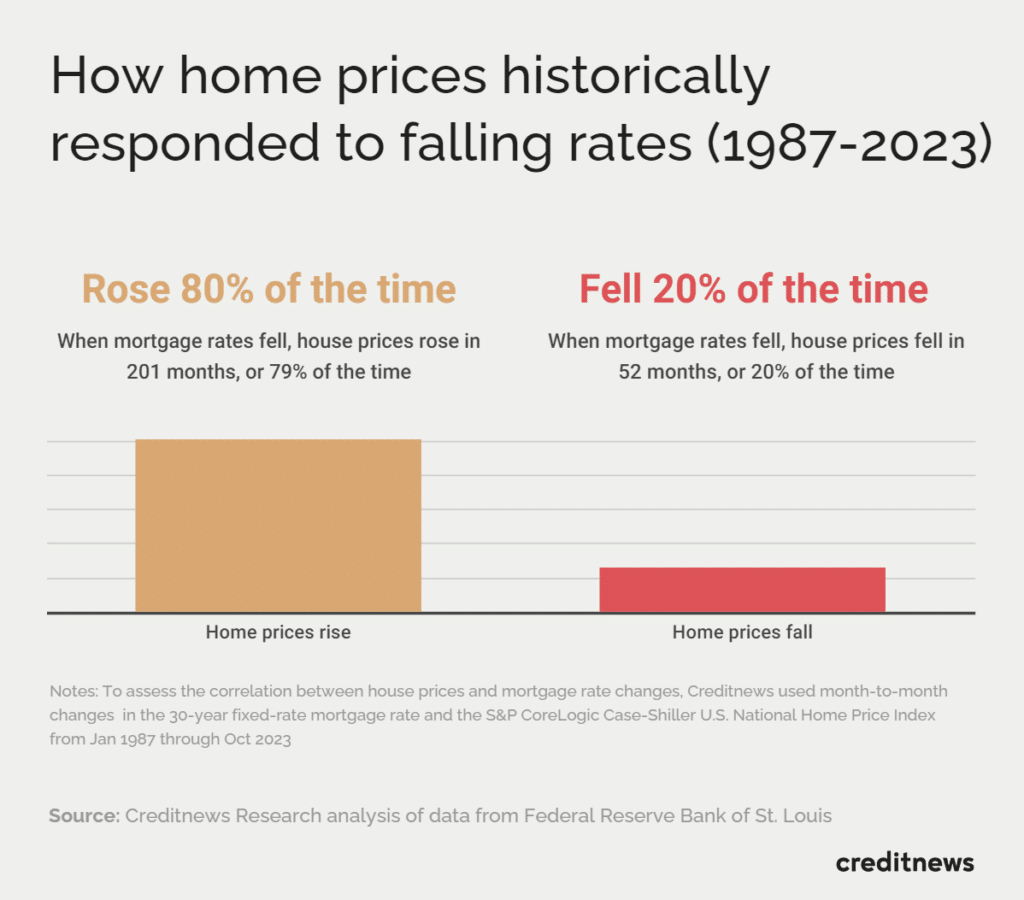

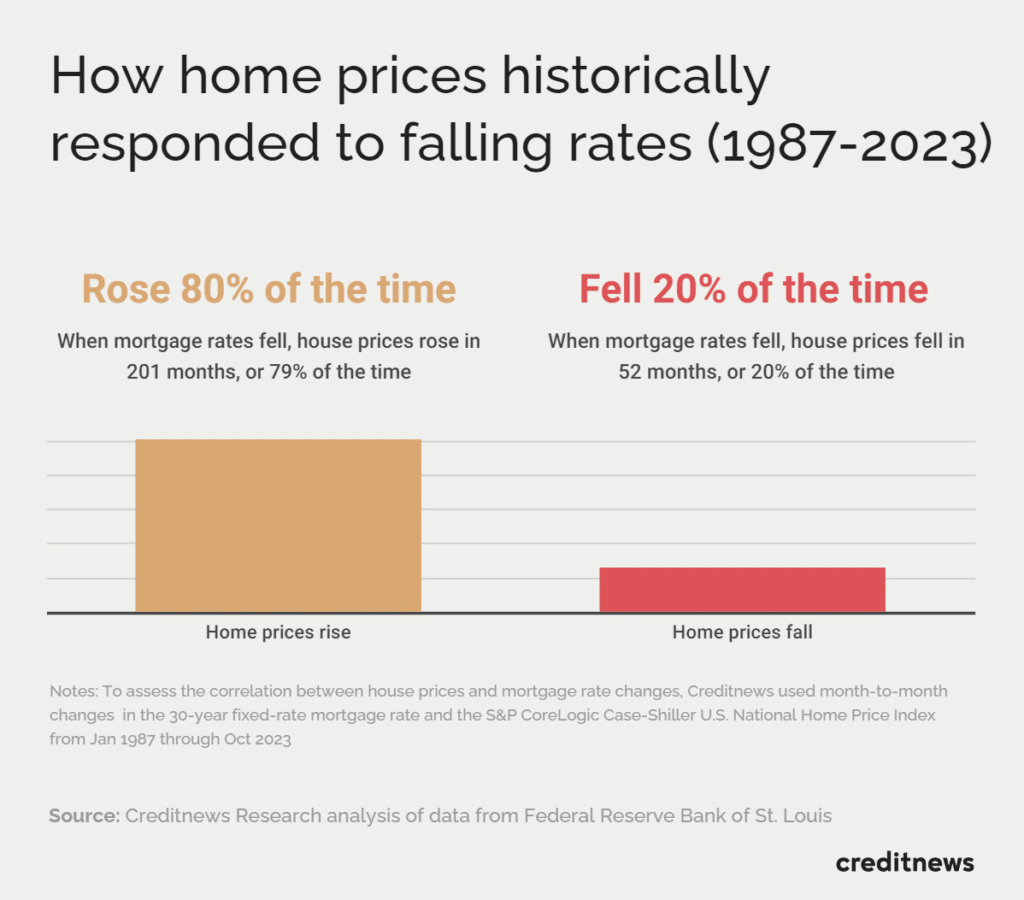

According to a new article from Creditnews Research, between 1987 and 2023, house prices rose in 201 months, or 80% of the time, when mortgage rates fell; and house prices dropped only when the monthly drop-in mortgage rates exceeded 0.4%.

However, such drops accounted for only a total of 2.40% of the months measured. In fact, housing prices and mortgage rates fell together only during the three major housing crises in that period—the savings and loan crisis, the Great Recession, and the Covid crisis.

The article further states that even when factoring in the time lag, mortgage rate drops resulted in house price growth over five times more than during price declines. Considering today’s chronically low housing inventory, low mortgage rates are not likely to improve supply or housing affordability.

But as the market currently is, the younger generations will bear the brunt of low housing affordability, as nearly one in five millennials now believe they will never own a home.

“With chronically low housing inventory, any increase in demand caused by lower mortgage rates will likely drive up prices in the limited pool of available houses, potentially offsetting any savings from lower mortgage rates,” said Dwight Cass, an analyst at Creditnews.

Some experts argue that there’s a lag effect between mortgage rate changes and their impact on housing prices.

This makes sense, as buying a house is a process that can take months to complete, involving the decision to buy, choice of a house, securing a mortgage, and signing a contract.

