The heart of the American Dream is owning your own home, but according to BestBrokers, a broker review and trading-related site, U.S. home prices have considerably outpaced both inflation and income growth over the past couple of decades.

And if you are hoping to finally buy a house this year, you may find yourself out of luck as factors such as high interest rates, rising construction costs, limited housing stock among surging demands, falling building permits, and still-lingering post-COVID-19 implications are likely to make the 2024 housing market a tough sell, especially for young Americans who likely have little capital to work with.

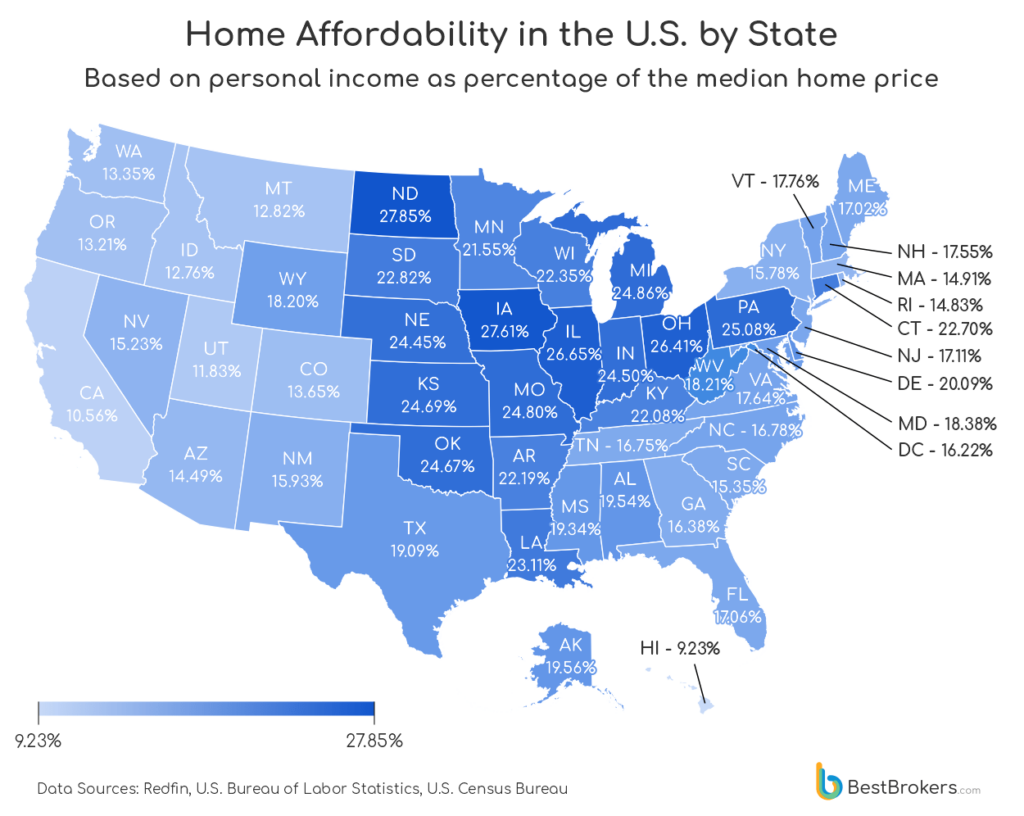

Yet, there are still some states that offer relatively affordable housing options when we take the ratio between home price and income into account.

