According to a new First American study, the housing market is about to undergo a demographic shift. Millennials are currently in their prime years to purchase a property, and demand is being progressively increased by Generation Z (and eventually by Generations Alpha and Beta).

Meanwhile, the majority of today’s housing stock is owned by baby boomers who are aging in place, which keeps turnover low and family-sized homes in desirable cities limited for the time being. However, it also prepares for a long-term, slow inventory release as late-life moves mount. For many years to come, the way these two demographic factors interact will influence housing supply, costs, and affordability patterns.

In this housing relay, baby boomers and Gen X represent the first leg. These elder cohorts dominate today’s owner-occupied housing at a time when homeownership peaks, but late-life dynamics will eventually lower their share of the nation’s housing supply. Downsizing, care relocations, and estate transfers are all consequences of aging that eventually recycles the home stock for younger buyers.

Homeownership by Generation, Growing Numbers & More

In 2025, it is expected that there will be an estimated 39.9 million homes and some 31.1 million homeowners, with a 78% homeownership rate, representing the high-water mark within the boomer generation. With the aid of paid-down mortgages, many people are opting to stay in their current residence during their retirement years. Technological developments that enable seniors to live more independently in their homes are contributing to the trend of “aging in place.”

They will eventually relocate to smaller or care-oriented settings due to health, accessibility, and family proximity, and by 2060, natural attrition will have reduced their numbers to 1.5 million households. The next generation of buyers will benefit from a consistent supply of larger, strategically positioned houses as a result of that change.

The “middle child” population, or Generation X, acts as the link. With about 35 million homes, Gen X is smaller than the baby boomer generation and will be in their prime earning years for the next 20 years. Gen Xers in their late careers and retirement are expected to drive the last stage of home ownership, contributing roughly 1.8 million new homeowner households and increasing their ownership percentage to 75% by 2040. The boomer-led supply wave continues until the mid-2040s and beyond as they transition from net buyers to net sellers, progressively releasing suburban home stock.

Younger generations advance behind them, albeit on a different timeline. For younger generations, family formation and homeownership have been pushed further out due to later marriage, postponed childrearing, and years spent focusing on school and careers. Renting has become the norm for longer when you include economic and affordability shocks, such as the Great Financial Crisis, the global housing boom, and the ensuing freeze. However, while homeownership is delayed, it is not prevented by these demand-side factors.

Millennials & Gen Z Fall Behind, But Not Too Far

The largest adult generation, millennials, are firmly in their prime purchasing years. Their household count increases slightly as they turn their education and professional accomplishments into home ownership, from around 35.8 million in 2025 to approximately 39.6 million in the early 2050s, but the proportion of households that own a home increase significantly, and much more quickly. As the homeownership rate rises from 51 to 73%, an estimated 10.6 million more people will become homeowners. It is expected that housing demand will have a lengthy, consistent tailwind through the late 2050s before leveling out thanks to a moderate increase in households and a significant shift from renters to owners.

Gen Z, who are just starting their housing experience, follows. Gen Z households are expected to grow from over 13 million in 2025 to nearly 40 million by the late 2040s, eventually overtaking millennials when they drop out of school and go out on their own. Like millennials, the transition to homeownership occurs after reaching educational and professional milestones. By 2060, it is projected that the number of Gen Z owners will have increased to nearly 27 million, from 25% in 2025 to roughly 66%. As the group passes the peak of their purchasing years, momentum will continue through the 2050s before starting to taper off in the 2060s.

The following wave is made up of Generations Alpha and Beta. They won’t be around much until the mid-2030s, when the eldest start living independently and starting families. By the 2050s, when millennials have outlived their prime purchasing period and Gen Z demand is starting to wane, homeownership is forecasted to soar as earnings rise, and family formation quickens. The generational handoff will continue into the second part of the century as these cohorts form a large pool of potential buyers by 2060.

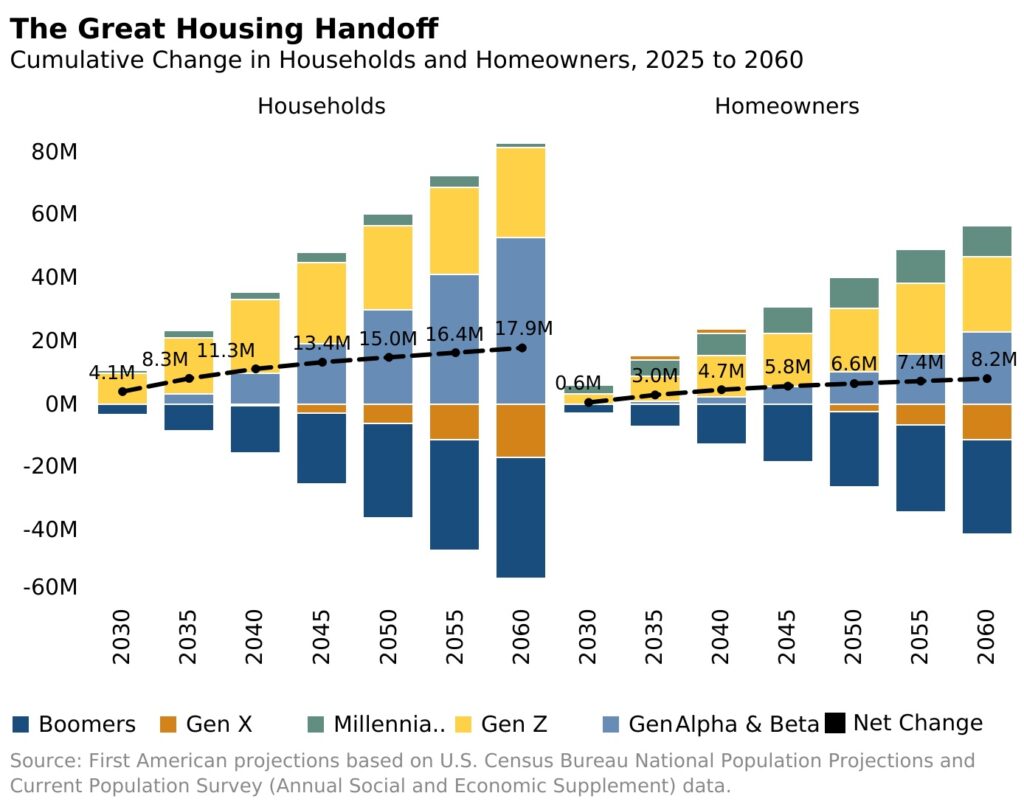

In conclusion, the following 35 years appear more like a generational relay than a surge when you zoom out from the cohort stories. Between 2025 and 2060, experts predict there will be a cumulative shift in households and homeowning households from elder sellers to increasing buyers, according to recent data. Over that period, it is anticipated that the number of households would increase by 17.9 million, or roughly 13%, and the number of homeowner households will increase by 8.2 million, or roughly 8.2%.

To read more, click here.