In 2023, nearly 8% of homes sold in the U.S. exceeded the $500,000 capital gains tax threshold, according to a new CoreLogic report. With high mortgage rates and housing expenses making homeownership nearly impossible for millions of households, the study found that owing capital gains taxes can be an unexpected—and most definitely unwanted—surprise for long-term homeowners who are selling one home and buying another.

However, with home prices surging in 2021 and 2022, an increasing number of homeowners are discovering for the first time that they may owe taxes on excess capital gains above the exemption limitations. This is because their property values have doubled, tripled, or even quadrupled in the years after they purchased the house.

Additional Home Sales Are Topping the Capital Gains Exemption Limit

The 2024 tax season officially ended earlier this week, with the IRS expecting Americans to file over 146 million returns. It is also expected that many homeowners who sold their residences the previous year will benefit from a big tax break on their homeownership investment at this time of year.

Per the report, since 1997, homeowners have been able to deduct housing capital gains of up to $500,000 (or $250,000 for a single filer) when they sell their homes. However, homeowners are not required to declare any sales that fall below the exemption limit to the IRS.

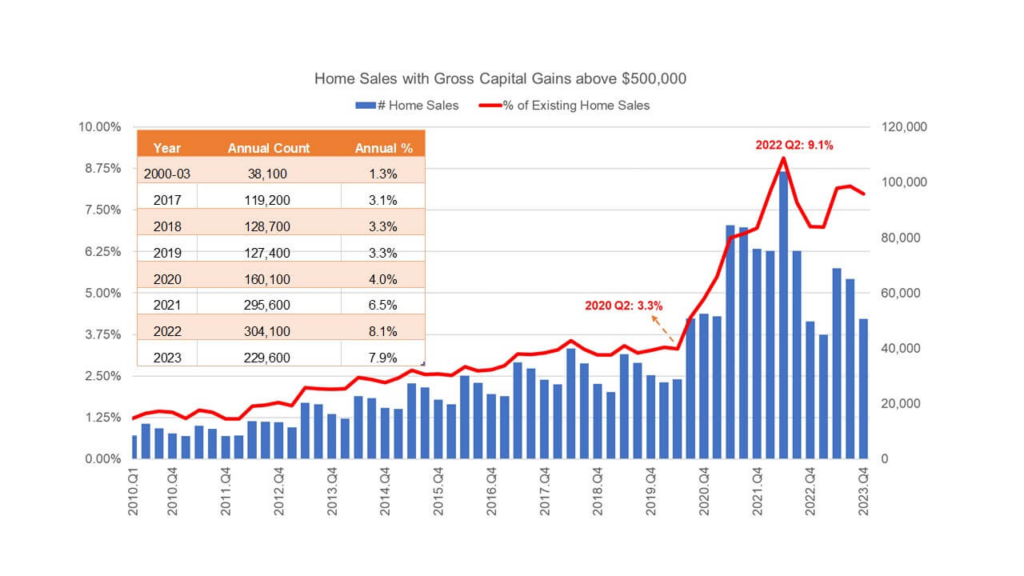

In the decade before the pandemic fuelled the housing boom, only a small fraction of house transactions had gross capital gains that might push homeowners over the exemption limit. Between 2000 and 2003, a few years after the Taxpayer Relief Act of 1997 was passed, only roughly 38,000 home transactions each year, or 1.3% of all existing home sales, had gross capital gains that exceeded the exemption ceiling. In 2017, 2018, and 2019, when the housing market was steadily improving, the numbers remained below 130,000 a year, accounting for approximately 3% of annual existing home sales.

However, all of that changed a few years ago, when property prices skyrocketed. In the peak year of 2022, more than 300,000 property transactions had gross capital gains exceeding the $500,000 exemption ceiling, a 140% rise over pre-pandemic levels.

In Q2 2022, when home price acceleration hit its pandemic-cycle peak, sales of homes that exceeded the capital gains restriction accounted for 9.1% of quarterly existing home sales. In 2023, their sales fell by 25% from 2022 to slightly less than 230,000, but were still up by 80% from 2019. At the end of 2023, the percentage of home transactions that triggered capital gains payments was 7.9%, 150% higher than the average from 2017 to 2019.

Long-Term Homeowners in High-Cost Areas Might Owe More Capital Gains Taxes

At the state level, long-term homeowners in high-cost locations are likely to bear the larger share of homes that require hefty capital gains payments. That is because, in monetary terms, high prices imply bigger amounts of capital gains when compared to the same rate of home price increase, and many high-priced places are typically among the fastest-appreciating markets.

Take California as an example: Between 2017 and 2023, the Golden State alone accounted for 37% of national sales, with gross capital gains greater than the exemption level. During the same year, California’s total existing house sales accounted for only 10% of the national total volume.

