According to a new Redfin study, for the four weeks ending March 3, the number of new listings increased 13% countrywide from a year earlier—representing the largest increase in almost three years.

The increase in new listings contributed to a 1.7% increase in the overall number of houses for sale. February is the first time that the number of homes for sale has climbed annually after eight months of losses.

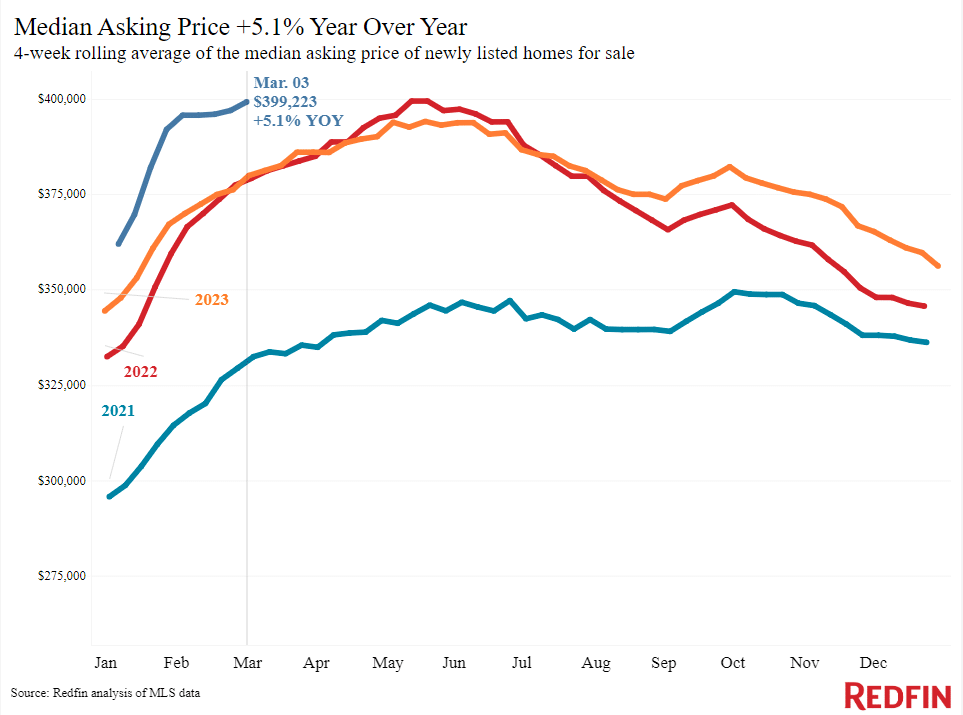

According to Redfin, the price data for this week offers prospective homeowners some small comforts as well. In addition, 5.5% of house sellers reduced their asking price on average, the largest percentage in any February since at least 2015. The asking prices of new listings experienced their least increase in almost two months.

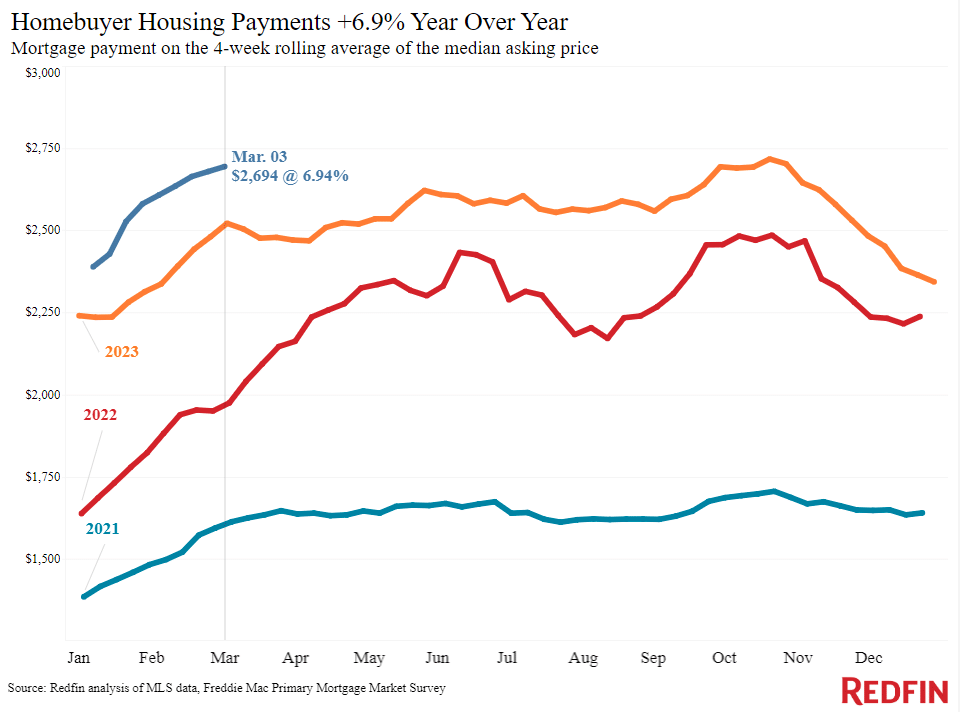

This week’s typical monthly housing payment was $2,694, just $23 less than the record high due to high mortgage rates. However, as price growth for new listings slows down, final selling prices—which increased 5.3% year-over-year, marking one of the largest rises in a year and a half—should soon begin to decline.

As spring approaches, those looking for a place to call home are also applying for mortgages. In comparison to the same period last year, there has been a 23% increase in touring activity, and week-over-week, mortgage-purchase applications have increased by 11%. As of right now, pending sales are down 6% year-over-year, suggesting that the early-stage buying activity hasn’t translated into higher sales.

“There have been two major obstacles for homebuyers over the last year: Low inventory and high housing costs,” said Chen Zhao, Economic Research Lead at Redfin. “Now, the first barrier is starting to come down as more supply comes on the market.”

Per the report, the average median sale price declined in just one metro year-over-year (YoY): San Antonio.

Metros With the Biggest YoY Increases in Median Sale Price:

- Newark, NJ (14.7%)

- Montgomery County, PA (14.6%)

- Anaheim, CA (14%)

- Fort Lauderdale, FL (13.9%)

- New Brunswick, NJ (13.8%)

Overall, pending sales increased in eight metros across the U.S.

Metros With the Biggest YoY Increases in Pending Sales:

- Cincinnati (9.2%)

- Milwaukee (6%)

- Pittsburgh (5%)

- Minneapolis (5%)

- Austin, TX (4.6%)

- San Francisco (2.8%)

- Seattle (0.7%)

- Cleveland (0.2%)

Metros that experienced the biggest YoY decreases in pending sales were: San Antonio, TX (-23.8%); Warren, MI (-15.7%); New Brunswick, NJ (-15.6%); Atlanta (-15.1%), and Nassau County, NY (-14.1%).

Metros With Biggest Year-Over-Year Increases in New Listings:

- Fort Worth, TX (27%)

- Fort Lauderdale, FL (25.4%)

- Houston (24.4%)

- Jacksonville, FL (24.1%)

- Miami (24.1%)

The three metros that experienced the biggest YoY decreases in new listings were: Atlanta (-5.9%), Newark, NJ (-2.1%), and Chicago (-0.4%).

“Housing costs are still high, but they’re likely to come down a bit as mortgage rates gradually decline through the year and price growth loses some steam,” Zhao said. “Buyers who can afford today’s mortgage rates may have better luck finding a home now than they have in the past several months, and they also may be less likely to face competition because inventory is improving.”

To read the full report, including more data, charts, and methodology, click here.