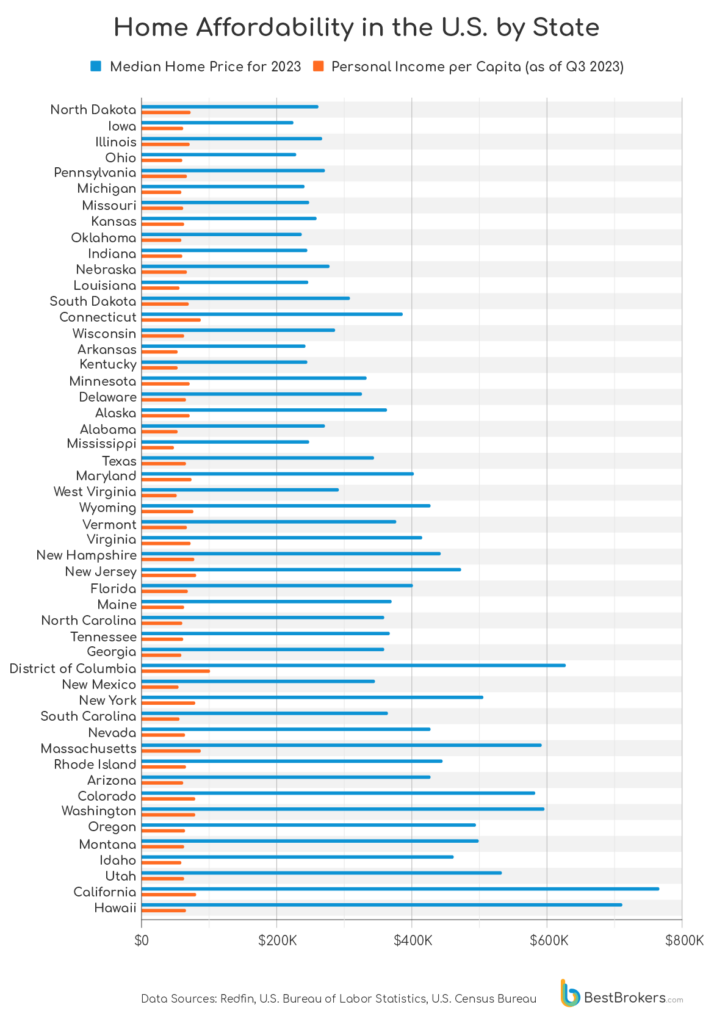

Interested to find out how prices vary state-by-state and where people can acquire a home within their budget, teams at BestBrokers conducted a thorough analysis of the median home stale prices for all residences across the country in 2023, drawing data from Redfin. To get a sense of how many years of savings it would take the average American to buy a home in every state around the country, we correlated these prices with per capita personal income figures for the third quarter of the same year, sourced by the U.S. Bureau of Economic Analysis. Then, we ranked the states based on home affordability and meticulously curated the top 10 most affordable states for prospective homebuyers, as well as the top 10 least affordable states in the country.

According to BestBrokers using Redfin’s data, home values remained elevated throughout much of 2023, experiencing a noticeable decline towards the end of the year. However, this drop doesn’t necessarily equate to increased affordability as housing prices remain at near record highs, with no market crash in sight, as some experts had previously predicted.

According to BestBroker:

“Last year, existing property sales fell to their lowest level in nearly 30 years, while the median price surged to historic highs, according to a recent report by the National Association of Realtors,” BestBroker wrote. “Although personal income has also risen since the 2000s, it has failed to keep pace with the soaring housing rates, resulting in a widening gap between income growth and home prices. From 2000 to 2023, median income in the U.S. increased by 63.82%, from $41,990 to $68,786 per year, while the median home price surged by 241.49%, from $119,600 to $408,428, as per the latest data from the U.S. Census Bureau.”

“The average age of homebuyers has also risen, with the typical buyer now being 44 years old, compared to 25-34 in 1981,” BestBroker continued. “In the past, people were more able to afford mortgages as borrowing money was cheap but this is no longer the case. The dollar had an average inflation rate of 2.46% per year between 2000 and today, producing a cumulative price surge of 79.10%. Consequently, today’s prices are 1.79 times higher than the average prices since 2000, as per the Bureau of Labour Statistics consumer price index. Essentially, a dollar today can only buy 55.866% of what it could buy back then.”

“As per our findings, In New York State the median home value stood at $505,992 as of 2023, while the income per capita added up to $79,856, resulting in a home price-to-income ratio of 6.34,” BestBroker concluded. “In other words, those living in the state would have to save their salaries for approximately 6 years and 4 months to buy a home with cash. This isn’t, however, the worst home price-to-income ratio at all. Even though the cost of living in the State of New York is notoriously high, perhaps largely influenced by New York City, those living in Hawaii, California and Utah face even worse levels of home affordability, according to our research.”

The U.S. median home sale price reached $408,428 in 2023, while the per capita income totaled $68,786 as of the third quarter. This equates to the median house price being almost six times a person’s annual salary.

Click here to read the report in its entirety.