According to the February Housing Report published by Realtor.com, the Spring housing market is showing early signs of being an active one for prospective homebuyers due to the fact that there were 14.8% more homes actively for sale on a typical day in February year-over-year, marking the fourth consecutive months of annual inventory growth.

“The first couple of months of 2024 have proven to be positive for inventory levels, as the number of homes actively for sale was at its highest level since 2020,” said Danielle Hale, Chief Economist of Realtor.com. “While the country is still well below pre-pandemic levels, the South is leading the charge, moving faster than other parts of the country, largely driving the increase in availability of homes priced between $200,000 and $350,000, a price category that saw the most year-over-year growth nationally.”

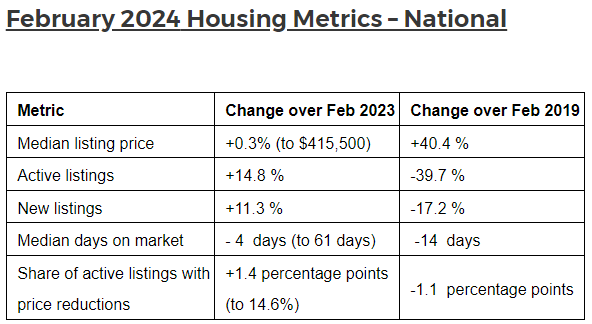

By the numbers, year-over-year:

- Median listing price: $415,000 (+0.3%)

- Active listings: +14.8%

- New listings: +11.3%

- Median days on market: 61 days (-4 days)

- Share of active listings with price reductions: 14.6% (+1.4%)

The share of affordable housing—or homes that range from $200,000 to $350,000)—grew by a whopping 20.6% since February 2023, outpacing all other price categories. For home shoppers looking for affordable options, this may lead to particularly favorable home buying conditions. And, though the market is still a ways away from pre-pandemic levels, homebuyers may anticipate more options to choose from, compared to recent years, heading into the hot spring homebuying season especially in this category.

Out of the four major regions of the U.S., the southern states saw the most growth of affordable homes: inventory of homes actively for sale increased in 29 out of 50 of the largest metros compared to last year. Orlando (+38.5%), Miami (37.4%) and Tampa (36.3%) experienced the most inventory growth. While most metros are still seeing lower inventory levels when compared to pre-pandemic years, three metros actually saw higher levels of inventory in February compared to typical 2017 to 2019 levels. The top three were in the South, particularly in Texas: San Antonio (+26.6%), Austin (+10.8%), and Dallas (+2.2%).

According to Freddie Mac, mortgage rates declined during November and December, but steadied around the 6.6% mark in January, but climbed higher following February’s inflation report, which hit 6.49%. Additionally, the percentage of homes with price reductions increased from 13.2% in February of last year to 14.6% this year, marking the first time the share of price reductions had increased over the previous year since May of 2023. In fact, newly listed homes were 11.3% above last year’s levels for the fourth month of increasing-listing activity after a 17-month streak of decline.

Click here to view the report in its entirety.