Home shoppers had more listings to choose from in October, as active inventory climbed 15.3% compared to last year. This statistic marks two full years of annual growth, according to the latest Realtor.com data. Still, the pace of expansion continues to ease, signaling that the post-pandemic recovery in housing supply may be leveling off. The number of homes for sale stayed above 1 million for the sixth consecutive month, yet remains more than 13% below 2017–2019 averages.

Inventory grew in all four major regions, led by the West and South at about 17% each, followed by the Midwest (+12%) and Northeast (+9%). Growth in the South and West has slowed sharply since spring, while the Midwest and Northeast are making modest gains and narrowing the regional divide that defined much of 2024. At the metro level, all of the 50 largest markets saw year-over-year gains, with Washington, DC (+38%), Charlotte (+36%), and Las Vegas (+35%) posting the most steep increases.

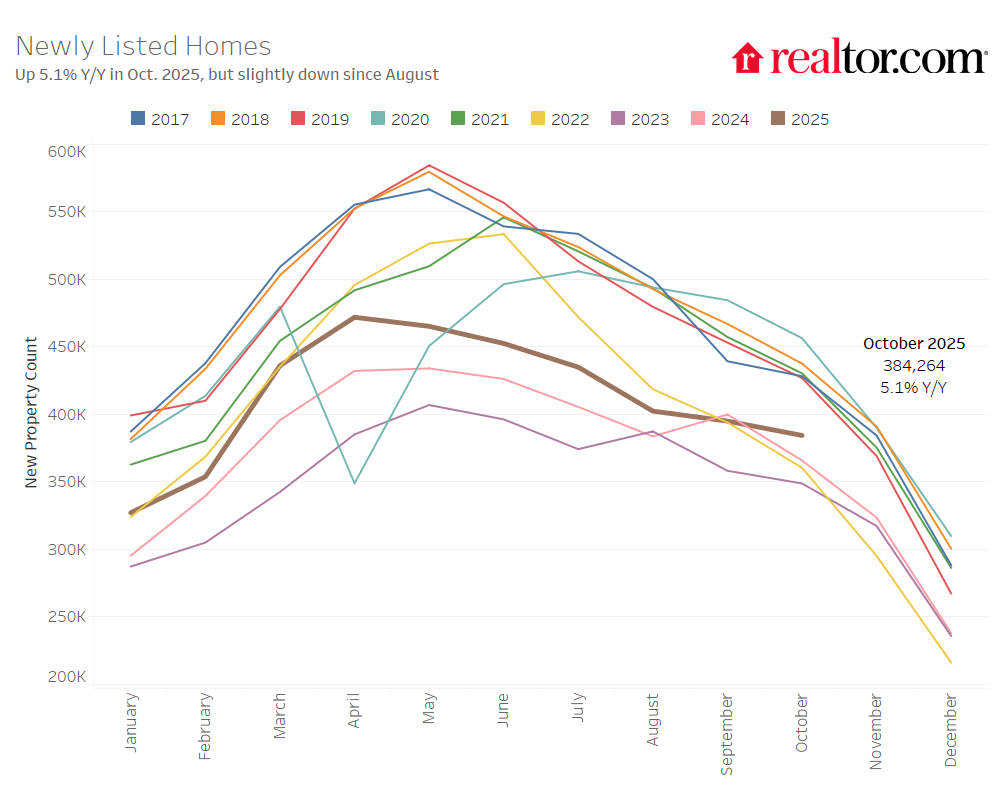

Even as buyers gained options, demand remained soft. Homes spent an average of 63 days on the market (five days longer than a year ago), extending a 19-month streak of slower sales. Pending home sales slipped 1.9% year-over-year, and new listings (although up slightly from last year) declined month over month in line with seasonal patterns.

Prices were largely steady nationwide, with the average list price at $424,200, a number just 0.4% higher than last October. As for regional trends? They diverged, with prices falling 0.9% in the South and 2.6% in the West, while holding flat in the Northeast and rising slightly in the Midwest. On a per-square-foot basis, values were up 3.8% in the Northeast and down across other regions.

Price cuts also remain a common occurrence, with 20% of listings seeing reductions, especially in Denver, Portland, and Indianapolis. At the same time, metros like Hartford and Chicago continue to lag far behind pre-pandemic inventory norms, revealing the fact that recovery remains uneven.

A special analysis this month highlights another emerging pressure, which is the ongoing federal government shutdown. Housing activity has cooled in metros with high shares of federal employees, such as Washington, DC, Virginia Beach, Oklahoma City, and Baltimore, each places where new listings and buyer searches have dipped as uncertainty over paychecks weighs on confidence.

The general consensus is that the market is shifting from rapid correction to cautious balance. Inventory is still growing, but at a slowing pace, and prices are stabilizing, while buyers remain hesitant even as mortgage rates ease. These are all clear signs that the housing market’s long road back to normal may be hitting a plateau.

To read more, click here.