A new market insights report from RentCafe states that Generation Z (Gen Z) is becoming the most diverse and possibly best-educated group in American history, setting them up to break ceilings never before thought possible.

However, according to RentCafe, how does Gen Z manage when it comes to affording rent or buying a home as they approach their prime homebuying years in relation to their predecessors, the Millennial Generation.

To shed light on the amount Gen Z might pay for housing as they reach the age of 30, RentCafe delved into historical housing costs—along with historical earning and spending patterns—specifically looking at Millennials housing costs when they were the same age (22 to 29-years-old) for comparison and projections.

RentCafe’s findings revealed that Gen Z, now numbering almost 66 million souls, will earn about half a million dollars in their 20s; that 14% higher than millennials did before they turn 30. As expected, income levels vary depending on metro, but are significantly higher in coastal metros, peaking in Silicon Valley’s San Jose and San Francisco.

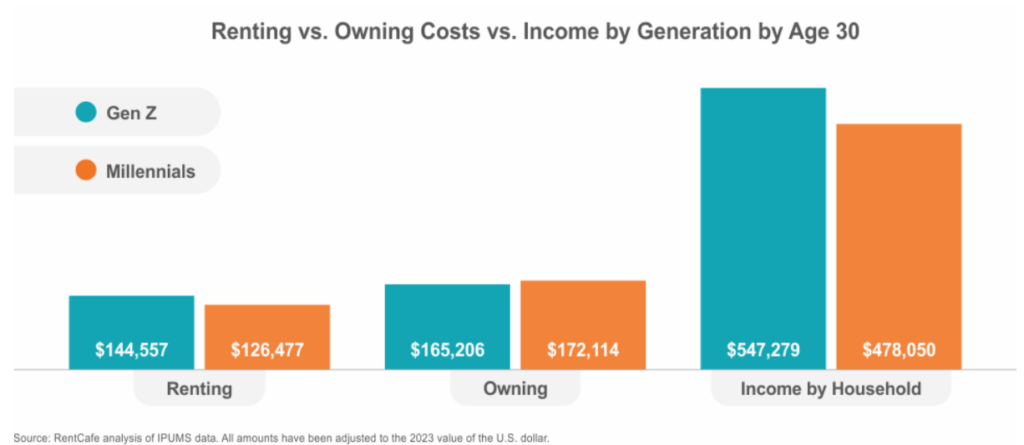

When it comes to housing costs, Gen Z will be spending $145,000 on rent by their 30th birthday, while Millennials spent $127,000 during the same stage of life (14% more). Notably, Gen Z’s renting costs account for 27% of their income from ages 22 to 29 (which is the same percentage as it was for Millennials) because Gen Z’s wages are higher today.

Whether you rent or buy, homeownership presented a bigger financial challenge for both generations: homeownership costs would account for 30% of Gen Z’s income during this eight-year span, whereas Millennials put a much higher percentage, 36%, toward owning a home before the age of 30.

Granted, renter life in major rental hubs on the coasts is costlier for Gen Zers. In particular, the Bay Area, Boston and exotic Honolulu stand out when it comes to renting costs for Zoomers by 30. But, at the same time, these places also offer the highest incomes for digital natives.

Gen Z pays $145,000 in rent and $165,000 for owning by 30

The earning potential of Gen Z is substantial, as they are earning roughly $500,000 on average before the age of 30. Plus, in a few select coastal metros, digital natives earn around $1 million in the first decade of their adulthood. When it comes to housing costs, by the age of 30, Gen Z is on track to spend $145,000 on rent—enough for a top-of-the-line Tesla.

When asked about buying a home, RentCafe said that owning for eight years in their 20s would cost Gen Z about $165,000, including taxes, insurance, and other expenses.

Meanwhile, their predecessors, Millennials, had lower costs for rent (by about $18,000) of $126,000 between 22 and 29 years old, but also earned about $70,000 less in their 20s ($480,000). Nevertheless, homeownership came at a higher price tag for Millennials with costs for the same eight-year span totaling $172,000, which is nearly $7,000 more than what Zoomers would pay. This would explain why the former generation took longer to reach the homeowner-majority milestone.

Click here to see the data in its entirety.