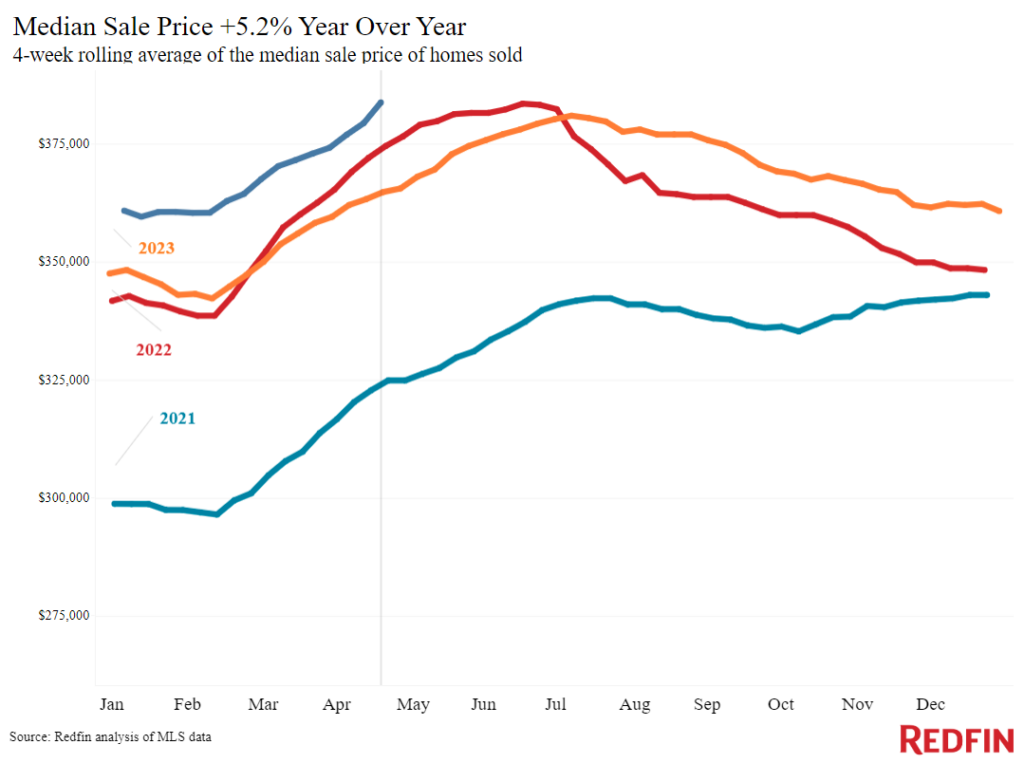

According to a new report from Redfin, the median U.S. home sale price reached a new high of $383,725 in the four weeks ending April 21, up 5.2% from the previous year—representing one of the largest increases since October 2022.

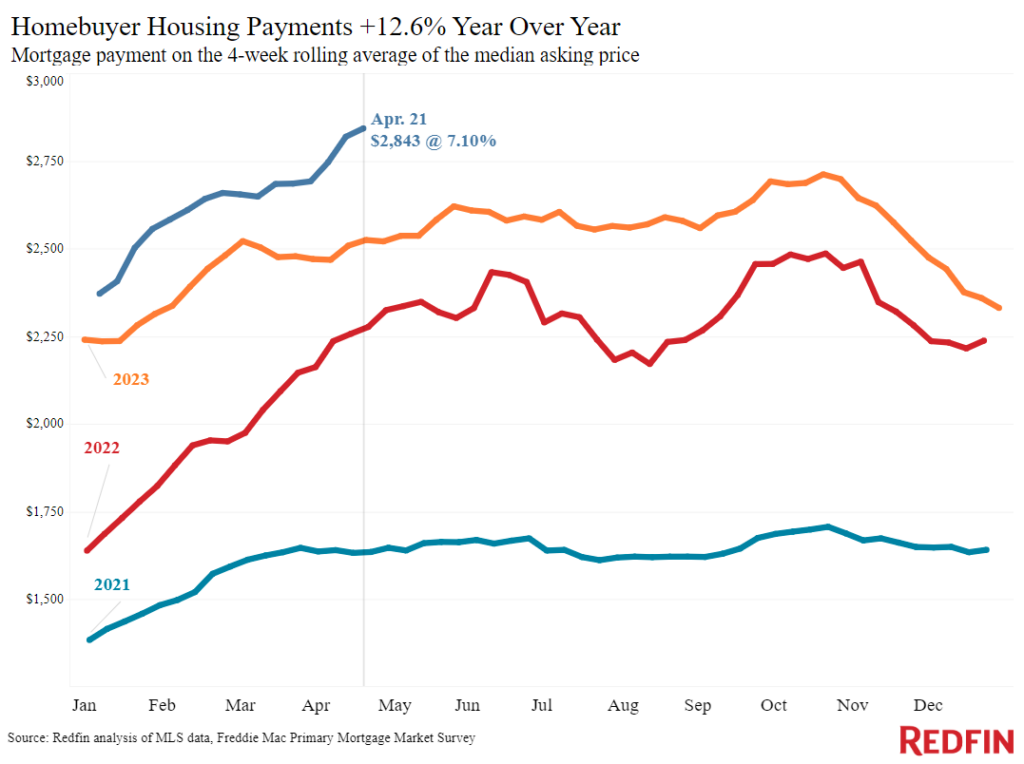

The average weekly mortgage rate rose to 7.1% this week, representing the highest level since November 2023, as it “became obvious” that the Fed would maintain interest rates high for longer than expected. High prices and mortgage rates pushed the median monthly housing payment to a record $2,843, up 13% year-over-year.

Home prices have risen despite the fact that there is greater inventory than last year. New listings are up 10.2% year-over-year, but growth in listings may be slowing as stubbornly high rates reinforce the lock-in effect.

Despite recent improvements, inventory remains low, which is helping to boost prices. Demand is holding up well in the face of 7%-plus interest rates, however, some indicators point to a downturn. Redfin’s Homebuyer Demand Index, which measures requests for tours and other buying services from Redfin agents, is nearing its best level in approximately eight months, while mortgage applications are down slightly (-1%) week-over-week.

“My advice to sellers is to price your home fairly. Even though sellers are getting top dollar at the moment, they should price competitively to attract buyers from the start and avoid having to drop their price as stubbornly high mortgage rates eat into buying budgets,” said Chen Zhao, Redfin Economic Research Lead. “My advice for serious buyers who can afford today’s costs is to shop for your dream home and accept that this year is probably not the time to find a dream deal. Price growth may cool slightly in the coming months if mortgage rates stay high or rates might fall slightly—but overall housing costs are likely to remain elevated for the foreseeable future.”

To read the full release, click here.