Zillow’s latest data reveals the share of rentals offering perks may have hit its peak. This news comes after a winter that saw nearly a third of rental listings offering tenants tempting concessions such as free months of rent or free parking. On the positive side for renters is that the market is much friendlier than it was just one year ago, with the share of rentals offering a concession rising 5.6 percentage points.

The impact of renter concessions

As spring approaches, February data show 32.2% of rental listings on Zillow offered a concession, down slightly from December and up 5.6 percentage points from a year earlier. That marks the slowest annual growth pace since last June. After seven months of consecutive monthly increases to end 2023, the share of rentals offering concessions fell to 31.9% in January before a slight uptick last month.

If past seasonal trends continue to hold, renters looking to secure a new lease in the upcoming spring or summer may encounter fewer incentives and increased competition.

“The rental market always ebbs and flows with the seasons, so it’s no shock that we’re seeing concessions start to level off as we move into the warmer months,” said Anushna Prakash, an Economic Research Data Scientist at Zillow. “It looks like we’re beginning to see the market balance the ongoing high demand from renters with a competitive environment for property managers and landlords. While concessions are beginning to dip, they are more common than they were a year ago, helped by new buildings that have opened their doors.”

Measuring the pace of rentals

While the expected seasonal shift accounts for the stabilization of concessions, the pace of rent growth and vacancy levels offer deeper insights. Recently, rents haven’t been going up as quickly as they did before the pandemic, and it looks like supply and demand are starting to balance out. The share of rental housing units that were vacant hit at 6.6% in Q4 of 2023, which is just a bit higher than the near-40-year low reported at the close of 2021. This indicates that there were enough eager renters, pushing the market toward stability.

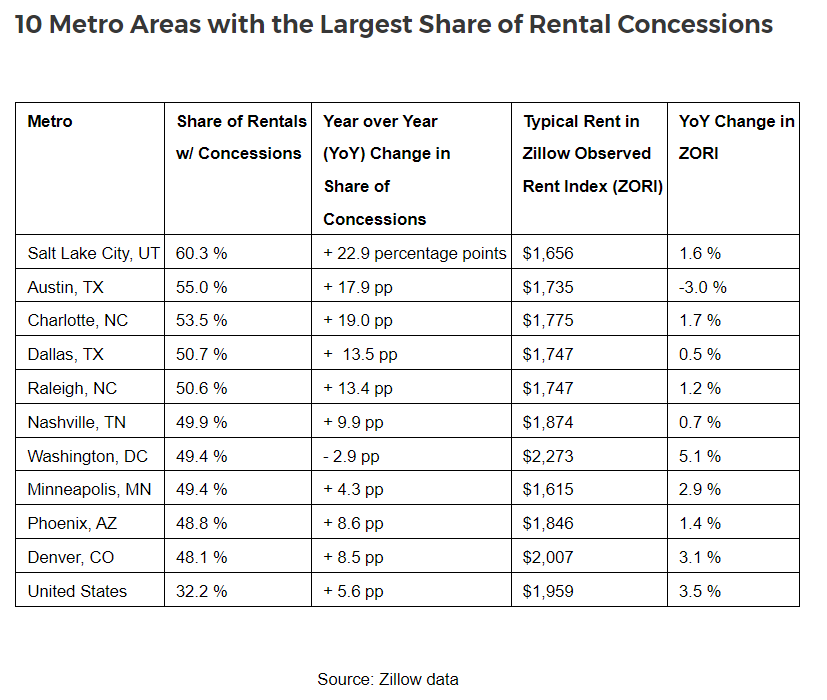

Metros leading the concession charge

Despite the national trend toward a stabilization of rental rates, certain markets continue to lead with high shares of concessions. These metros exemplify the diversity within the rental market, with strategies varying widely across regions to attract tenants.

Zillow found that in nine of the 10 metros where the share of rental concessions was reported highest, rents were growing more slowly than the nationwide 3.5% annual rate, and they are falling in Austin. This could mean there are more apartments available than there are people looking to rent them.

Conversely, in areas where there are fewer of these kinds of deals available, such as Providence, Rhode Island (12.3% of rentals offered concessions in February); Hartford, Connecticut (16.3%); and Cincinnati, Ohio (18.9%), some of the fastest rent increases are being reported. In Providence, for example, typical rents have jumped by 8.1% year-over-year. Both Hartford and Cincinnati both saw rents increase by 6.4%.

A question of supply?

As the spring rental market takes shape, it is worth noting that builder confidence in the market for newly built single-family homes climbed three points to 51 in March, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

“Buyer demand remains brisk, and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year,” said NAHB Chairman Carl Harris. “But even though there is strong pent-up demand, builders continue to face several supply-side challenges, including a scarcity of buildable lots and skilled labor, and new restrictive codes that continue to increase the cost of building homes.”

As builder sentiment rises, mortgage rates are still factoring into the decision-making process of many reluctant to make the jump from renter to homeowner.

Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) averaged 6.74% as of March 14, 2024, down from the previous week when it averaged 6.88%. A year ago at this time, the 30-year FRM averaged 6.60%.

Sam Khater, Freddie Mac’s Chief Economist, noted, “Despite the recent dip, mortgage rates remain high as the market contends with the pressure of sticky inflation. In this environment, there is a good possibility that rates will stay higher for a longer period of time.”