Despite saving money in the early years of their mortgage, 70% of homeowners who have taken out an adjustable-rate mortgage (ARM) in the past 10 years regret it, according to a new study from Point.

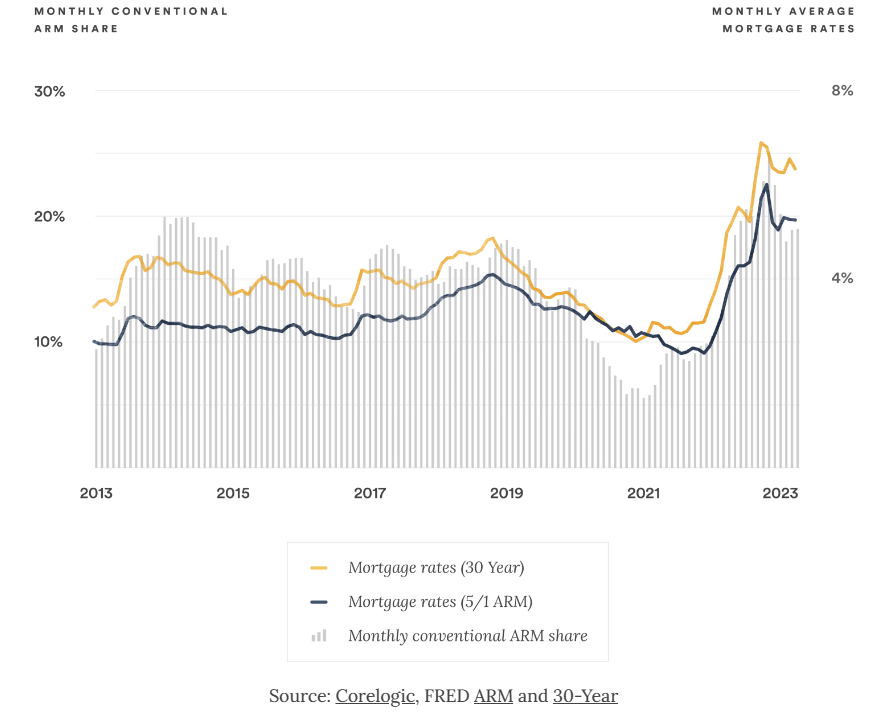

ARMs typically offer lower interest rates during the introductory period than fixed-rate mortgages, but unlike fixed-rate mortgages, ARM rates adjust to market levels once the initial introductory period ends, and then at regular intervals until the mortgage is repaid. Many homeowners who took out an ARM within the last 10 years may be at or near the end of their fixed-rate period at a time when interest rates are at their highest levels in decades. As a result, many ARM holders can expect a higher monthly mortgage payment now than they had three-, five-, seven-, or 10-years ago.

The push/pull of affordability and inflation

Despite increasing payments and the fact that many of these homeowners say they regret getting their ARM in the first place. Of the 30% of respondents who are still in the fixed-rate period, an overwhelming majority (82%) of those surveyed said they plan to keep it even after the fixed-rate period ends.

“Homeowners are living in a very different economic environment than just a few years ago–high inflation has made everyday goods more expensive than ever,” said Eddie Lim, Co-Founder and CEO of Point. “Given all these factors, it’s a less-than-ideal time to incur a sudden increase in monthly mortgage obligations. Many homeowners we work with mention that the burden of additional expenses is driving them to try to access their home’s equity.”

Despite a boost the nation’s housing supply, affordability remains an issue to buyers who are seeking to pursue the American dream of homeownership.

According to Redfin, for the four-week period ending March 3, the number of new listings increased 13% countrywide year-over-year—representing the largest increase in almost three years. The increase in new listings contributed to a 1.7% increase in the overall number of houses for sale. February is the first time that the number of homes for sale has climbed annually after eight months of losses.

Offsetting this rise in supply, potential buyers remain hampered by rates that edge toward the 7%-mark, as Freddie Mac reports the 30-year fixed-rate mortgage (FRM) averaged 6.88% as of March 7, 2024, down from the previous week when it averaged 6.94%. A year ago at this time, the 30-year FRM averaged 6.73%.

Options for ARM holders

Among the survey respondents who are in the fixed-rate period and said they plan to exit their ARM, 39% plan to refinance into a fixed-rate mortgage at the end of their fixed-rate period. Of those homeowners, 71% said they don’t know if their monthly mortgage payment will increase or decrease after a refinance. Additionally, those who elect to refinance into a fixed-rate mortgage in the current rate environment would still be contending with historically high rates–while also adding time to their loan.

“Refinancing to get out of a high-interest, fluctuating mortgage may seem like the best option at first glance, but in reality, it could cost homeowners more in the end, depending on their situation,” Lim added. “No matter what kind of decision a homeowner needs to make, it pays–literally–to consider all of your options.”

Click here to view Point’s full report on ARMs, authored by Amanda Woolley.