A new report from Point2 covering the top-100 metropolitan real estate markets revealed that covering the first year of home costs up front can take anywhere from 4-to-24 years of savings.

A new report from Point2 covering the top-100 metropolitan real estate markets revealed that covering the first year of home costs up front can take anywhere from 4-to-24 years of savings.

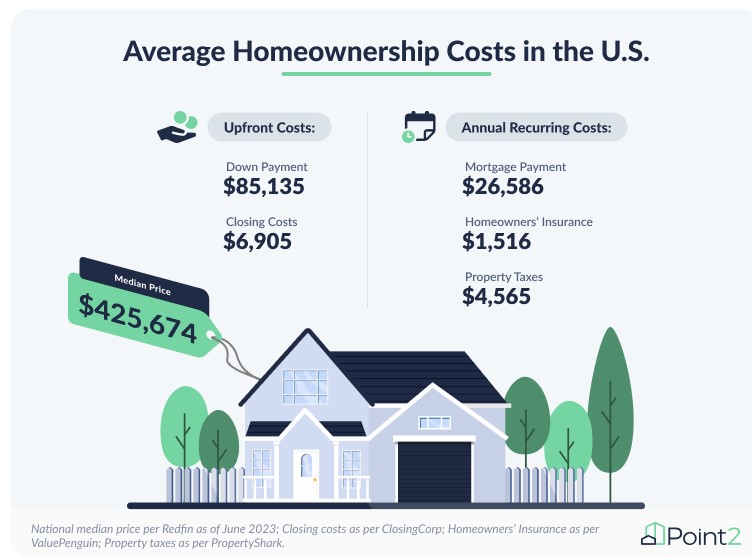

Buying real estate for the first time can be a daunting task, not even factoring in extraneous expenses into the mix, especially when the average, national down payment on a house is $85,100, homeownership-related costs risk breaking the bank even before considering mortgage payments, insurance, and taxes.

Yet, the cost of that first year as an owner is a beast of its own that cannot be ignored—especially in a big city.

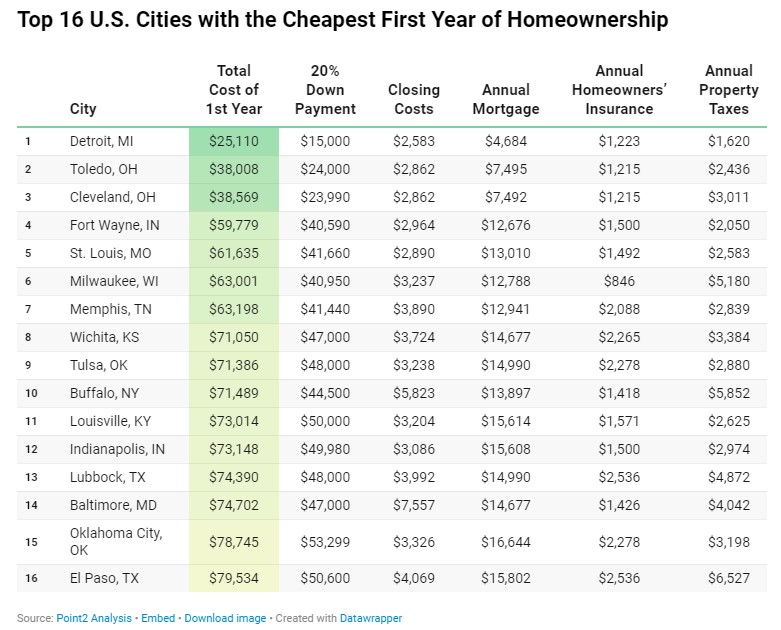

- In the 100 largest U.S. cities, the cost of the first year of homeownership ranges between $25,100 and $389,900—which is a staggering 15 times the lower amount.

- First-year expenses are less than $80,000 in 16 big cities, most of them in the Midwest. Detroit and Ohio’s Toledo and Cleveland top the list of markets with the cheapest homeownership costs.

- Homeownership costs go above $200,000 in 15 other markets, 11 of which are in California. Alongside San Francisco, the most excessive first-year expenses are in Fremont, San Jose, Irvine, and Los Angeles.

- In 75 markets, it takes more than a decade of saving up to cover the full cost of the first year of homeownership. The average homebuyer is particularly priced out in LA, NYC, and Irvine, CA, where matching the amount would require more than 20 years.

Point2 wanted to see where buyers could have a smooth transition into a new home versus where they would have a tougher time during their first year.

For a clearer glimpse into what first-time buyers are experiencing, Point2 analyzed the number of years it would take for the average renter to save up for the upfront costs required to buy, as well as how many years it would take to cover the full cost of the first year of homeownership.

All-in-all, on 16 big cities reported homeownership costs below $80,000 as the average national homeownership rate hovers around 66%, and while fluctuations are expected, there is “very little hope” of the needle suddenly moving more in favor of homebuyers. Rather, climbing interest rates, high prices, and squeezed inventory create a cocktail doomed to make some people postpone homebuying — and others rethink the decision altogether.

It’s essential for aspiring homebuyers to see the full financial picture of the first year of ownership in deciding whether to go for it or wait it out. Plus, with first-year homeownership costs surpassing $100,000 in one-third of the country’s 100 largest markets, it’s no wonder many choose the latter.

Yet, despite the tough financial journey of first-time buyers, there are some large cities where going for it might be the right answer. More precisely, in 16 of the largest U.S. cities, the cost of homeownership falls below $80,000. Notably, this benchmark feels more like a best-case scenario the more you look into the six-digit costs in most of the other large markets.

Click here to see what else Point2 revealed in their research.