But even with the 2-year lag factored in, mortgage rate declines were associated with house price growth over five times as often as they were with house price declines.

While the Federal Reserve’s Open Market Committee has signaled that rate reductions may be on the horizon, it is unlikely that mortgage rates will fall below 6.5% in 2024 to keep to the Committee’s commitment to keep inflation near the 2% mark.

And lowering rates doesn’t instantly lower mortgage rates—partly due to banks having to ramp up their mortgage operations by hiring and dealing with the logistics of higher demand.

Jay Bacow, Co-Head of Securitized Products Research at Morgan Stanley, mentioned on a recent episode of the firm’s Thoughts on the Market podcast, “Lenders don’t really drop the primary rate as fast as a secondary rate goes down because they’re not going to be able to deal with the added volume of inquiries until they add staffing.”

But there’s another reason for the 6.5% floor.

Currently, banks are earning 5.4% on the reserves they hold at the Fed, which are risk-free. If the Fed cuts rates, including the rate it pays on reserves, by a total of 1.50 percentage points, as the market expects, banks will be more willing to shift some of those funds into mortgage lending.

A 6.5% mortgage rate is considered the minimum necessary to entice banks to take the extra risks that rates might rise again, making their 6.5% mortgages less valuable because rates and prices on debt instruments move inversely.

Click here to see Creditnews’ report in its entirety.