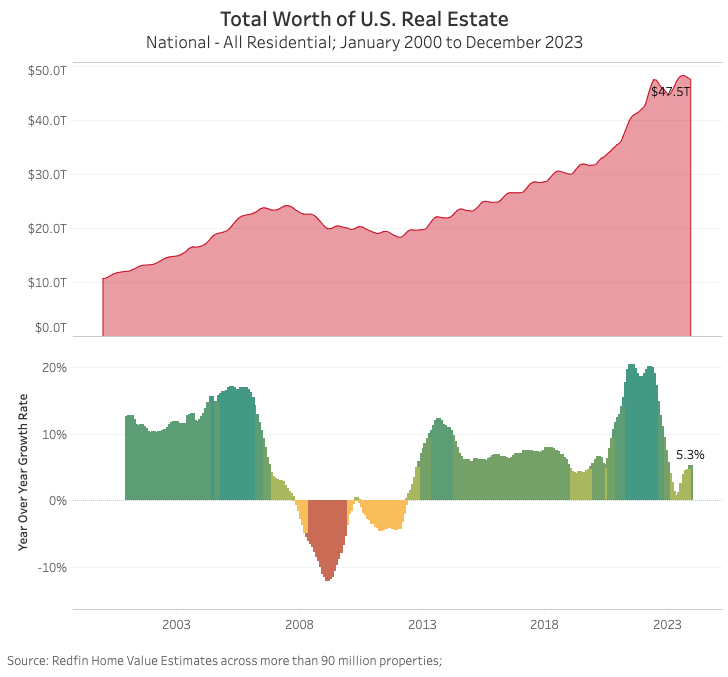

According to a new research report from Redfin, the U.S. housing market gained $2.4 trillion in value—or 5.3%—bringing the total market value to $47.5 trillion. This number accounts for more than 90 million residential properties.

In percentage terms, the total value of U.S. homes increased 5.3% from a year earlier in December, the biggest increase in 11 months, and was up 13.3% ($5.6 trillion) from two years earlier.

Housing demand is sluggish due to elevated mortgage rates and affordability challenges, yet home values keep rising.

The Primary Reasons Home Values Keep Rising

- There’s a shortage of homes for sale. Many homeowners are hesitant to put their houses on the market because they scored an ultra low mortgage rate in recent years, and selling would mean giving it up. Supply is even more constrained than demand, meaning buyers are competing for a limited pool of homes. That’s propping up values for both homes that are already for sale and those that could hit the market in the future.

- Home values hit a low about a year ago. The total value of U.S. homes was nearing a trough at the end of 2022, which is part of the reason year-over-year growth at the end of 2023 was so large. It’s typical for home values to cool in the winter, but they experienced an abnormally large slowdown in 2022 as the shock of surging mortgage rates sent a freeze through the housing market.

- More homes were built. While America is grappling with a housing shortage, it continues to build homes, which contributed to the gain in total home value last year.

“America’s homeowners are sitting pretty. They’re holding a massive amount of housing wealth, despite lackluster demand from buyers, because home values skyrocketed during the pandemic and now a supply shortage is preventing those values from falling,” said Redfin Economics Research Lead Chen Zhao. “Prospective buyers aren’t as lucky. The combination of elevated mortgage rates, high home prices and a limited pool of homes for sale means homeownership is about as unaffordable as ever. One bright spot for buyers is that mortgage rates should start declining before the end of 2024.”

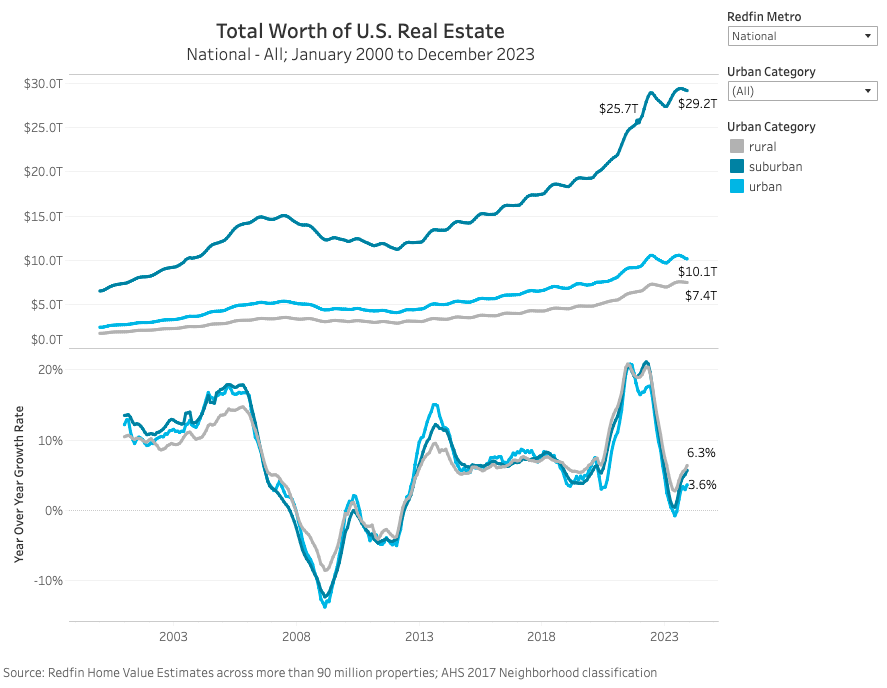

In addition, home values in urban areas are not holding up as well as those in rural or suburban areas.

The total value of homes in urban areas rose 3.6% year over year to $10.1 trillion in December. Meanwhile, the value of homes in the suburbs rose 5.6% to $29.2 trillion and the value of homes in rural areas increased 6.3% to $7.4 trillion.

The suburbs came back into vogue during the pandemic while cities fell out of favor—largely due to the shift to remote work and the housing affordability crisis. While cities have bounced back to some extent as employers have asked workers to return to the office, many Americans still work remotely, incentivizing homebuying and building in far-flung, affordable areas.

Suburban housing has a much higher total value than rural and urban housing simply because most Americans live in the suburbs. There are about 56 million residential properties in the suburbs, compared with just over 20 million each in rural and urban areas.

Click here for the comprehensive report.