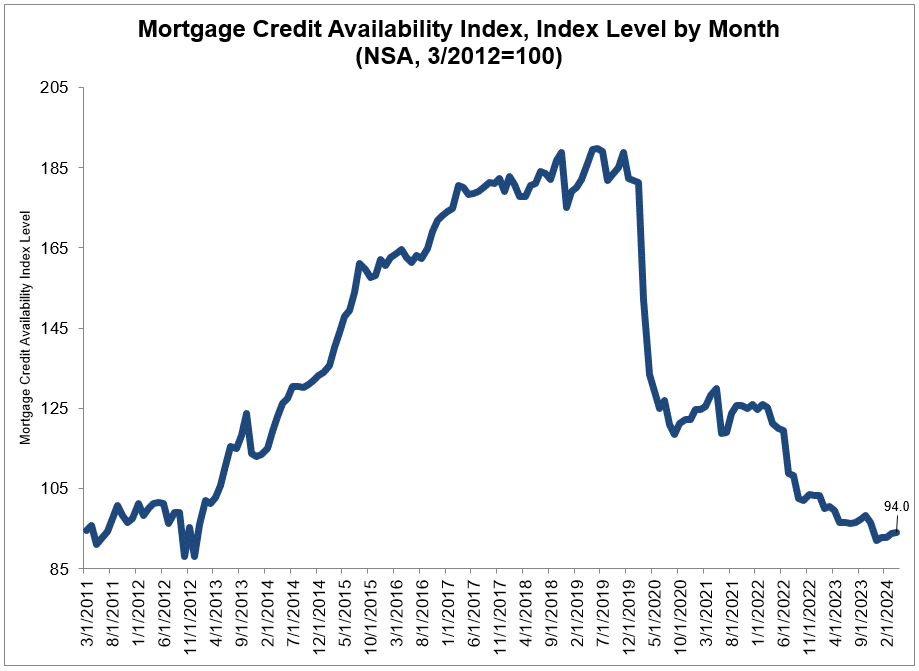

Mortgage credit availability improved in March, according to the Mortgage Bankers Association‘s (MBA) Mortgage Credit Availability Index (MCAI). This comes after MBA reported that mortgage applications decreased 2.3% for the week ending April 26.

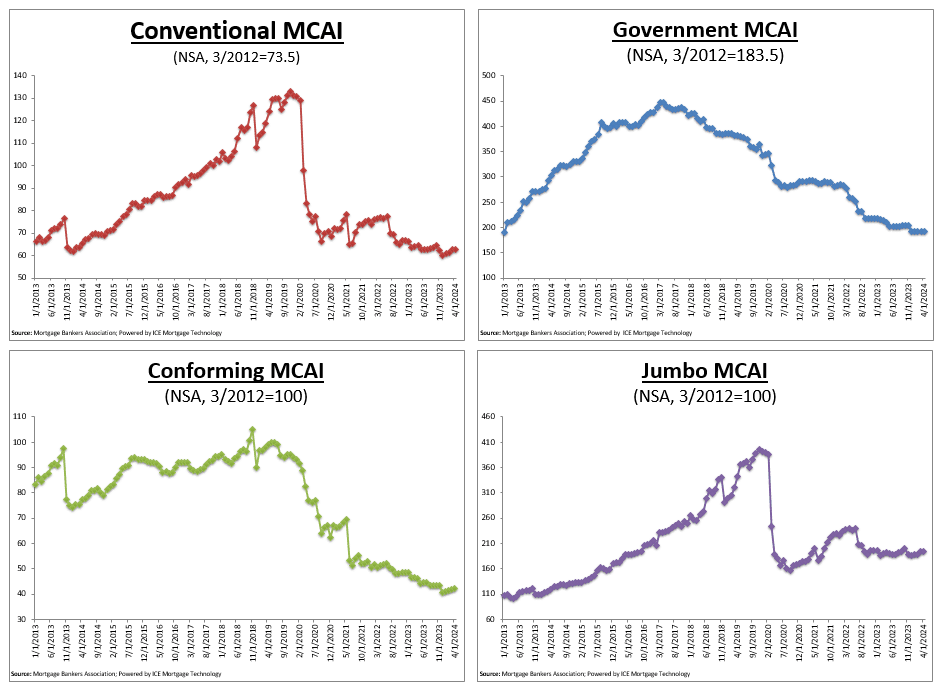

The MCAI increased by 1.1% to 93.9 in March. A decrease in the MCAI suggests tighter lending rules, whilst an increase in the index indicates looser credit. The report found that the Conventional MCAI rose 2.1%, while the Government MCAI fell by just 0.1%. The Jumbo MCAI climbed by 2.6%, while the Conforming MCAI rose by 1.2%.

“Credit availability increased in March, driven by growth in conventional credit. There were increased offerings of cash-out refinance loan programs across fixed rate and ARM loans, as well as for all occupancy types,” Joel Kan, MBA’s VP and Deputy Chief Economist. “Although credit supply increased for the third consecutive month, it remains low at nearly 7% below a year ago and still close to 2012 lows.”

Conventional, Government, Conforming, and Jumbo MCAI Component Indices

The MCAI increased by 0.1% to 94.0 in April. The Conventional MCAI climbed by 0.3%, while the Government MCAI fell by 0.0%. The Jumbo MCAI and the Conforming MCAI, two of the Conventional MCAI’s component indices, both climbed by 0.3%.

“The jumbo index grew 2.6% last month and was the only component seeing credit supply higher than a year ago,” Kan said. “Growth in jumbo credit availability was driven by both non-QM and super conforming loan programs.”

To read the full report, including more data, charts, and methodology, click here.