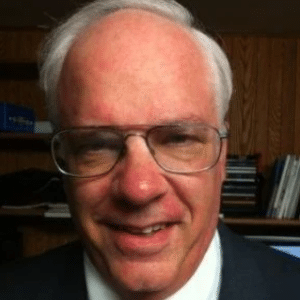

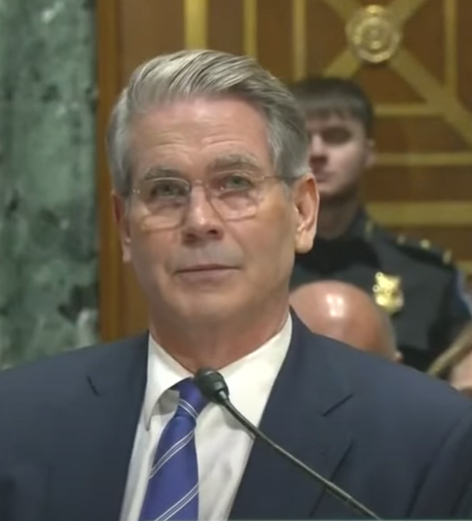

Treasury Secretary Scott Bessent said in a Sunday interview that some sectors of the economy are in a recession or at risk of one.

The housing sector is among the areas of the economy experiencing softness now, Bessent noted in an interview on CNN’s State of the Union. “If the Fed brings down mortgage rates,” Bessent suggested, “they can end this housing recession.”

Though not directly impacted by Fed rate cuts, mortgage rates have dropped over the past few months, but the overall housing market remains weak.

Bessent said that the Trump administration worked to lower the deficit-to-gross-domestic-product ratio from 6.4% to 5.9% through government spending cuts, which should help to push down inflation. But he complained the central bank is not moving fast enough to bring down interest rates, he said.

“If we are contracting spending, then I would think inflation would be dropping,” he said. “If inflation is dropping, then the Fed should be cutting rates.”

Fears of a Larger Recession?

He further cautioned that a failure to further cut rates could lead to a general recession.

The Fed cut interest rates by 25 basis points last week, the second such monthly cut. Though an additional cut was expected by many at the Fed’s December meeting (there is no scheduled meeting in November, Powell cautioned that such a cut is not a foregone conclusion during his remarks last week.

The tech sector has largely propped up other sectors of the economy this year.

“The tech sector has been the key driver of recent U.S. growth, with surging stock prices and heavy investment in equipment and software,” wrote Oxford Economics’ lead economist, Adam Slater, in a note shared with Fortune. “But this leaves the U.S. vulnerable if tech suffers a downturn—without tech investment, U.S. GDP would have barely grown in H1 2025, and business investment would have actually declined.”

Oxford Economics modeled two scenarios off the back of a tech downturn, an environment where investment slows and stock prices fell in tandem. The first, a U.S.-centered downturn with modest international spillover would see domestic GDP growth fall to 0.8% in 2026—which Slater writes is “flirting with recession.” The ripple effects would also snag the global economy, slowing it from predicted growth of 2.5% in 2026 to 2%.