The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for February 2024 indicates that the number of mortgage applications for the purchase of new homes rose by an estimated 15.7% over the previous year. In January 2024, there was a 1% rise in applications. This comes after mortgage applications for new home purchases in January jumped 19.1% compared from a year ago.

“New home purchase activity in February was slightly hampered by the rise in mortgage rates over the month. However, homebuyers kept up their demand despite how competitive the purchase market still is, driving the level of applications to 16% ahead of last year’s pace,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The average loan size increased to its highest level since March 2023 at almost $406,000, but it was still below the record high in MBA’s survey of more than $436,000 in April 2022. The FHA share of purchase applications, which provides a read on first-time homebuyer activity, increased to 25.7%, indicating that first-time buyers continue to turn to new homes due to the lack of affordable existing home options. The estimated sales pace of new home sales was 689,000 units, a slight decline from the previous month.”

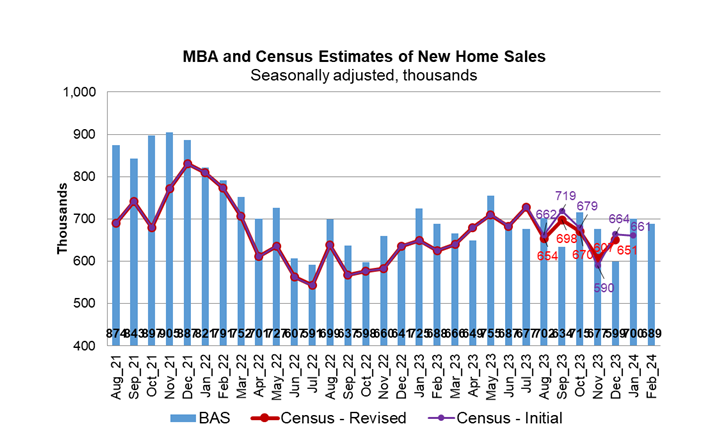

According to the MBA, seasonally adjusted annual new single-family house sales were running at a rate of 689,000 units in February 2024. New single-family home sales have historically been a leading indication of the U.S. Census Bureau’s New Residential Sales report. The BAS’s mortgage application data is used to estimate new house sales, together with several characteristics and market coverage assumptions.

Seasonally adjusted estimates for February show a 1.6% decline from the 700,000 units rate in January. MBA projects that, on an unadjusted basis, there were 62,000 sales of new homes in February 2024, down 1.6% from 63,000 sales in January.

Conventional loans accounted for 63.9% of loan applications by product type, followed by FHA loans (25.7%), RHS/USDA loans (0.3%), and VA loans (10.1%). In January and February, the average loan amount for newly constructed residences was $401,282 and $405,719, respectively.

To read the full report, including more data, charts, and methodology click here.