While homebuying remains a challenging process for many Americans, potential home shoppers in some of the most expensive U.S. metros have even more trouble. A new Realtor.com study showed that in the second-most expensive state in America, the average household income required to purchase a median-priced home is over double the national figure in its most popular metros.

The average median salary in the Golden State is $73,220, compared to less than $50,000 in smaller, more affordable states like Mississippi or West Virginia, according to Forbes. Realtor.com’s April housing data revealed that the nationwide required household income to purchase the median priced property increased to $116,000, up $5,900 from the previous year, after accounting for taxes and insurance.

For prospective homebuyers in California’s major metros of Los Angeles, San Diego, San Francisco, and San Jose, the household income required to purchase the median-priced property exceeds a whopping $200,000.

“California is a fascinating market not only because the income-required figures are an eye-popping quarter of a million dollars, but because it is a microcosm of the variety we’re seeing in housing markets nationally,” said Danielle Hale, Chief Economist, Realtor.com. “In areas like San Francisco home prices have fallen enough to offset rising mortgage rates, and the income needed to buy a home has dropped. In other markets, like San Jose and Sacramento, home price declines have been more modest and rising mortgage rates have pushed required incomes higher despite lower home prices.”

“And finally, the majority of major U.S. markets see trends like we’re seeing in Southern California,” Hale said. “In Los Angeles, Riverside, and San Diego rising home prices and mortgage rates have combined to push required incomes higher—in some cases like in these California markets, up by double-digits compared to one year ago.”

For Some, Homebuying in California Comes at an Unfathomable Price

Six metros throughout the U.S. required a family income of more than $200,000, with California’s major metros at the top: San Jose ($361,000), Los Angeles ($298,000), San Diego ($259,000), and San Francisco ($256,000).

The big East Coast hubs of Boston (household income $226,000) and New York (household income $218,000) don’t trail far behind.

In contrast to the higher household income required to purchase the median-priced property in the major coastal metros, there were 16 metro areas with a household income of less than $100,000. The most affordable cities were Pittsburgh (household income $67,000), Detroit (household income $69,000), and Cleveland (household income $71,000).

Top 10 Metro Areas with Lowest Required Income to Purchase a Median Home:

