A new study from Zillow has found that older homeowners and those in less expensive metros are the least likely to be discouraged from moving by today’s higher mortgage rates.

According to Zillow data, 10.8 million current homeowners U.S., or 13%, should be immune to the effects of high interest rates. Markets with more homeowners free from rate lock have seen more homes listed for sale, giving buyers more choices during a prolonged shortage of housing inventory.

Many homeowners have a mortgage rate below the prevailing rate and are therefore “rate locked”—financially incentivized to keep their current home and low rate.

“The so-called mortgage rate lock-in effect has seriously curtailed both home sales and inventory over the past two years. Homeowners are more free to sell in less expensive areas—bringing more resale inventory into the market and facilitating sales,” said Orphe Divounguy, Zillow Senior Economist. “Massive appreciation has left homeowners with record levels of equity, and many are financially able to move on, even given today’s higher rates.”

Ranking affordable pockets in the nation

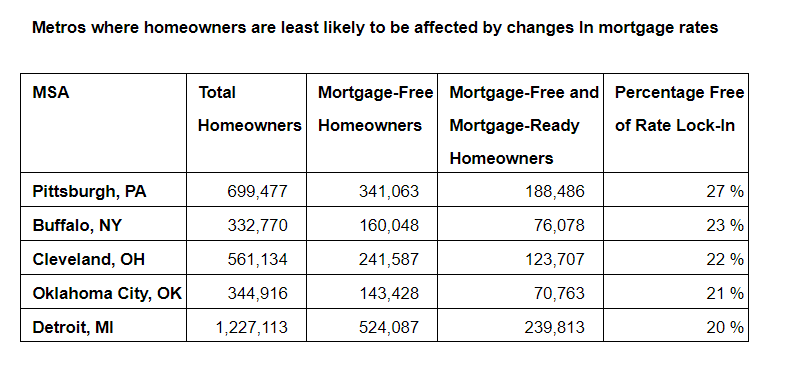

U.S. census data shows that 10.8 million homeowners are both mortgage-free and make enough income to afford monthly payments on a typical home where they live, if they bought it today. These homeowners are likely to be older and live in more affordable markets. Nearly 38% of Boomer homeowners in Pittsburgh are free from rate lock, making them the least locked-in of all generations of homeowners among the 50 largest U.S. metros.

Rate lock has shown signs of easing in recent months, but the flow of listings is still significantly below pre-pandemic rates, and total inventory is in an even bigger hole, down roughly 37% compared to 2019.

The state of the mortgage rate

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) found that the 30-year fixed-rate mortgage (FRM) averaged 6.82% as of April 4, 2024, up slightly week-over-week when it averaged 6.79%. A year ago at this time, the 30-year FRM averaged 6.28%.

“Since the start of 2024, the 30-year fixed-rate mortgage has not reached seven percent, but has not dropped below 6.6 percent either,” said Sam Khater, Freddie Mac’s Chief Economist. “While incoming economic signals indicate lower rates of inflation, we do not expect rates will decrease meaningfully in the near-term. On the plus side, inventory is improving somewhat, which should help temper home price growth.”

The drastic shift in mortgage rates was cited as a primary reason behind homeowners’ reluctance to list. Rates reached record lows in 2020 and 2021, doubled in 2022, hit 23-year highs in 2023, and have remained elevated ever since, hovering in the 7% range. New research from the Federal Housing Finance Agency (FHFA) shows that mortgage rate lock-in prevented roughly 1.33 million sales between Q2 of 2022 and 2023 year-end.

Owners in more affordable markets face lower barriers to entry for their next home, generally have less mortgage debt, and can more easily move on—with or without taking on a new mortgage. The share of owners free of rate lock is highest in relatively affordable markets in the Upper Midwest—Pittsburgh, Buffalo, and Cleveland—the latter two of which are among Zillow’s Hottest Markets for 2024.

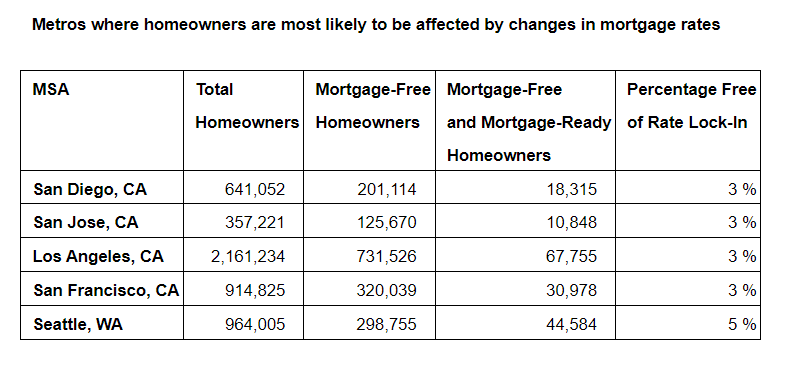

It’s harder to give up a low rate and more expensive to move in the least affordable markets, so there tends to be fewer new listings of existing homes coming on the market in these areas. Zillow data shows a clear positive correlation between the share of homeowners without a mortgage and the change in new listings since early 2022, when rates rose. Metros with a higher share of locked-in homeowners saw larger decreases in new listings.

Is anyone impervious to rate lock?

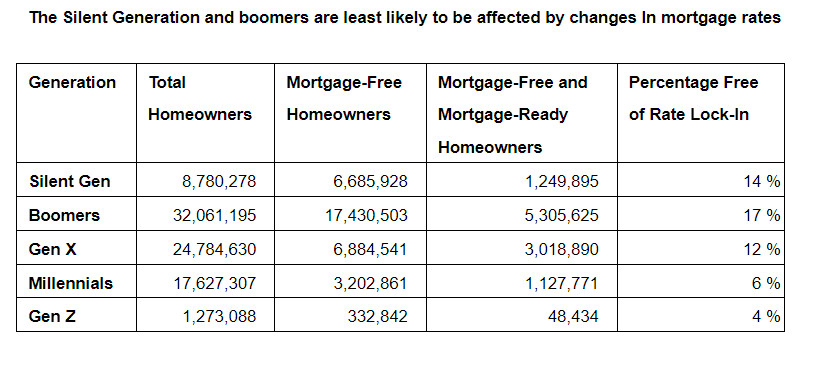

Baby boomers were least impacted by rate lock, while millennials and Gen Z’ers feel the brunt significantly more. Older homeowners tend to have more equity built up in their home, and boomers have the highest incomes, on average, among current generations. Higher wealth and higher incomes make a cash purchase or higher down payment for their next home (in their market) more doable, and mortgage payments less onerous. Nationwide, 17% of baby boomer homeowners are free from the effects of rate lock, compared to just 6% of millennial homeowners and 12% percent of Gen X homeowners.