The Consumer Financial Protection Bureau (CFPB) has released its latest research, revealing that as interest rates rose, more borrowers paid “discount points”—a one-time payment made to a lender at closing in exchange for a lower interest rate—upfront. Between 2021 and 2023, the percentage of homebuyers who paid discount points approximately doubled. The increase was significantly bigger for borrowers with weaker credit ratings.

While discount points may benefit some borrowers, the financial implications are complex. Paying one discount point is similar to paying a 1% fee on the loan amount, however discount points have no set value in terms of interest rate changes. Most borrowers only profit from discount points if they keep their mortgage long enough to let the monthly savings from the lower interest rate exceed the initial fees.

Key Findings:

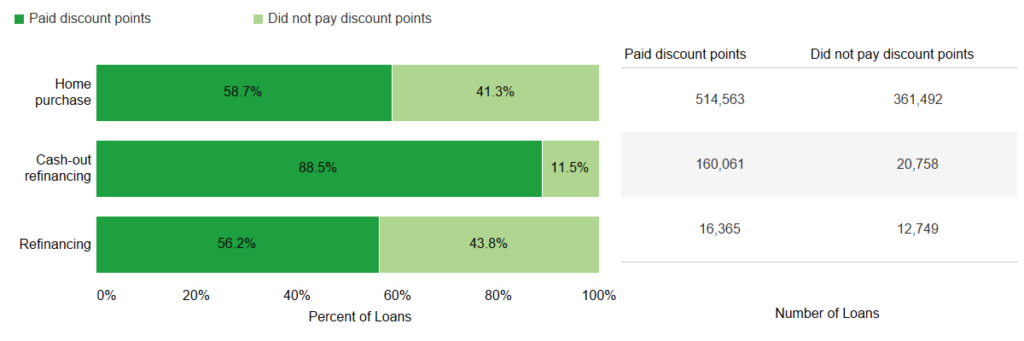

- The majority of recent borrowers paid discount points, including nearly 9 out of 10 borrowers with cash out refinances.