Five other expensive states accounted for 31% of sales nationwide that had gross capital gains above the exemption limit:

- New York

- New Jersey

- Massachusetts

- Florida

- Colorado

Along with California, these states accounted for 68% of national transactions with gross capital gains in excess of the exemption level. From 2017 to 2023, their combined existing house sales accounted for 35.5% of total national sales.

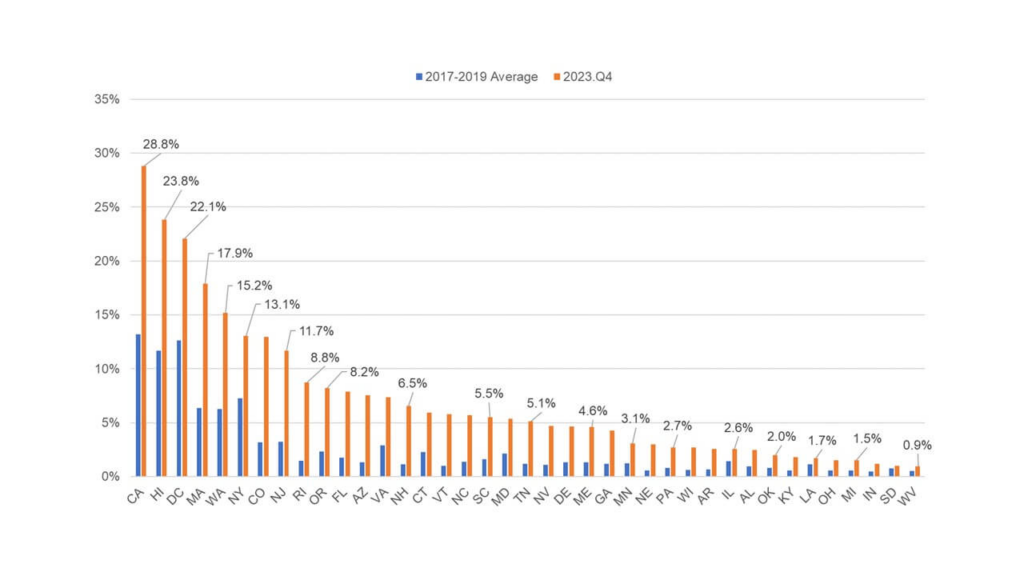

Exemption-exceeding housing capital gains have become more widespread in many high-cost regions, particularly California. At the end of 2023, California had 28.8% of existing home sales with gross capital gains exceeding $500,000. Hawaii and Washington, D.C. followed with 23.8% and 22.1%, respectively.

Sales exceeded the exemption by double digits in Massachusetts (17.9%), Washington (15.2%), New York (13.1%), Colorado (13%), and New Jersey (11.7%). Rhode Island (8.8%), Oregon (8.2%), and Florida (7.9%) are three states with high single-digit sales (at or above the national average).

Prior to the pandemic, exemption-breaking home sales totaled 13.2% in California, 12.6% in Washington, D.C., 11.7% in Hawaii, 7.3% in New York, 6.4% in Massachusetts, 6.3% in Washington, and 3.2% in both Colorado and New Jersey.

So, what does this mean for homeowners in areas like California, where nearly three out of every 10 recent home sales have reached the exemption threshold?

For one thing, it implies that owing capital gains taxes when selling a home is more prevalent than it was when the Taxpayer Relief Act went into force. Then, very few homes—except for multimillion-dollar residences owned by high-income, high-net-worth individuals—could earn huge capital gains that would push them over the tax threshold. Nearly 30 years later, even modest homes for middle-class families in many high-cost cities often sell for more than $1 million.

Capital Gains Exemptions Are Not Adjusted for Inflation

Since 1997, capital gains exemptions for homes have not kept pace with inflation or the cost of living. This differs from many other federal tax laws, such as the standard deduction or the income tax credit, which include annual inflation adjustments.

Now, the cost of living as measured by the Consumer Price Index (CPI) has nearly doubled, while typical home values have more than tripled (about a multiple of 3.6) and are expected to quadruple given current appreciation patterns. In other words, adjusted for inflation, the exemption provision, which was worth $500,000 ($250,000 for a single filer) in 1997, is now worth $262,000 (or $131,000).

For long-term owners who are selling their home or looking to buy another, owing capital gains taxes can be an unexpected challenge. With high mortgage rates and housing expenses already posing financial setbacks for many Americans, capital gains taxes can make it even more difficult for the millions of people trying to afford homeownership in today’s economy.

To read the full report, including more data, charts, and methodology, click here.