Last fall, the average down payment for a home in the U.S. reached a record high, according to a new CoreLogic report. The average down payment amount fell during the housing crisis of the Great Recession (2008–2009), although, per the report, it has subsequently gradually climbed. However, since the pandemic’s commencement in early 2020, the average down payment has increased, hitting a record high in October 2023.

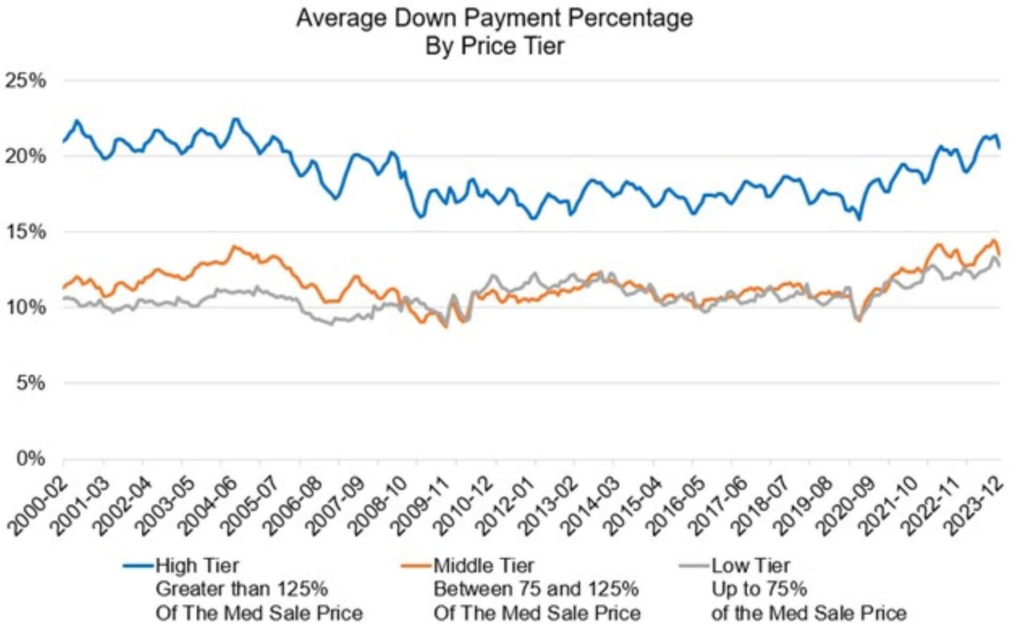

Down payment levels are heavily influenced by home prices, and as prices have increased significantly in recent years, so have average down payments. Homebuyers’ average down payments increased by 8% year-over-year in December 2023, according to CoreLogic Public Record data. In December 2023, the average down payment for a US home was 16%, or around $84,000.

YoY Rise in Average Down Payment Size Was the Largest for Low-Tier Homes

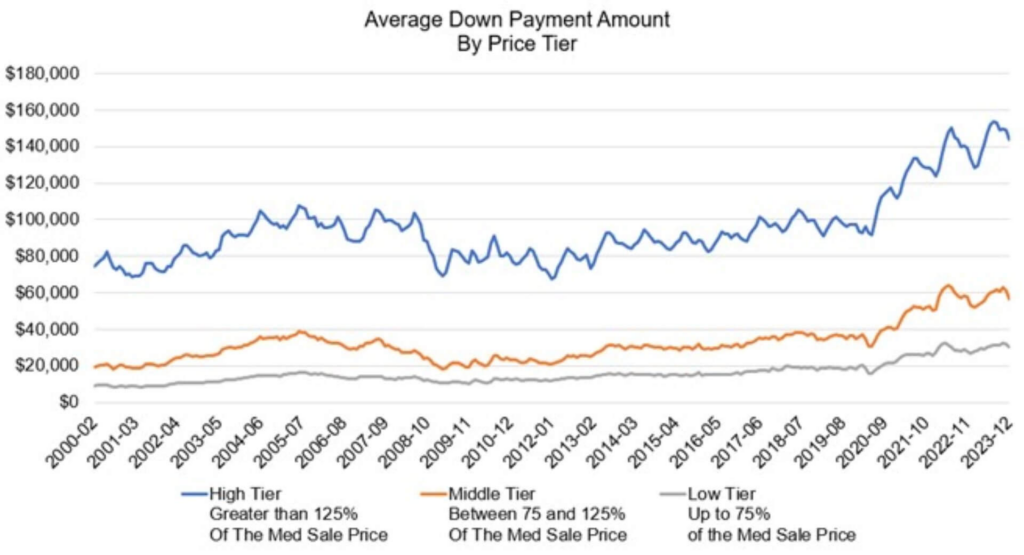

The average down payment has increased across all price ranges. In December 2023, the average down payment for low-tier residences (those priced below 75% of the median sales price) was $29,987, up from $27,011 the previous year. In December 2023, the average down payment for low-tier residences was about 13% of the sales price.

Additionally, the average down payment for middle-tier residences (those priced between 75% and 125% of the median sales price) was $56,371, up from $53,031 in the previous year and accounting for 14% of the transaction price in December 2023.

In December, the average down payment for high-tier properties (those priced at more than 125% of the median sales price) was $143,681, up from $133,340 the previous year and accounting for around 21% of the total price. Mortgages for high-end residences are typically high-balance or jumbo loans, which need bigger down payments.

The average down payment increased the most year-over-year for low-tier homes (11%), followed by high-tier homes (8%). In comparison, the year-over-year growth for middle-tier residences was only 6%.

U.S. Metros With the Highest Down Payments in December 2023

- San Francisco (29%)

- San Jose, CA (28%)

- Anaheim, CA (27%)

- Naples, FL (27%)

- New York (26%)

In general, high-cost areas required greater down payments since purchasers in these metros typically had higher incomes, resulting in more purchasing power. Another possible explanation is that buyers may wish to lower their monthly mortgage payments to mitigate the impact of increasing interest rates.

To read the full report, including more data, charts, and methodology, click here.