In Q3 of 2025, the Enterprises conducted 50,096 foreclosure prevention activities, totaling 7,263,900 since conservatorships began in September 2008. Some 6,557,663 of these measures—including 2,809,639 permanent loan modifications—have assisted distressed homeowners in remaining in their residences.

Initiated forbearance plans rose from 22,119 in Q2 of 2025 to 23,674 in the third. At the conclusion of the quarter, there were 33,360 loans in forbearance, or roughly 0.11% of all loans serviced and 6.2% of all loans that were past due.

The Enterprises’ Mortgage Performance

In Q3 of 2025, main forbearance was used in 65% of the adjustments. Thirty-five percent of all loan modifications during the quarter were extend-term only. During the quarter, some 238 short sales and deeds-in-lieu were finalized, increasing the total to 706,237 since the conservatorships started in September 2008.

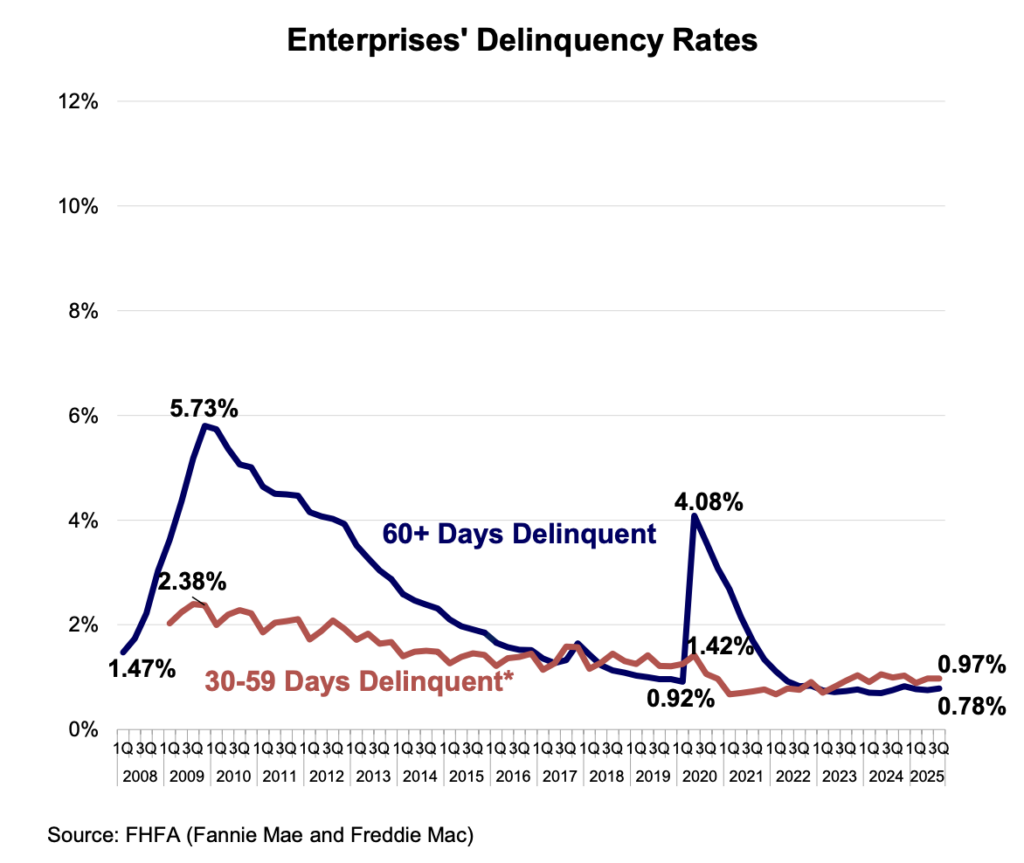

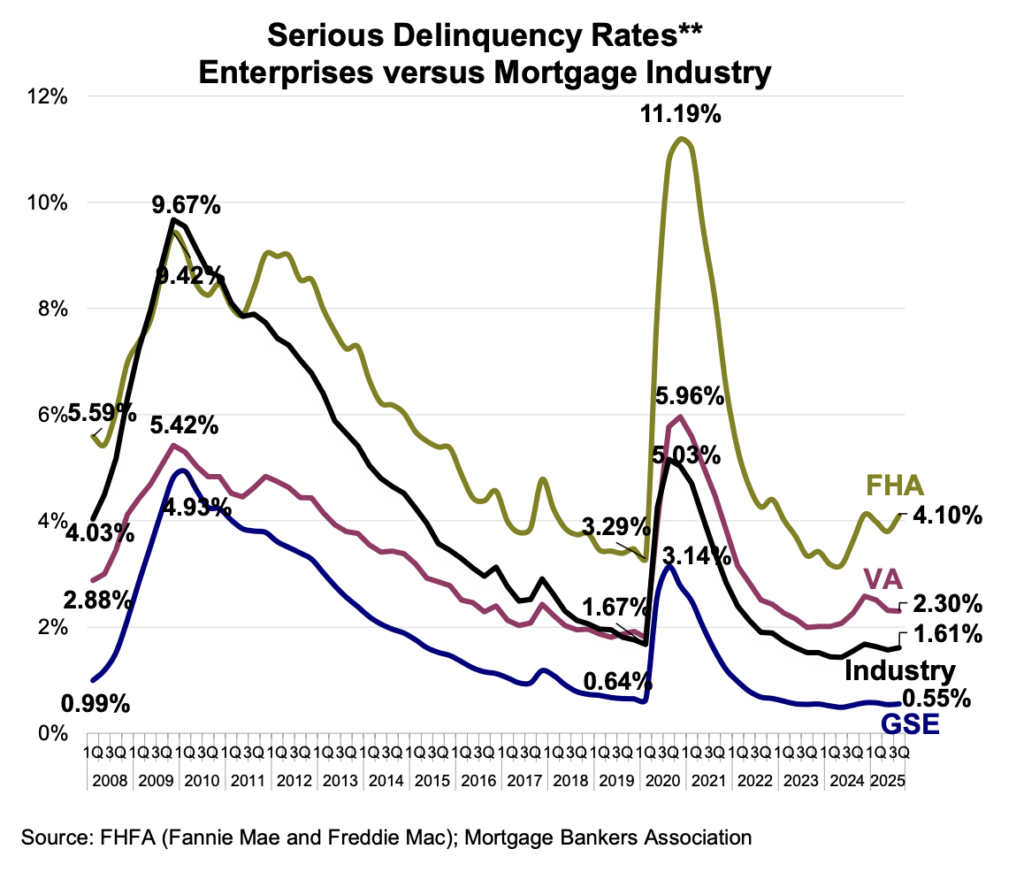

By the conclusion of Q3 of 2025, the 60+ day delinquency rate had risen from 0.76% at the end of Q2 to 0.78%. By the conclusion of Q3 of 2025, the Enterprises’ significant (90 days or more) delinquency rate had risen to 0.55%. This was in contrast to the industry average of 1.61% for all loans, 2.30% for Veterans Affairs (VA) loans, and 4.10% for Federal Housing Administration (FHA) loans.

Additionally, in Q3 of 2025, third-party and foreclosure sales climbed 4.7% to 3,344, while foreclosure starts jumped to 24,802.

September saw a rise in total refinance volume, but overall third-quarter activity was lower than that of Q2. Higher mortgage rates in June and July were the main cause of the decline. The average interest rate on a 30-year fixed-rate mortgage dropped to 6.35 percent in September from 6.59% in August as mortgage rates continued to decline.

After peaking at 82% over the previous three years, cash-out refinances as a percentage of overall refinances fell from 63% in August to 55% in September 2025.

Note: The percentage of the Enterprises’ loans that are 30-59 days delinquent remained steady at 0.97% while the 60+ days delinquency rate increased to 0.78% at the end of Q3 of 2025. The Enterprises’ serious delinquency rate increased to 0.55% at the end of the quarter. This compared with 4.10% for Federal Housing Administration (FHA) loans, 2.30% for Veterans Affairs (VA) loans, and 1.61% for all loans (industry average).

To read the full report, click here.