- Pittsburgh – $67,000

- Detroit-Warren-Dearborn, MI – $69,000

- Cleveland-Elyria, Ohio – $71,000

- Birmingham-Hoover, AL – $75,000

- Buffalo-Cheektowaga, NY – $79,000

- St. Louis, MO-IL – $82,000

- Rochester, NY – $87,000

- Indianapolis-Carmel-Anderson, IN – $87,000

- Louisville/Jefferson County, KY-IN – $87,000

- New Orleans-Metairie, LA- $90,000

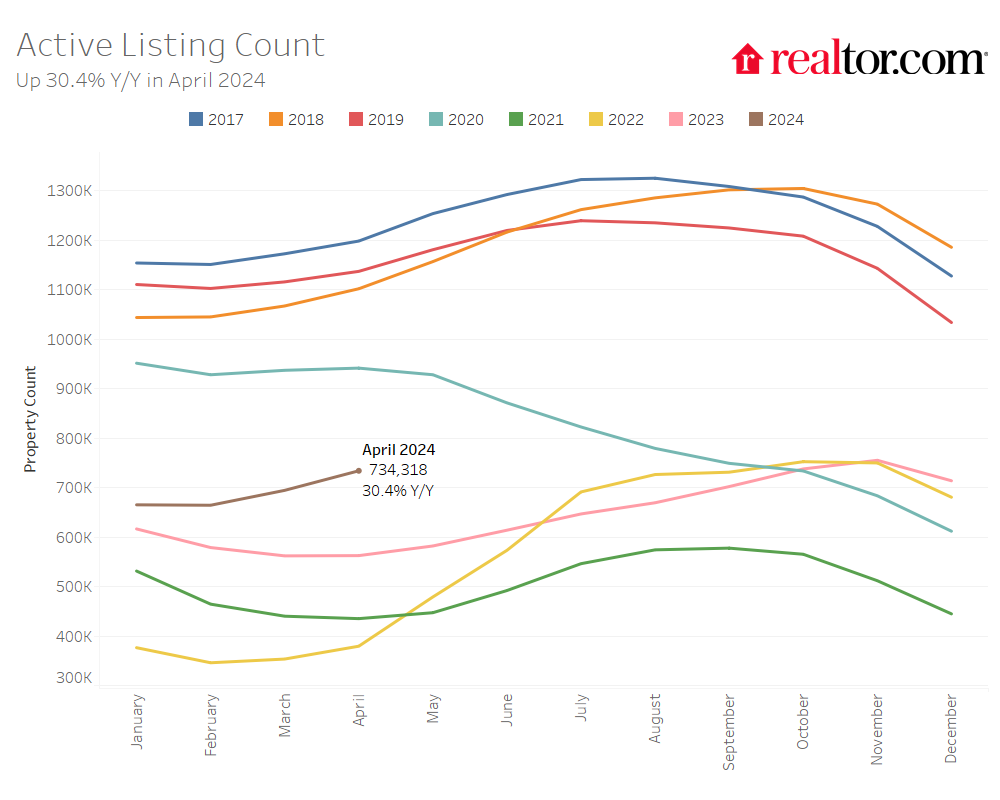

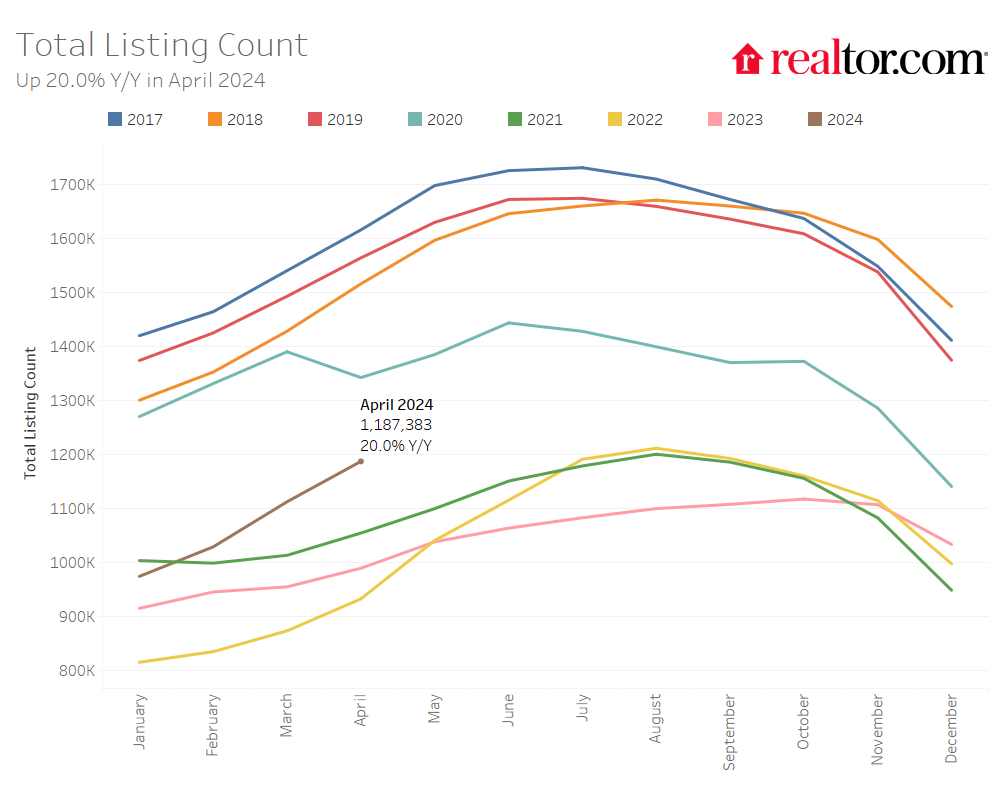

Affordable Housing Inventory Inches Upward

While the popular west coast state saw an increase in the household income required to purchase the median-priced property, affordable inventory is increasing in other parts of the country. The South has been significantly responsible for the increase in availability of homes priced between $200,000 and $350,000, as well as the overall increase in home availability. More than half (56.6%) of available inventory in April 2024 was in the South, up from 52.0% the previous year and 47.7% in April 2019.

An increase in available homes for purchase, combined with population movement, has positioned the South to dominate the nation in existing home sales, growing from 43.2% in March 2019 to 45.3% in March 2024. Across the country, active inventory increased over the previous year, with the South expanding 43.0%, the West 27.4%, the Midwest 17.6%, and the Northeast 4.0%. Interestingly, large Florida metros saw inventory expansion driven mostly by an increase in the supply of attached houses (condos, townhomes, and row homes).

Median List Price Remains Stable, but Price per Square Foot is Creeping Up

Between March 2024 and April 2024, the median list price in the U.S. tates grew from $424,900 to $430,000, maintaining constant when compared to the same median list price in April of the previous year. This is most likely due to the variety of properties on the market, particularly in the South, where sellers are advertising smaller, more affordable homes. While the median list price has stayed relatively stable, it has increased 3.8% on an adjusted per-square-foot basis, demonstrating that homes are keeping value even as inventory expands.

The South has been significantly responsible for the increase in availability of homes priced between $200,000 and $350,000, as well as the overall increase in home availability. Home listings in the South accounted for more than half (56.6%) of available inventory in April 2024, up from 52.0% the previous year and 47.7% in April 2019.

In April, all four areas’ active inventory increased over the previous year. The South witnessed 43.0% growth in listings, while inventory increased by 27.4% in the West, 17.6% in the Midwest, and only 4.0% in the Northeast.

The South had the highest growth in newly listed home inventory, at 19.7%, followed by the West at 18.4%, the Midwest at 7.5%, and the Northeast at 2.9%.

In April, 48 of the 50 largest metros saw a rise in new listings over the previous year, with only three seeing more newly listed properties than the average April from 2017 to 2019. Seattle (+46.5%), San Jose (+40.6%), and Austin (+36.1%) had the most growth in newly listed properties, while Detroit (-3.8%) and Cincinnati (-1.6%) saw new listings fall. Only Austin (+18.8%), San Antonio (+2.6%), and Jacksonville (+1.6%) had more new listings hit the market in April compared to pre-pandemic levels.

To read the full report, including more data, charts, and methodology, click here.