The latest Annual Mortgage Bankers Performance Report from the Mortgage Bankers Association (MBA) reveals that independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks lost an average of $1,056 on each loan they originated in 2023.

Average production volume was $1.9 billion (6,021 loans) per company in 2023, down from $2.6 billion (8,371 loans) per company in 2022. On a repeater company basis, average production volume was $2 billion (6,436) in 2023, down from $2.7 billion (8,605 loans) in 2022.

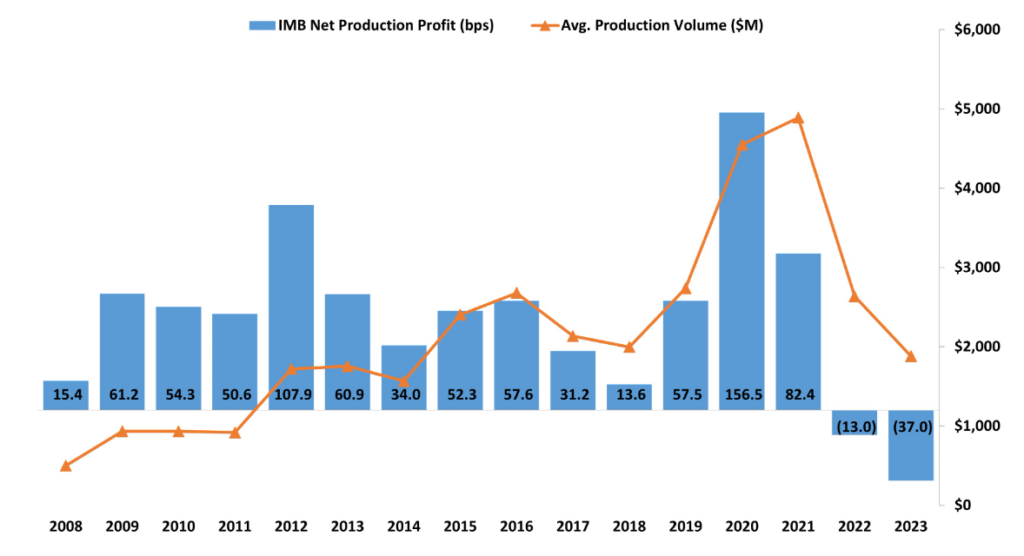

In basis points, the average production loss was 37 basis points in 2023, worsening from a loss of 13 basis points in 2022. Since the inception of MBA’s Annual Performance Report in 2008, net production income by year has averaged 49 basis points ($1,117 per loan).

“Mortgage lender financial results worsened in 2023 with the average net production loss moving to 37 basis points from losses of 13 basis points in 2022. And although production revenues stabilized, costs escalated to a study high $11,258 per loan,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Mortgage market conditions were challenging last year because of higher mortgage rates, low housing inventory, and weaker housing affordability. These factors resulted in a further decline in volume, compounding the precipitous drop in 2022. Many companies were still chasing cost containment and personnel reduction throughout the year.”

Additional findings from MBA’s Annual Performance Report

- The refinancing share of total originations (by dollar volume) decreased to 11% in 2023 from 20% in 2022. For the entire mortgage industry, MBA estimates the refinancing share last year decreased to 19% from 57% in 2022.

- The average loan balance for first mortgages reached a study high of $331,437 in 2023, up from $323,780 in 2022.

- Total production revenues (fee income, net secondary marking income and warehouse spread) were 329 basis points in 2023, down from 333 basis points in 2022. On a per-loan basis, production revenues were $10,202 per loan in 2023, down from $10,322 per loan in 2022.

- Total loan production expenses–commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations–increased to $11,258 per loan in 2023, up from $10,624 in 2022.

- Net servicing financial income, which includes net servicing operational income, as well as mortgage servicing right (MSR) amortization and gains and losses on MSR valuations, was at a gain of $263 per loan in 2023, down from a gain of $586 per loan in 2022.

- Including all business lines, 36% of the firms in the study posted pre-tax net financial profits in 2023, down from 53% in 2022.

“Some companies were able to weather the storm through cash reserves built up in the second half of 2019 through 2021,” added Walsh. “Companies also benefited from mortgage servicing cash flows that remained strong in an environment of low delinquencies and low prepayments. However, most of the valuation mark-ups on mortgage servicing rights were taken in 2022, resulting in lower net servicing financial income in 2023.”