According to research by the Economic & Strategic Research (ESR) Group at Fannie Mae, roughly two-thirds of consumers say that bad weather has affected their insurance rates, while nearly half of consumers are worried about how weather-related disasters would affect their homes.

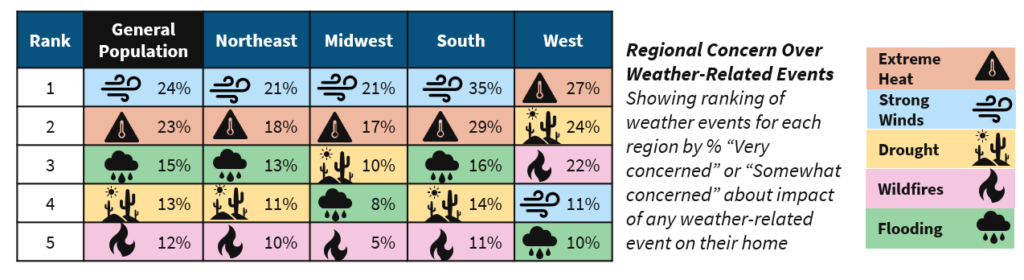

According to the ESR Group’s latest National Housing Survey, for homeowners and renters, worries about weather-related events include extreme heat, strong winds (from hurricanes and tornadoes), drought, wildfires, and flooding.

Key Findings:

- Nearly half of respondents expressed concern about the impact of extreme weather events on their homes, but they’re especially concerned about excessive wind and heat. As it might have been expected, location has a big impact on the weather-related incidents that worry customers the most: In the Northeast, Midwest, and South, strong winds are the main issue compared to the West, where intense heat is the primary concern.

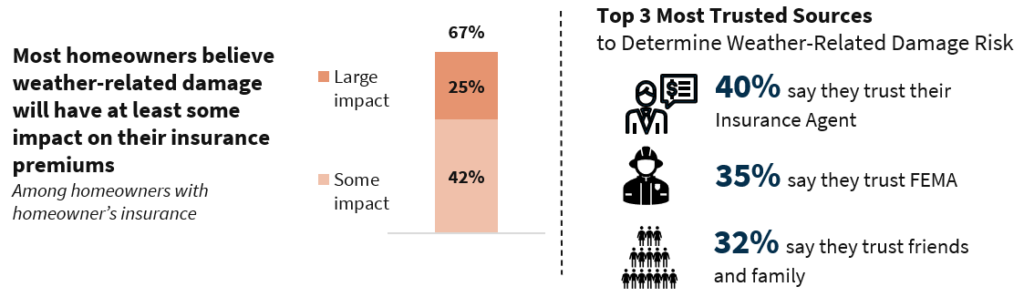

- Two-in-three insured homeowners said weather-related events and damage have had an impact on their home insurance premiums. In addition, an estimated two thirds of homeowners have implemented preventative measures to lower their home’s risk of damage.

- Consumers trust a mix of sources to determine the risk of weather-related damage to their homes. Insurance brokers (40%), the Federal Emergency Management Agency (FEMA), or 35%), and friends and family (32%) are their preferred “sources of truth”.

Consumer Weather Concerns Are Geographically Driven

The report showed that consumers overall are most anxious (either “extremely” or “somewhat”) about extreme heat (24%) and strong winds from tornadoes and hurricanes (23%), out of the nearly half of customers who are concerned about weather-related catastrophes. Less anxiety was expressed by respondents about flooding (12%), wildfires (13%) and drought (15%).

Even more depth is provided by a geographical perspective. Strong winds (35%) are a greater concern in the South than in the West, where wildfires (22%) and drought (24%) are of substantially greater concern.

Interestingly, homeowners’ concerns about the costs that extreme weather-related damage would entail (46%) trailed behind those about other, possibly more familiar aspects of home ownership, such as routine maintenance costs (70%) and property tax increases (64%), the impact of economic inflation on affordability (60%), and job loss concerns (49%). The outcomes for tenants were comparable.

Will Weather-Related Events Impact Insurance Premiums?

According to two thirds of homeowners, weather-related damage has affected their insurance rates in some way. A “large” influence on insurance premiums was reported by one in four respondents.

Almost a tenth of the homeowners with insurance who were insured expressed uncertainty about their ability to pay their payments when it came time for the next renewal. Digging deeper, Fannie Mae research found that compared to White homeowners (8%), more Black (14%), Hispanic (13%), and Asian (15%) insured homeowners reported concerns about being able to afford their rates at renewal.

In addition, the study revealed that two-thirds of homeowners said they had taken preventative actions to lower the possibility that their home will sustain damage in the future. A third of the respondents took action to stop wind damage, a quarter (27%) prevented water damage from backups in sewage and drains, and a further 24% addressed floods.

In 2023, the National Oceanic and Atmospheric Administration reported that a record number of weather- and climate-related disasters costing billions of dollars or more struck the U.S.

These catastrophes have an effect on housing expenses, and there is still a lot of work to be done to increase public awareness of the issue, especially with regard to the difficulties with affordability that both homeowners and renters face.

To read the full report, including more data, charts, and methodology, click here.