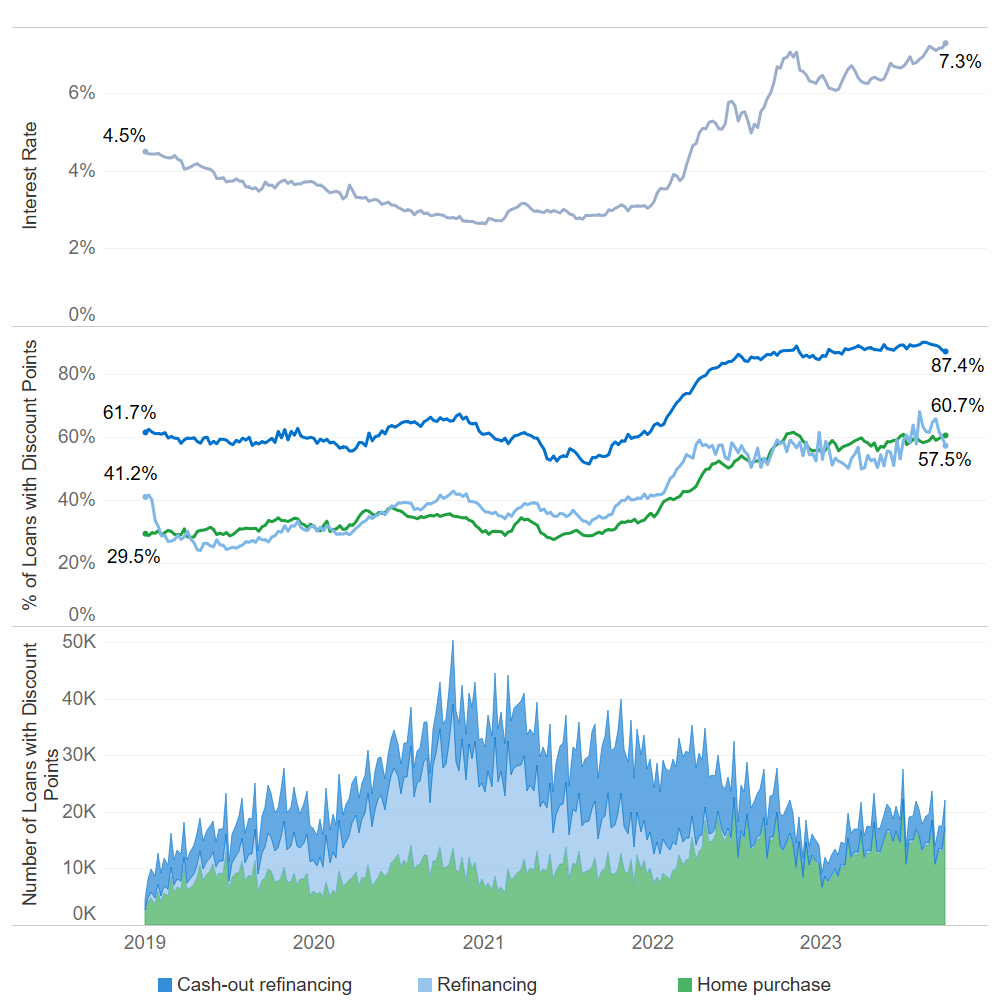

- More borrowers paid discount points as interest rates increased.

- Borrowers with lower credit scores were more likely to pay discount points.

“Higher interest rates on mortgages have led borrowers to pay upfront fees to lower their interest payments,” said Rohit Chopra, Director of CFPB. “The heavy use of ‘discount points’ suggests that many borrowers are uncertain about their ability to refinance in the future.”

FHA Borrowers With Lower Credit Scores More Likely to Pay Discount Points

According to the report, borrowers with lower credit scores were more likely to pay discount points, and this was especially true for Federal Housing Administration (FHA) borrowers with poor credit scores. This suggests that lenders may be utilizing discount points to reduce borrowers’ monthly payments and debt-to-income ratio, which is one of the metrics used by lenders to determine a borrower’s ability to repay in order to qualify for a mortgage. Almost 77% of FHA borrowers with credit scores below 640 purchased discount points, whereas 65% of all FHA borrowers did.

Discount points were most commonly used by borrowers with cash-out refinances, with 87% paying them in September 2023, up from 61% in January 2021. In September 2023, nearly 61% of borrowers with house purchase loans and 58% of borrowers with non-cash-out refinance loans paid discount points, compared to 31% and 36% in 2021. Borrowers who used cash-out refinances also paid more discount points. In the 2023 quarterly statistics, the median number of discount points was 2.1 for cash-out refinance loans, 1.1 for non-cash-out refinances, and 1.0 for home purchase loans.

Lenders’ marketing and first pricing quotes to consumers frequently include discount points in the fine print, making their interest rates appear more competitive. Although discount points and APR are given in advertisements and later in the Loan Estimate and Closing Disclosure, consumers who do not understand the mechanics of discount points may misinterpret a lender’s interest rate for a better deal than it is.

Understanding the Function of Discount Points

Investors with mortgage debt can also benefit from discount points. When interest rates fall or are predicted to fall, investors have a significant risk of prepayment because consumers are more inclined to refinance and pay off their mortgage early. As a result, even if an investor benefits from a high interest rate, they understand that the cash flows may be temporary. Discount points can minimize a loan’s prepayment risk by lowering the interest rate, reducing the consumer’s motivation to refinance.

Because discount points add another layer of complication, customers would need to obtain offers from numerous lenders with either the same interest rate or the same number of discount points to determine which offer is the best fit for their scenario. Borrowers who choose a loan only on the basis of the interest rate may unintentionally pay for more discount points than is necessary.

Even when consumers understand how discount points function, most borrowers only profit from them if they keep their mortgage for long enough to make the monthly savings from the lower interest rate exceed the initial expenses. This is sometimes referred to as extending the mortgage’s “break-even period,” which may be roughly calculated by dividing the cost of the discount points by the borrower’s monthly savings. Borrowers with a long-term mortgage and cash on hand may benefit from paying discount points. However, discount points are less effective for cash-strapped borrowers and those planning to refinance or relocate soon.

Overall, 2022 and 2023 saw record-breaking interest rates, forcing borrowers to respond swiftly. As a result, borrowers were more likely to pay discount points, with cash-out refinance borrowers being the most likely to pay discount points and paying more of them than other borrowers. In addition to responding to the high interest rate environment, many lenders may use discount points to ensure that borrowers are eligible for a mortgage.

To read the full report, including more data, charts, and methodology, click here.