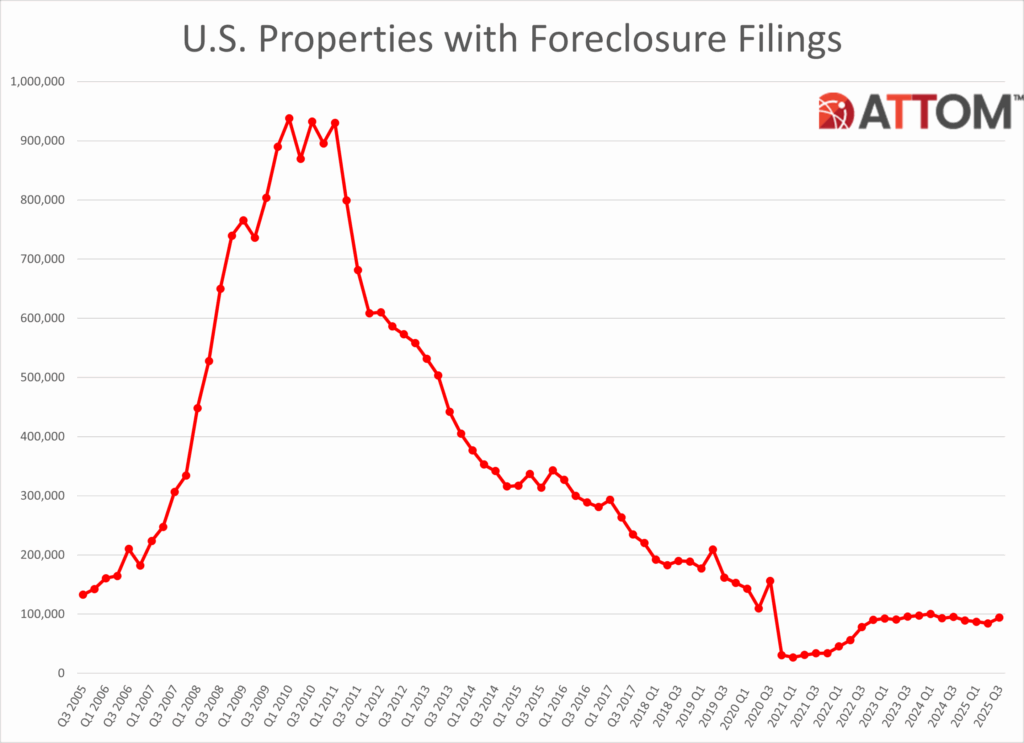

The third quarter of 2025 saw an estimated 101,513 U.S. homes with foreclosure filings, up less than 1% from the previous quarter and 17% from a year ago, according to ATTOM’s Q3 2025 U.S. Foreclosure Market Report.

According to the data, there were 35,602 foreclosure filings on U.S. properties in September 2025, which is a decrease of 0.3% from the previous month and an increase of 20% from a year earlier.

“In 2025, we’ve seen a consistent pattern of foreclosure activity trending higher, with both starts and completions posting year-over-year increases for consecutive quarters,” said Rob Barber, CEO at ATTOM. “While these figures remain within a historically reasonable range, the persistence of this trend could be an early indicator of emerging borrower strain in some areas.”

Key Findings from the Q3 2025 U.S. Foreclosure Market Report:

- In September 2025, there was a foreclosure filing on one out of every 3,997 properties nationwide.

- In September 2025, the states with the highest foreclosure rates were South Carolina (one in every 2,883 housing units), Delaware (one in every 2,325 housing units), Nevada (one in every 2,417 housing units), Indiana (one in every 2,697 housing units), and Florida (one in every 2,182 housing units with a foreclosure filing).

- In September 2025, 23,761 properties in the U.S. began the foreclosure process, a 20% increase from September 2024 and a 2% decrease from the previous month.

- In September 2025, 3,780 U.S. residences were foreclosed on by lenders, a decrease of 7% from the previous month and an increase of 44% from September 2024.

Measuring U.S. Foreclosures

In Q3 2025, 72,317 properties in the United States began the foreclosure process, an increase of 2% from the quarter before and 16% from the same period last year.

States that had the greatest number of foreclosure starts in Q3 of 2025 included:

- Texas (9,736 foreclosure starts)

- Florida (8,909 foreclosure starts)

- California (7,862 foreclosure starts)

- Illinois (3,515 foreclosure starts)

- New York (3,234 foreclosure starts)

The largest number of foreclosures in Q3 2025 began in the following major metro areas with a population of 200,000 or more:

- Houston (3,763 foreclosure starts)

- New York (3,452 foreclosure starts)

- Chicago (3,144 foreclosure starts)

- Miami (2,502 foreclosure starts)

- Los Angeles (2,321 foreclosure starts)

Where Are the Worst Foreclosure Rates Nationwide?

In Q3 2025, there were foreclosure filings in one out of every 1,402 dwelling units nationwide.

States with the worst foreclosure rates were in:

- Florida (one in every 814 housing units with a foreclosure filing)

- Nevada (one in every 831 housing units);

- South Carolina (one in every 867 housing units)

- Illinois (one in every 944 housing units)

- Delaware (one in every 974 housing units)

Among an estimated 225 metropolitan statistical areas with a population of at least 200,000, those with the worst foreclosure rates in Q3 2025 were:

- Lakeland, FL (one in every 470 housing units)

- Columbia, SC (one in 506)

- Cape Coral, FL (one in 589)

- Cleveland (one in 593)

- Ocala, FL (one in 665)

Other large cities with a population of one million or more, such as Cleveland (ranked #4), have foreclosure rates in the top 20 worst in the country, including Jacksonville, FL (ranked #6), Las Vegas (ranked #9), Houston (ranked #14), and Orlando, FL (ranked #17).

U.S. Bank Repos Heighten from Last Year

In Q3 2025, lenders repossessed 11,723 properties in the United States through foreclosure (REO), an increase of 4% from the previous quarter and 33% from the same period last year.

Those states that had the greatest number of REOs in Q3 2025 were:

- Texas (1,288 REOs)

- California (1,132 REOs)

- Florida (762 REOs)

- Pennsylvania (708 REOs)

- New York (644 REOs)

The average duration of the foreclosure process for properties that were foreclosed in Q3 2025 was 608 days. This continues a declining trend that has been in place since mid-2020, with a 6% decline from the previous quarter and a 25% decline from the same period last year.

States with the longest average foreclosure timelines for homes foreclosed in Q3 2025 were in:

- Louisiana (3,632 days)

- Nevada (2,667 days)

- Rhode Island (1,929 days)

- New York (1,867 days)

- Hawaii (1,710 days)

States with the shortest average foreclosure timelines for homes foreclosed in Q3 2025 were in:

- West Virginia (135 days)

- Texas (154 days)

- Virginia (160 days)

- Wyoming (165 days)

- Montana (174 days)

Overall, even though some states saw quarterly drops, the overall pattern indicates that foreclosure activity is still higher than it was a year ago.

In Q3 2025, foreclosure activity maintained its steady rising trajectory, with annual increases in both starts and completions. Even if total levels are still low by historical standards, the market may be gradually changing as a result of wider economic factors, as evidenced by the constancy of these advances over successive quarters.

To read more, click here.