The latest available data from the Mortgage Bankers Association (MBA) brought good news on the affordability front as the national average new mortgage payment decreased from $2,199 to $2,137 over the course of the month.

The latest available data from the Mortgage Bankers Association (MBA) brought good news on the affordability front as the national average new mortgage payment decreased from $2,199 to $2,137 over the course of the month.

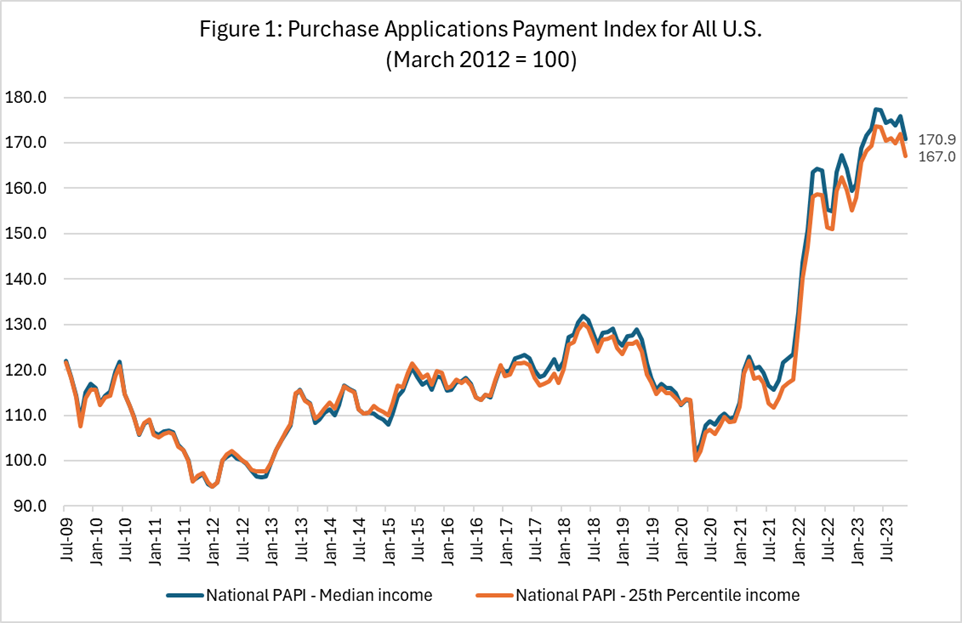

This information comes to us by way of the MBA’s Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time—relative to income—using internal data derived from the MBA’s Weekly Applications Survey.

“Homebuyer affordability improved in November, with a decline in mortgage rates providing relief to prospective homebuyers,” said , MBA’s Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “MBA expects that affordability conditions will continue to improve as mortgage rates decline, which should generate increased demand heading into the spring homebuying season.

An increase in MBA’s PAPI—indicative of declining borrower affordability conditions—means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI—indicative of improving borrower affordability conditions—occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

By the numbers, the national PAPI has decreased 2.8% to an index level of 170.9 in November from the 175.9 reported in October. With this decrease, the PAPI is now at the lowest level since February 2023. Median earnings were up 3.9% compared to one year ago, and while payments increased 8.1%, the strong earnings growth means that the PAPI is up 4.0$ on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,425 in November from $1,466 in October.

In addition, the Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey decreased from $2,672 in October to $2,597 in November.

Additional findings of the PAPI, as highlighted by the MBA, include:

- The national median mortgage payment was $2,137 in November—down $62 from October. It is up $160 from one year ago, equal to an 8.1% increase.

- The national median mortgage payment for FHA loan applicants was $1,902 in November, down from $1,955 in October and up from $1,631 in November 2022.

- The national median mortgage payment for conventional loan applicants was $2,137, down from $2,208 in October and up from $1,994 in November 2022.

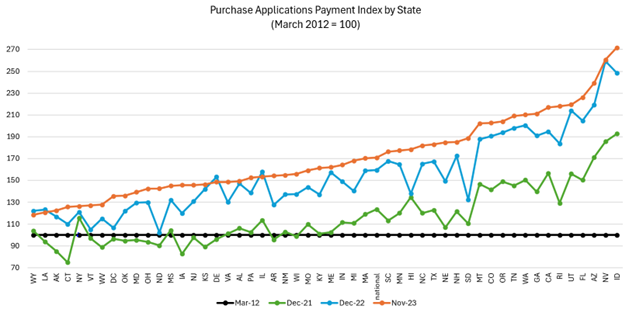

- The top five states with the highest PAPI were: Idaho (271.6), Nevada (260.6), Arizona (239.3), Florida (226.0), and Utah (219.5).

- The top five states with the lowest PAPI were: Wyoming (118.5), Louisiana (120.7), Alaska (122.4), Connecticut (125.9), and New York (126.3).

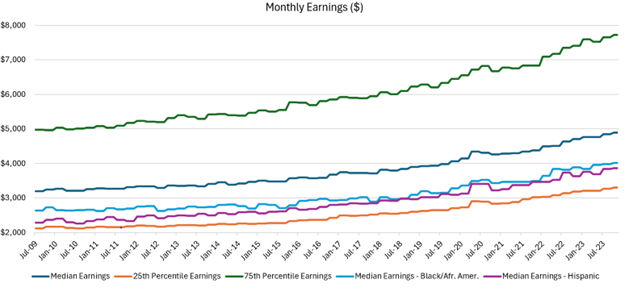

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 176.9 in October to 171.8 in November.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 163.8 in October to 159.2 in November.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 178.3 in October to 173.3 in November.

Click here to view the research in its entirety.