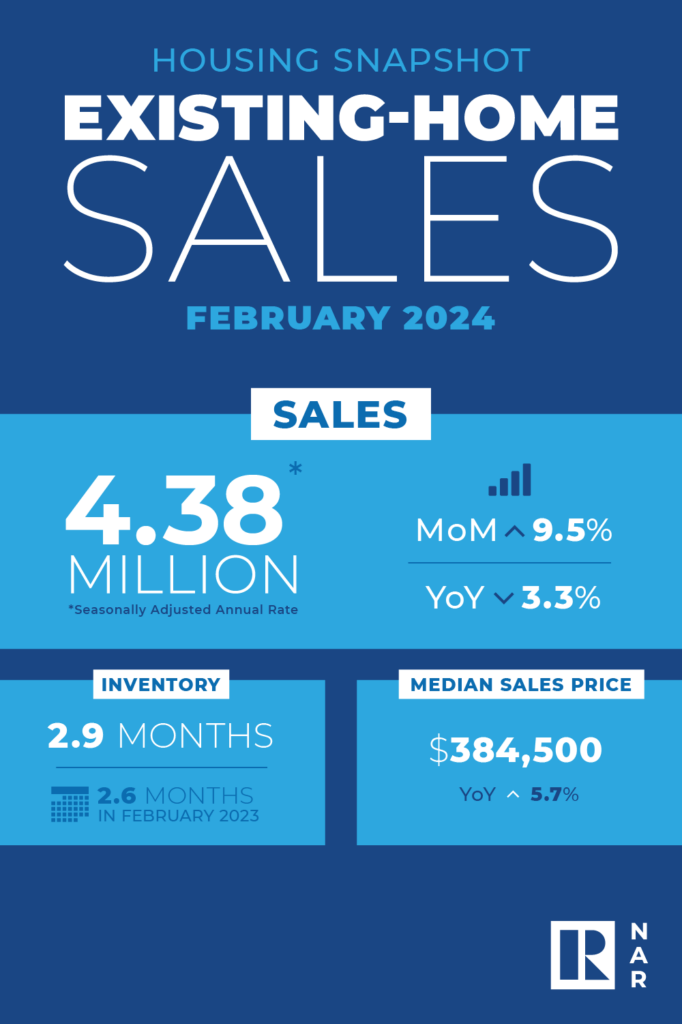

New findings from the National Association of Realtors (NAR) found that existing-home sales increased 9.5% in February 2024 to a seasonally adjusted annual rate of 4.38 million, the largest monthly increase reported since February 2023. However, that news is tempered by NAR’s report also noting that existing-home sales declined 3.3% year-over-year (down from 4.53 million in February 2023).

NAR defines existing-home sales as completed transactions that include single-family homes, townhomes, condominiums and co-ops.

Total housing inventory registered at the end of February 2024 was 1.07 million units, up 5.9% from January and 10.3% from one year ago (970,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from three months in January 2024, but up from 2.6 months in February 2023.

“Additional housing supply is helping to satisfy market demand,” said NAR Chief Economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

The median existing-home price for all housing types in February was $384,500, an increase of 5.7% from the prior year ($363,600). All four U.S. regions posted price increases.

Buyers come off the sidelines

According to the monthly Confidence Index from NAR, properties typically remained on the market for 38 days in February, up from 36 days in January, and 34 days in February 2023.

First-time buyers were responsible for 26% of sales in February, down from 28% in January and 27% in February 2023. NAR’s 2023 Profile of Home Buyers and Sellers (released in November 2023) found that the annual share of first-time buyers stood at 32%. All-cash sales accounted for 33% of transactions in February 2024, up from 32% in January 2024, and 28% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 21% of homes in February, up from 17% in January and 18% in February 2023.

Distressed sales, defined as foreclosures and short sales, represented 3% of all sales in February, virtually unchanged from last month and the previous year.

Breakdown by region

At 480,000 units, existing-home sales in the Northeast were identical to January, but down 7.7% from February 2023. It’s the fourth consecutive month that home sales in the Northeast registered 480,000 units. The median price in the Northeast was $420,600, up 11.5% from one year ago.

In the Midwest, existing-home sales rose 8.4% from one month ago to an annual rate of 1.03 million in February, down 3.7% from the previous year. The median price in the Midwest was $277,600, up 6.8% from February 2023.

Existing-home sales in the South jumped 9.8% from January to an annual rate of 2.02 million in February, down 2.9% from one year earlier. The median price in the South was $354,200, up 4.1% from last year.

In the West, existing-home sales skyrocketed 16.4% from a month ago to an annual rate of 850,000 in February, a decline of 1.2% from the prior year. The median price in the West was $593,000, up 9.1% from February 2023.

“Due to inventory constraints, the Northeast was the regional underperformer in February home sales, but the best performer in home prices,” Yun added. “More supply is clearly needed to help stabilize home prices and get more Americans moving to their next residences.”

Rates playing a key role

According to Freddie Mac, the 30-year fixed-rate mortgage (FRM) averaged 6.74% as of March 14. That total was down from 6.88% the prior week, but up from 6.60% just one year ago.

Earlier this week, for the fifth meeting in a row, the Federal Reserve’s Federal Open Market Committee (FOMC) made the call that their best course of action was to do nothing with interest rates, holding rates steady at 5.50%.

Mortgage Bankers Association (MBA) SVP and Chief Economist Mike Fratantoni commented, “The FOMC held rates unchanged at its March meeting and continued to signal its next move will be a rate cut. The only question is when. Their new projections indicate three cuts for 2024, unchanged from their December projections for 2024, but with one less rate cut expected in 2025. We are forecasting that the first rate cut will be in June, and a total of three rate cuts this year. The committee did not indicate any changes to the pace of quantitative tightening. We continue to expect longer-term rates, including mortgage rates, to decline gradually over the course of this year.”

However, just as soon as the Fed made their announcement to hold rates steady, Freddie Mac reported that the 30-year FRM shot 13 basis points upward, averaging 6.87% as of March 21, 2024.

“Falling mortgage rates hinge on falling inflation, but recent data still puts inflation well above the Fed’s 2% target,” noted Realtor.com Senior Economic Research Analyst Hannah Jones. “In this week’s meeting, the FOMC released an update to their Summary of Economic Projections. The latest projections show that interest rates are likely to be higher for slightly longer than expected in the previous update, but the trajectory will remain dependent on incoming inflation and employment data.”

Targeting single-family and condo/co-op sales

NAR reports that single-family home sales grew to a seasonally adjusted annual rate of 3.97 million in February, up 10.3% from 3.6 million in January, but down 2.7% year-over-year. The median existing single-family home price was $388,700 in February, up 5.6% from February 2023.

At a seasonally adjusted annual rate of 410,000 units in February, existing condominium and co-op sales increased 2.5% from last month, but declined 8.9% from one year ago (450,000 units). The median existing condo price was $344,000 in February, up 6.7% from the previous year ($322,400).