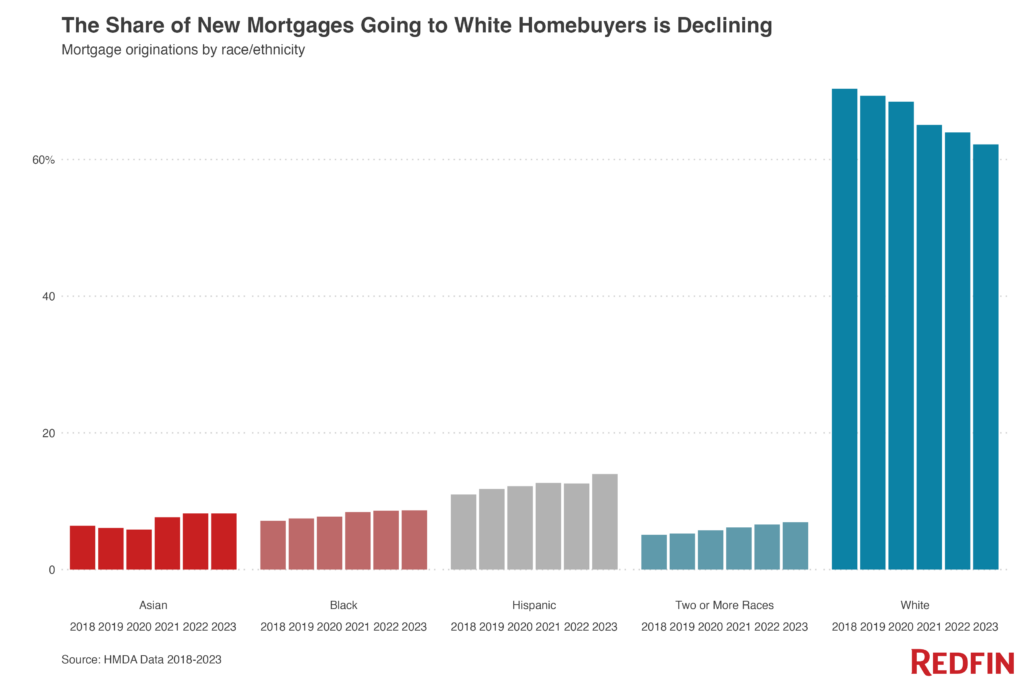

According to a new report from Redfin, diversity is reigning in the mortgage market as the share of U.S. mortgages taken out by white homebuyers has declined over the last five years while the share of Hispanic, Black, and Asian homebuyers has ticked up.

Redfin aggregated and analyzed data from past Home Mortgage Disclosure Act (HMDA) reports from 2018-2023 to write this report. The HMDA covers mortgage originations for primary, owner-occupied dwellings and does not cover originations for investment properties or second homes.

According to Redfin’s analysis, just under two-thirds (62.2%) of new mortgages issued in 2023 went to white homebuyers. While that’s a far higher share than any other group, it’s down from 64% in 2022 and 70.4% in 2018. It’s also now more in line with the country’s demographics, as 59.5% of the U.S. population is white (as of 2022, the most recent year for which data is available).

Meanwhile, the share of new mortgages taken out by Hispanic buyers increased to 14% in 2023 from 12.6% in 2022 and 11% in 2018. Black buyers represented 8.7% of new mortgage holders last year—little changed from 8.6% in 2022 but up from 7.1% in 2018. Still, these figures lag demographic trends, as 18.8% of the U.S. population is Hispanic and 12.2% of the population is Black.

“The pool of homebuyers taking out mortgages is becoming less white because America is becoming more diverse, and many people of color are in their prime homebuying years,” said Redfin Senior Economist Elijah de la Campa. “The racial wage gap, while still sizable, has also been shrinking. That has made homeownership more feasible for some Black and Hispanic people, though they’re still significantly less likely to own homes than white people.”

People of color have seen larger income gains than white people

Redfin reports that the annual income for Hispanic people was estimated at $69,000, a number which is up a remarkable 40.2% from 2018. This is much larger than the gain for white people, whose median income rose 31% to an estimated $86,000. Black and Asian people also saw bigger increases in estimated incomes, which climbed a respective 34.7% to $54,000 and 36.4% to $114,000.

While the racial wage gap remains large, it has shrunk in recent years due to positive job reports, and low unemployment resulting in a tight labor market. When the labor market is tight, employers are often less selective and look for candidates outside of their networks, which provides opportunities for marginalized communities.

American diversity: by the numbers

White people make up 59.5% of the U.S. population (as of 2022), down from 61.6% in 2018, 69.7% in 2000 and 84.1% in 1970. Meanwhile, people of color have taken up a growing share of the population, with Hispanic people seeing the biggest rise. Today, they represent 18.8% of the U.S. population, up from 18% in 2018, 12.6% in 2000 and 4.1% in 1970.

The Black share of the population is the exception, stagnating in comparison; at 12.2%, it’s little changed from 12.4% in 2018 and 12.1% in 2000, but is up slightly from 11% in 1970.

The number of people in the U.S. who self-identify as white (a different metric than the share) recently declined for the first time since 1790.

“In addition to lower fertility and immigration, much of this loss is attributable to the continued aging of the white population. Fewer births and more deaths resulted in a natural decrease (more deaths than births) for the 2010s decade, even before the COVID-19 pandemic,” William Frey, a Senior Fellow at the Brookings Institution, wrote in a 2021 report. “In addition, the rise of multiracial marriages has led to an increase in the number of young people who identify as mixed race rather than white alone. The new census results also show a substantial rise in the number of Americans that indicated belonging to two or more racial groups.”

More people of color are reaching prime homebuying years

Data shows that 21.1% of Hispanic people living in the country are between 25-34-years-old, which are commonly cited as the prime homebuying time of people’s lives, up from 20.6% in 2018 and 16.5% in 2000. Meanwhile, 13.7% of Black U.S. residents are of prime homebuying age, up from 13.4% in 2018 and 12.6% in 2000. The share has also ticked up among Asian people, to 7% from 6.9% in 2018 and 4.9% in 2000.

But the opposite is true for white people, 54.4% of whom are of prime homebuying age. While that’s a higher share than any other group, it’s down from 56.6% in 2018 and 64.1% in 2000. Please note that the most recent year in this dataset is 2022.

The most common age among white people in the U.S. is 60 (due to the boomer generation)—far beyond prime homebuying age. That’s about double the most common ages of Black and Asian people and five times higher than the most common age of Hispanic people.

White people are buying fewer home than they used to

White people took out 1,582,643 mortgages in 2023, down 22.1% from a year earlier and down 31.3% from 2018. By comparison, Hispanic people took out 355,757 mortgages, down just 11.1% year over year and down 1.3% from 2018. Asian people took out 209,085 mortgages, down 19.9% year over year and down 0.5% from 2018. And Black people took out 220,410 mortgages, down 19.4% from a year earlier and down 5.7% from 2018.

This is occurring at the same time as home purchases are dropping across the board over the past year due to elevated and rising mortgage rates and high home prices, but it is notable that the declines were more pronounced among white people.

Most white people already own homes, meaning there’s not a lot of room for growth. Nearly three-quarters (74%) of white people in the U.S. own homes, compared with 62.2% of Asian people, 49.9% of Hispanic people and 45.7% of Black people.

Click here for Redfin’s report in its entirety.