As Asian American and Pacific Islander (AAPI) Heritage Month draws to a close, which traditionally takes place in the month of May, a new report from Zillow has found that Asian and Pacific Islander-headed households face higher housing payment burdens than any other race.

As Asian American and Pacific Islander (AAPI) Heritage Month draws to a close, which traditionally takes place in the month of May, a new report from Zillow has found that Asian and Pacific Islander-headed households face higher housing payment burdens than any other race.

According to Zillow, Asian mortgage applicants have low denial rates overall, but those who are denied are disproportionately denied because of a high debt-to-income ratio, which is traditionally earmarked as 30% of total income.

Mostly concentrated in higher cost-of-living areas, Asian mortgage borrowers in 2022 purchases homes that were 42% more expensive than the average median mortgage buyer overall.

Pacific Islander-headed households have the lowest homeownership rate amoung all races across the lowest highest income levels.

Zillow said that AAPI borrowers face unique challenges and financial strains within their own communities because a majority of the AAPI households are typically in more expensive areas. In 2022 alone, the typical value of a home purchased by an Asian buyer was $575,000, while a Pacific Islander purchased a home at an average of $465,000, surpassing the overall median of $405,000 for all mortgage buyers.

In return, this causes AAPI households to stretch their budgets further than other races have to in order to make their monthly mortgage payments.

“Many AAPI-led households live in pricier coastal metros like New York, San Francisco, San Jose, and Los Angeles, which possibly helps drive up demand and thus the price home buyers can expect to pay,” said Nicole BachaudNicole Bachaud, Senior Economist at Zillow. “Residents of these communities tend to prioritize living in these areas because they offer a strong sense of community, access to cultural amenities and proximity to ethnic enclaves where they can find familiar cultural and social networks that often help facilitate area jobs.”

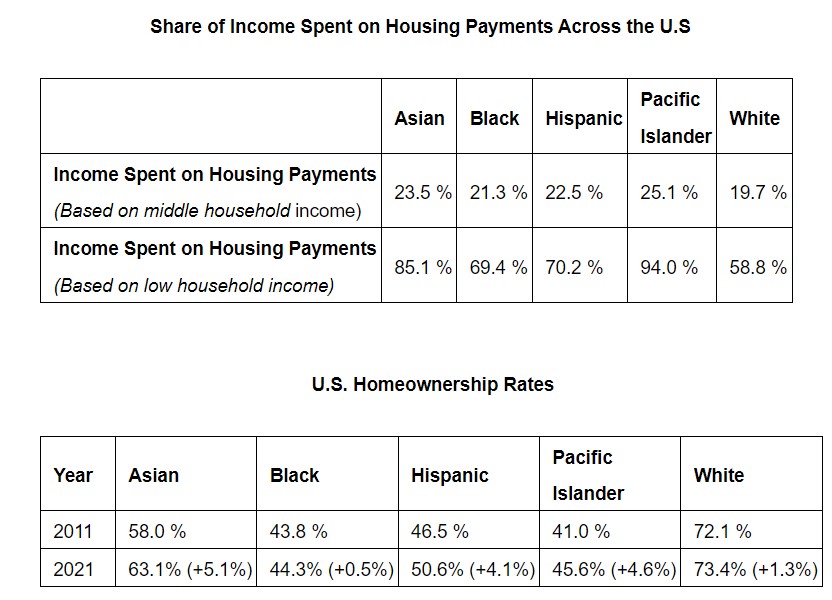

In the past 10 years, Asian homeownership surged by 5.1 percentage points, reaching a record high of 63.1%, outpacing all other racial and ethnic groups; Pacific Islanders followed with a 4.6 percentage point increase. However, despite these gains, both communities allocate a substantial portion of their household income to mortgage and rent payments. Nationally, when comparing across similar income levels, Asian-headed households allocate a higher percentage of their income towards housing payments than all other races except for Pacific Islanders.

Although Asian mortgage applicants have the lowest mortgage denial rate among all races, they are disproportionately burdened by a high debt-to-income (DTI) ratio. According to preliminary 2022 Home Mortgage Disclosure Act (HMDA) data, 41% of Asian applicants and 39.2% of Pacific Islander applicants who were denied a mortgage had their denial attributed to a too high DTI ratio, surpassing the 33.6% of denials for all races being based on DTI. They also face a higher proportion of denials due to insufficient funds to cover closing costs and lack of collateral compared to other racial groups.

“High incomes and homeownership gains may overshadow the significant housing affordability challenges still faced by many AAPI households,” concluded Bachaud. “Expanding housing inventory and implementing policies and solutions to enhance affordability are crucial for promoting homeownership and advancing housing equity in the United States.”