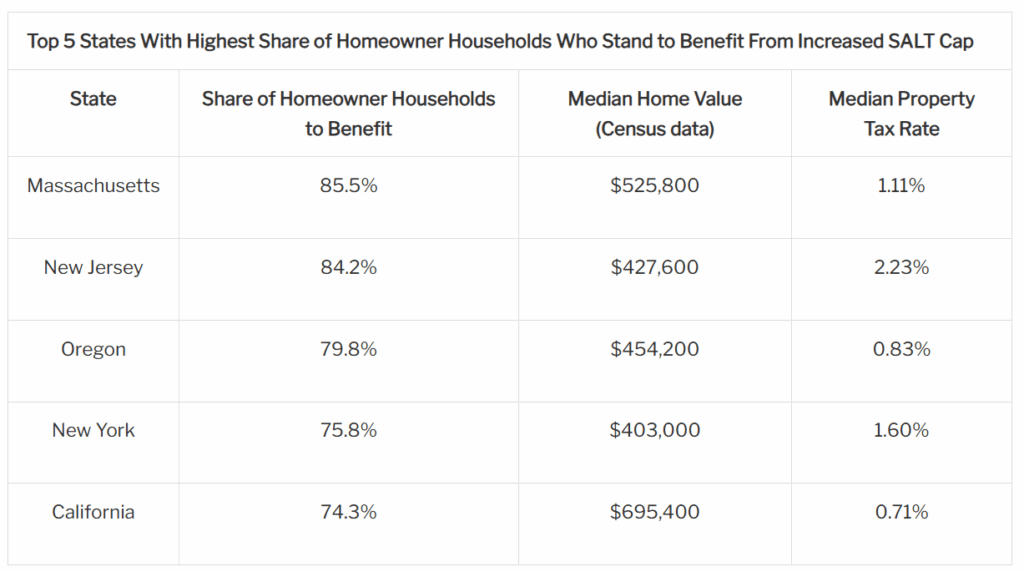

More than eight in 10 (85.5%) Massachusetts homeowners stand to benefit from the new tax rules if they choose to itemize their deductions, according to Redfin. This means they could deduct more than $10,000 (the old cap) in combined property, and state and local income taxes—the highest share of any U.S. state.

Massachusetts was followed by New Jersey (84.2%), Oregon (79.8%), New York (75.8%), and California (74.3%). These states share one thing in common: expensive homes. All five are among the 10 states with the highest median home values.

It’s worth noting, however, that not all states with high home values will benefit as significantly from the tax rule changes.

For example, Washington has the fifth-highest median home value of all states, yet only 9.6% of homeowners stand to benefit from the increased cap. That’s because Washington has no state income tax, and its median property tax rate is a relatively low 0.84%. In Colorado, which has the sixth-highest median home value of all states, a low median property tax rate of 0.49% means only 15.3% of homeowners stand to benefit from the new rules.

“West Virginia has the lowest median home value in the country, but nearly a third of homeowners there could benefit from the new cap,” Khan said. “Benefits vary so widely because the mix of home values, property taxes, and income taxes looks very different depending on where you live. In states with both high home values and high taxes, most homeowners are now able to deduct more than they could under the old $10,000 cap. In lower-tax states—or states with no income tax—the impact is smaller, even for people with expensive homes.”

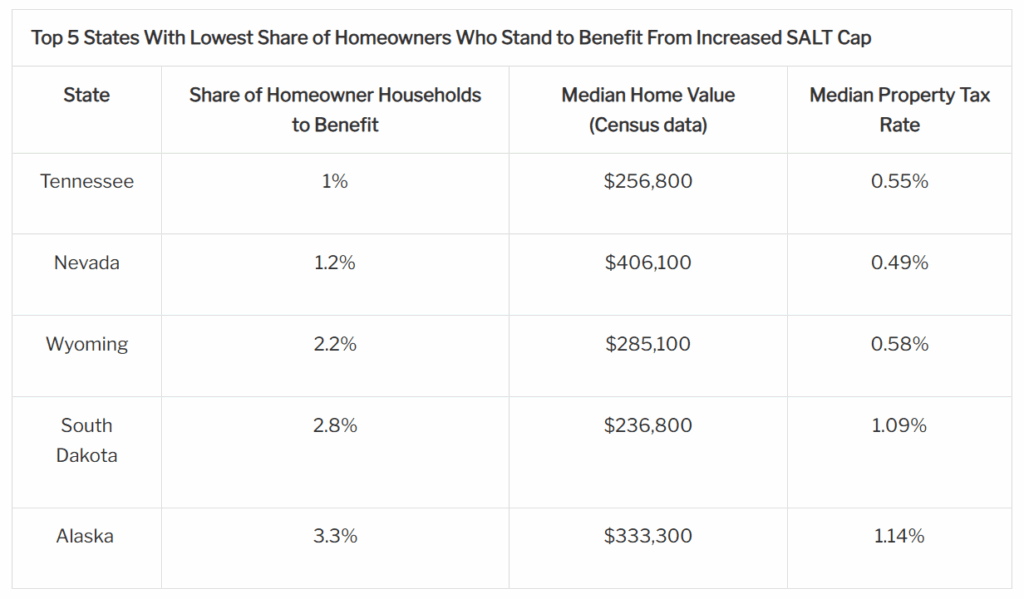

On the other side of the ledger, only 1% of homeowners in Tennessee stand to benefit from the increased SALT cap—the lowest of any state.

The next lowest shares are in Nevada (1.2%), Wyoming (2.2%), South Dakota (2.8%), and Alaska (3.3%). The common thread between the bottom five states is the lack of a state income tax, while Tennessee, Nevada and Wyoming also have among the lowest median property taxes.

Typical SALT Cap Savings

The typical homeowner in Nassau County, New York, impacted by the increased SALT cap will save an average of $7,200 annually—the most in any of the top 100 U.S. metro areas and the highest savings possible, as it represents the maximum deduction of $40,000.

Nassau County was followed by San Francisco ($6,843), San Jose ($6,661), New York ($5,473), and Oakland ($5,455).

Nearly all (96.1%) of homeowner households in Nassau County stand to benefit from the increased SALT cap if they itemize their deductions—the highest share among the top 100 U.S. metro areas.

Click here for more on Redfin’s analysis of the SALT cap and its impact on U.S. homeowners.