The pool of refinance candidates expanded in October and drove mortgage repayments upward, according to ICE Mortgage Technology in its just-released ICE First Look at mortgage delinquency, foreclosure, prepayment trends.

ICE is a neutral provider of a robust end-to-end mortgage platform and part of Intercontinental Exchange Inc. (NYSE: ICE).

“Softening mortgage rates expanded the pool of refinance candidates in October, pushing prepayments to their highest level in three and a half years,” said Andy Walden, Head of Mortgage and Housing Market Research at ICE. “This trend was largely driven by people who purchased homes at elevated rates in recent years seizing the opportunity to lower their monthly payments.”

Walden added: “Overall mortgage health remains solid, with continued improvement in delinquency rates across all stages. While foreclosure activity has ticked up, levels remain historically low. This uptick is driven by a rise in FHA foreclosures along with the resumption in VA foreclosures following last year’s moratorium.”

October Delinquencies Improve; Loans in Foreclosure Highest Since 2023

Here key takeaways from the ICE report:

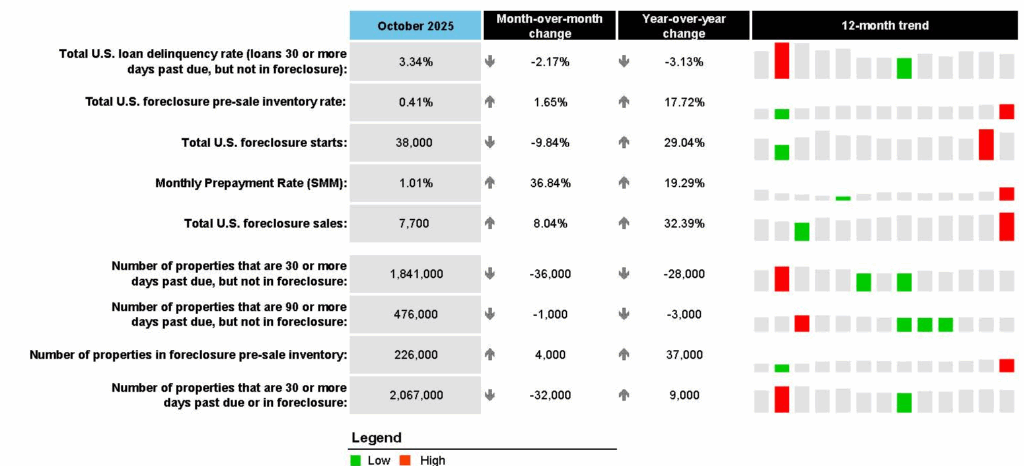

Delinquencies improved: ICE said the national delinquency rate fell by 7 basis points (bps) in October to 3.34%. That is down 11 bps from the same time last year and 53 bps below the October 2019 pre-pandemic benchmark.

Broad strength in delinquency rates: Performance improved across the board, ICE reported, with both early-stage (30-day) and late-stage (90+ day) delinquencies declining during in October.

Prepayments reached a multi-year high: ICE reported that the single month mortality (SMM) rate, which tracks prepayments, rose by 27 bps in October to 1.01%. That marks the highest level in 3.5 years and an increase of 16 bps from last year when interest rates were at similar levels.

Foreclosure activity trending upward: Although October foreclosure starts slowed by 9.8% from the prior month, the overall trend continues to rise. ICE reported that foreclosure inventory is up by 37,000 (+19%) year over year, and foreclosure sales have increased by 1,900 (+32%) from last year’s levels.

Government loans driving foreclosure growth: While foreclosure activity remains muted by historical standards, ICE said the number of loans in active foreclosure hit its highest level since early 2023, driven by a notable rise in FHA foreclosures (+50% YoY) along with a resumption of VA activity after last year’s moratorium.